Sa102 2018

What is the HMRC 102 Form?

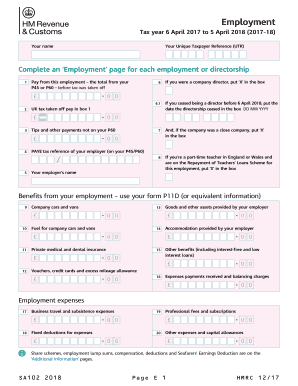

The HMRC 102 form, commonly referred to as the SA102, is a tax document used in the United Kingdom to report income from employment. This form is essential for individuals who are self-assessing their income tax obligations. It collects details about earnings, tax codes, and other relevant financial information that the HM Revenue and Customs (HMRC) requires for accurate tax calculation. Understanding the purpose and structure of the SA102 is crucial for ensuring compliance with tax regulations.

Steps to Complete the SA102

Completing the SA102 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including your P60, P45, and any payslips that detail your earnings. Next, fill in your personal information, including your name and National Insurance number. Then, report your total income from employment, including any taxable benefits. It is also important to input any tax deducted at source. Finally, review the completed form for any errors before submitting it to HMRC.

Legal Use of the SA102

The SA102 form must be completed accurately to comply with UK tax laws. It serves as a legal document that reflects your income and tax contributions. Submitting incorrect information can lead to penalties or audits from HMRC. Therefore, it is vital to ensure that all details are correct and that the form is submitted by the required deadlines to avoid any legal issues.

How to Obtain the SA102

The SA102 form can be obtained directly from the HMRC website or through tax preparation software that supports self-assessment. It is also available in paper format upon request. For those who prefer digital options, many online platforms provide easy access to the form, allowing for electronic completion and submission, which can streamline the process significantly.

Form Submission Methods

There are several methods for submitting the SA102 form. You can file it online through the HMRC self-assessment portal, which is the most efficient option. Alternatively, you can print the completed form and mail it to HMRC. In-person submission is generally not available, but you can seek assistance at local tax offices if needed. Each method has specific guidelines and deadlines, so it is important to choose the one that best fits your situation.

Key Elements of the SA102

The SA102 form includes several key elements that must be accurately reported. These elements consist of your employment income, tax code, and any taxable benefits received. Additionally, you will need to provide information on any tax that has been deducted from your earnings. Each section of the form is designed to capture specific financial details that contribute to your overall tax assessment.

Quick guide on how to complete sa102 2015

Finalize Sa102 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Manage Sa102 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Sa102 with ease

- Find Sa102 and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign Sa102 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa102 2015

Create this form in 5 minutes!

How to create an eSignature for the sa102 2015

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is HMRC 102 and how does it relate to airSlate SignNow?

HMRC 102 refers to a specific form related to the UK's tax agency. airSlate SignNow simplifies the process of digitally signing and submitting HMRC 102 forms, ensuring compliance and convenience for businesses managing tax documentation.

-

Is airSlate SignNow suitable for managing HMRC 102 submissions?

Yes, airSlate SignNow is specifically designed to help businesses efficiently manage HMRC 102 submissions. With its intuitive interface and robust features, you can easily send, sign, and track these documents securely online.

-

What features does airSlate SignNow offer for handling HMRC 102 forms?

airSlate SignNow provides essential features such as electronic signatures, document templates, and automated workflows, making handling HMRC 102 forms streamlined. These tools ensure accuracy and reduce the time spent on administrative tasks.

-

How does airSlate SignNow ensure the security of HMRC 102 documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like HMRC 102 forms. The platform uses encryption, secure cloud storage, and compliance with regulatory standards to protect your data.

-

What are the pricing options for using airSlate SignNow for HMRC 102?

airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective option for handling HMRC 102 forms. Pricing varies based on features and the number of users, ensuring you find the right fit for your organization.

-

Can I integrate airSlate SignNow with other tools for processing HMRC 102 forms?

Absolutely! airSlate SignNow integrates seamlessly with popular software tools like Google Workspace and Microsoft applications, enhancing your workflow for managing HMRC 102 forms. These integrations allow for better document management and collaboration.

-

What are the benefits of using airSlate SignNow for HMRC 102?

Using airSlate SignNow for HMRC 102 brings numerous benefits, including increased efficiency in document signing and submission, reduced paper waste, and improved compliance. It empowers businesses to navigate their tax obligations with ease and confidence.

Get more for Sa102

- Commercial tenant move out checklist form

- Minnesota residential lease agreement rentmsu form

- Fedex receipt form

- Gepa statement examples form

- Fia cyber crime online complaint form

- Cochise county housing authority form

- Super 8 credit card authorization form

- Rocky hillct rabies testing submissions form

Find out other Sa102

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online