Hmrc Lettings Relief April 2021

Understanding the HMRC Lettings Relief

The HMRC Lettings Relief is a tax relief available to individuals who rent out a property that is their main residence. This relief can reduce the amount of Capital Gains Tax (CGT) owed when selling a property. It is essential for landlords to understand how this relief works, as it can significantly impact their tax obligations. The criteria for eligibility include having lived in the property as your main home and renting it out for a specific period. Familiarity with these criteria can help ensure that landlords maximize their tax benefits.

Steps to Claim HMRC Lettings Relief

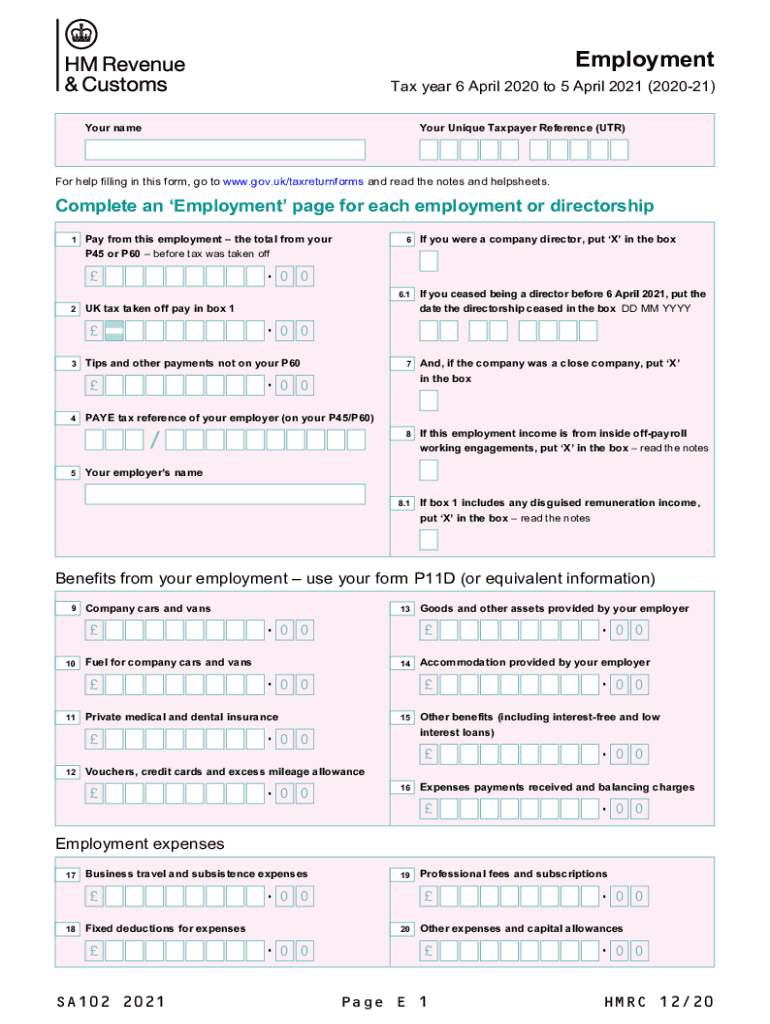

Claiming HMRC Lettings Relief involves several straightforward steps. First, ensure that you meet the eligibility criteria, which include having lived in the property as your main home and having rented it out during your ownership. Next, gather necessary documents, such as proof of residence and rental agreements. When ready, you can claim the relief through your Self Assessment tax return. It is advisable to consult with a tax professional if you are unsure about the process or need assistance in completing the forms correctly.

Key Elements of HMRC Lettings Relief

Several key elements define the HMRC Lettings Relief. The relief applies only to individuals who have rented out their main residence. It is important to note that the amount of relief available may vary based on the duration of the rental period and the time the property was used as the main home. Additionally, the relief is limited to a specific amount, which can change annually. Understanding these elements is crucial for landlords to accurately calculate their potential tax savings.

Required Documents for HMRC Lettings Relief

When applying for HMRC Lettings Relief, certain documents are essential to support your claim. These typically include:

- Proof of ownership of the property, such as a title deed.

- Evidence of residency, like utility bills or bank statements.

- Rental agreements or contracts demonstrating the rental period.

- Any correspondence with HMRC regarding the property.

Having these documents ready can streamline the application process and ensure compliance with HMRC requirements.

Potential Penalties for Non-Compliance

Failing to comply with the regulations surrounding HMRC Lettings Relief can lead to significant penalties. If you do not accurately report rental income or claim relief incorrectly, HMRC may impose fines or require back payments of taxes owed. Additionally, interest may accrue on any unpaid tax amounts. To avoid these consequences, it is crucial to maintain accurate records and seek advice if you are uncertain about your tax obligations.

Eligibility Criteria for HMRC Lettings Relief

To qualify for HMRC Lettings Relief, certain eligibility criteria must be met. Primarily, the property must have been your main residence at some point during your ownership. You must also have rented out the property while living there. The relief is available only to individuals, not companies or partnerships. Additionally, the relief applies to properties that have not been used exclusively for rental purposes. Understanding these criteria can help you determine your eligibility and maximize your tax relief.

Quick guide on how to complete hmrc lettings relief april 2020

Effortlessly Complete Hmrc Lettings Relief April on Any Device

Managing documents online has become increasingly prevalent among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Handle Hmrc Lettings Relief April using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

Edit and eSign Hmrc Lettings Relief April with Ease

- Obtain Hmrc Lettings Relief April and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Hmrc Lettings Relief April and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hmrc lettings relief april 2020

Create this form in 5 minutes!

How to create an eSignature for the hmrc lettings relief april 2020

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the sa102 feature in airSlate SignNow?

The sa102 feature in airSlate SignNow allows users to automate their document workflows seamlessly. This feature enhances efficiency by enabling businesses to send and eSign documents without delays, streamlining the signing process signNowly.

-

How does pricing work for the sa102 package?

The sa102 package offers flexible pricing options designed to meet the needs of businesses of all sizes. Users can choose from monthly or annual plans, ensuring they receive the best value for their investment in airSlate SignNow's eSigning capabilities.

-

What are the key benefits of using the sa102 solution?

The sa102 solution provides numerous benefits, including time savings, enhanced security, and improved compliance with legal standards. Businesses can manage their document workflows efficiently, ensuring that all signatures are legally binding and securely stored.

-

Can I integrate sa102 with other software applications?

Yes, the sa102 solution is designed to integrate seamlessly with a variety of software applications, including CRM systems and cloud storage services. This flexibility allows businesses to embed eSigning functionality directly into their existing workflows.

-

How does airSlate SignNow ensure document security for sa102 users?

AirSlate SignNow prioritizes security for sa102 users by employing robust encryption methods and compliance with industry standards. This ensures that all eSigned documents remain confidential and secure throughout the signing process.

-

Is it easy to use the sa102 feature for non-technical users?

Absolutely! The sa102 feature in airSlate SignNow is designed with user-friendliness in mind, making it accessible for non-technical users. The intuitive interface guides users through the signing process without any complex steps.

-

What types of documents can be signed using sa102?

With the sa102 feature, you can sign a wide variety of documents including contracts, agreements, and forms. This versatility allows businesses to manage different types of documents efficiently, ensuring a streamlined workflow.

Get more for Hmrc Lettings Relief April

- Iantd student medical form doc

- Record of master calendar pre trial appearance and order form

- Iowa child labor permit form

- Disney dreamer academy form

- How to fill guarantor form equity

- Seller transferor is not as of the date of transfer a resident of the state of maine form

- Certification of lock in for purposes of the form

Find out other Hmrc Lettings Relief April

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract