IRS Form 8846 "Credit for Employer Social Security and Medicare Taxes 2022

What is the IRS Form 8846: Credit for Employer Social Security and Medicare Taxes

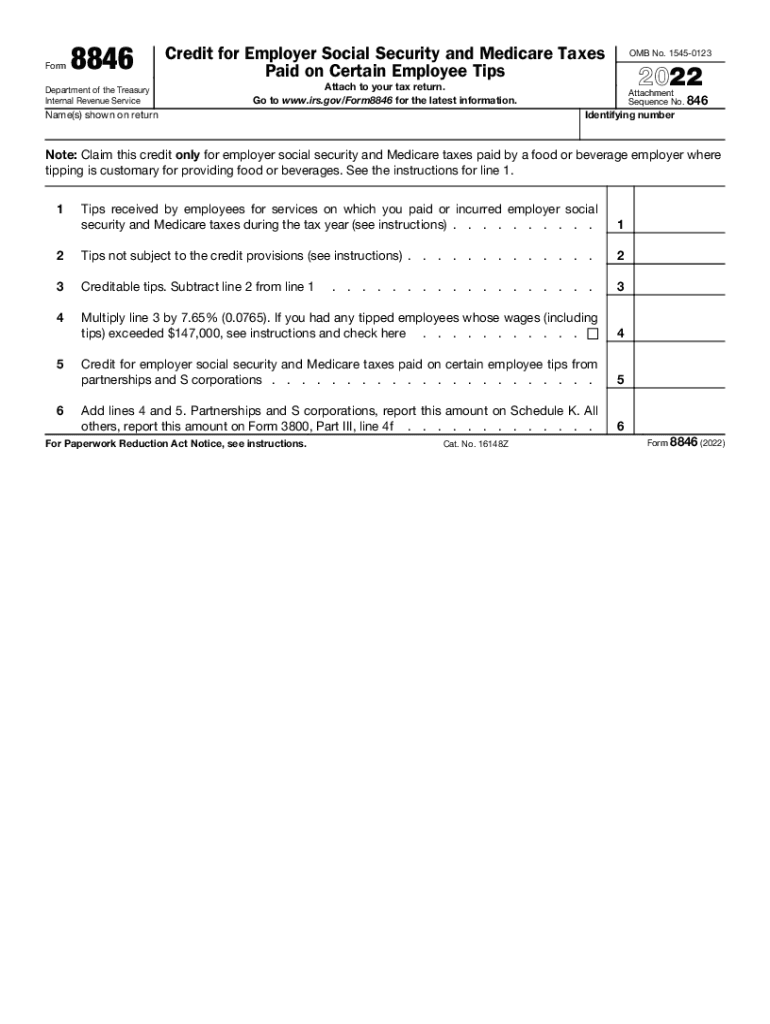

The IRS Form 8846 is designed for employers to claim a credit for Social Security and Medicare taxes paid on certain tips received by their employees. This form is particularly relevant for businesses in the hospitality and food service industries, where tipping is common. By utilizing this form, employers can reduce their overall tax liability, making it a valuable tool for financial management.

Steps to Complete the IRS Form 8846

Completing the IRS Form 8846 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total tips received by employees and the amount of Social Security and Medicare taxes paid. Next, accurately fill out the form by providing the required details in the designated sections. It's essential to double-check calculations to avoid errors that could lead to delays or penalties. Finally, ensure that all signatures are in place before submission.

Eligibility Criteria for IRS Form 8846

To qualify for the credit claimed on Form 8846, employers must meet specific eligibility criteria. The business must be subject to Social Security and Medicare taxes and must have employees who receive tips. Additionally, the tips must be reported by employees, and the employer must have paid the corresponding taxes. Understanding these criteria is crucial for businesses to determine their eligibility for the credit.

Filing Deadlines and Important Dates for IRS Form 8846

Filing deadlines for IRS Form 8846 are critical for ensuring compliance and avoiding penalties. Generally, the form must be filed along with the employer's income tax return. Employers should be aware of the specific deadlines associated with their tax filings, as these can vary based on the business structure and fiscal year. Staying informed about these dates helps businesses plan effectively and maintain compliance with IRS regulations.

Required Documents for IRS Form 8846

When preparing to submit IRS Form 8846, several documents are necessary to support the claim. Employers should have records of all tips received by employees, documentation of Social Security and Medicare taxes paid, and any relevant payroll records. Keeping these documents organized and readily accessible can streamline the filing process and help substantiate the credit claimed on the form.

Form Submission Methods for IRS Form 8846

Employers have multiple options for submitting IRS Form 8846, including online filing, mailing a paper form, or submitting it in person at designated IRS offices. Each method has its own advantages, such as convenience or immediate confirmation of receipt. Understanding these submission methods allows employers to choose the one that best fits their needs and ensures timely processing of their credit claim.

IRS Guidelines for Form 8846

The IRS provides specific guidelines for completing and submitting Form 8846. These guidelines outline the information required, the calculations necessary to determine the credit, and the proper way to report the credit on tax returns. Familiarizing oneself with these guidelines is essential for ensuring that the form is filled out correctly and that the credit is claimed appropriately, minimizing the risk of audits or penalties.

Quick guide on how to complete irs form 8846 ampquotcredit for employer social security and medicare taxes

Set Up IRS Form 8846 "Credit For Employer Social Security And Medicare Taxes Effortlessly on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage IRS Form 8846 "Credit For Employer Social Security And Medicare Taxes on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign IRS Form 8846 "Credit For Employer Social Security And Medicare Taxes with Ease

- Find IRS Form 8846 "Credit For Employer Social Security And Medicare Taxes and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow includes for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign IRS Form 8846 "Credit For Employer Social Security And Medicare Taxes while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8846 ampquotcredit for employer social security and medicare taxes

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow 8846?

airSlate SignNow 8846 is a comprehensive eSignature solution that enables businesses to send, sign, and manage documents with ease. Designed to simplify the signing process, it offers an intuitive platform that caters to companies of all sizes, ensuring high efficiency and security.

-

How does airSlate SignNow 8846 enhance document management?

With airSlate SignNow 8846, businesses can streamline their document workflows through automated processes and templates. This feature allows users to easily track the status of documents, ensuring timely completions and reducing administrative overhead signNowly.

-

What are the pricing plans for airSlate SignNow 8846?

airSlate SignNow 8846 offers flexible pricing plans that cater to different business needs. Our plans are designed to provide cost-effective solutions while delivering a robust eSignature experience, ensuring that businesses can choose a plan that best fits their operational requirements.

-

What features can I expect from airSlate SignNow 8846?

airSlate SignNow 8846 provides essential features such as document templates, real-time notifications, and advanced security measures. These features empower users to harness the full potential of eSignatures while maintaining compliance with legal standards.

-

Is airSlate SignNow 8846 suitable for small businesses?

Yes, airSlate SignNow 8846 is ideal for small businesses looking for an affordable and efficient eSignature solution. Its user-friendly interface and scalable features help small businesses streamline their signing process without the complexity often associated with larger systems.

-

Can I integrate airSlate SignNow 8846 with other software?

Absolutely! airSlate SignNow 8846 can be easily integrated with various third-party applications and services. This flexibility allows businesses to incorporate eSigning seamlessly into their existing workflows, enhancing productivity and collaboration across platforms.

-

What are the security features of airSlate SignNow 8846?

airSlate SignNow 8846 prioritizes the security of your documents by implementing industry-standard encryption and compliance protocols. We ensure that all electronic signatures are legally binding and secure, providing peace of mind that your data remains safe throughout the signing process.

Get more for IRS Form 8846 "Credit For Employer Social Security And Medicare Taxes

- Name change notification form new hampshire

- Commercial building or space lease new hampshire form

- New hampshire disability compensation form

- New hampshire legal form

- Nh guardian form

- New hampshire bankruptcy form

- Bill of sale with warranty by individual seller new hampshire form

- Bill of sale with warranty for corporate seller new hampshire form

Find out other IRS Form 8846 "Credit For Employer Social Security And Medicare Taxes

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now