Form 8846, Credit for Employer Social Security and 2021

What is the Form 8846, Credit For Employer Social Security And

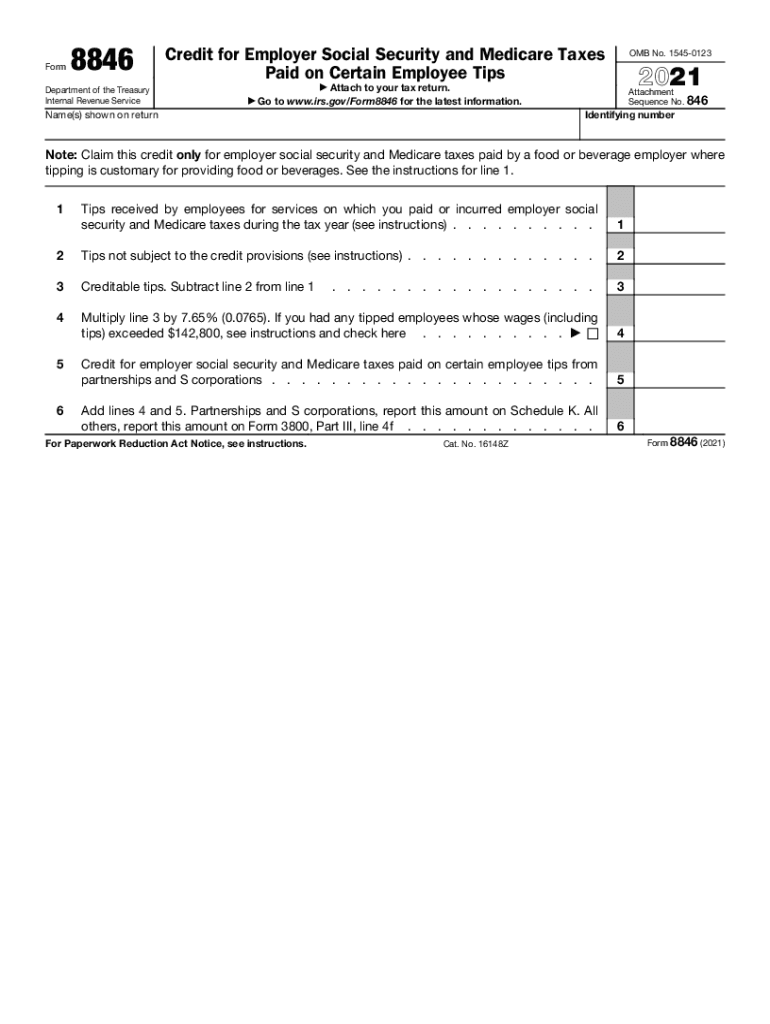

The Form 8846 is a tax form used by employers to claim a credit for certain social security and Medicare taxes paid on behalf of their employees. This form is specifically designed for businesses that qualify for the credit, allowing them to reduce their overall tax liability. The credit is available to employers who have paid social security taxes on employee wages, particularly for those employees who are eligible for the credit under specific criteria set by the IRS.

How to use the Form 8846, Credit For Employer Social Security And

To effectively use the Form 8846, employers must first determine their eligibility for the credit. This involves reviewing the IRS guidelines and ensuring that the employees in question meet the necessary criteria. Once eligibility is confirmed, employers can fill out the form by providing detailed information about their business, the employees, and the amount of social security taxes paid. After completing the form, it should be submitted with the employer's tax return to claim the credit.

Steps to complete the Form 8846, Credit For Employer Social Security And

Completing the Form 8846 involves several key steps:

- Gather necessary information about your business and employees.

- Review eligibility requirements for the credit.

- Fill out the form by entering relevant details, including the total amount of social security taxes paid.

- Double-check the information for accuracy to avoid delays.

- Submit the completed form with your tax return.

Key elements of the Form 8846, Credit For Employer Social Security And

Several key elements are essential when filling out the Form 8846:

- Employer identification information, including the business name and tax identification number.

- Details of the employees for whom the credit is being claimed, including their names and social security numbers.

- The total amount of social security taxes paid on behalf of eligible employees.

- Signature of the employer or authorized representative to validate the form.

Eligibility Criteria

To qualify for the credit claimed through Form 8846, employers must meet specific eligibility criteria. These include:

- Having paid social security taxes for employees who qualify under the IRS guidelines.

- Ensuring that the employees are not excluded from the credit based on their employment status or other factors.

- Filing the form within the designated time frame to ensure the credit is applied to the correct tax year.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with Form 8846. The form should be submitted along with the employer's annual tax return. Typically, tax returns for most businesses are due on April fifteenth of the following year. However, if an extension is filed, the deadline may be extended to October fifteenth. It is crucial to adhere to these deadlines to avoid penalties and ensure the credit is applied appropriately.

Quick guide on how to complete form 8846 credit for employer social security and

Prepare Form 8846, Credit For Employer Social Security And effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Form 8846, Credit For Employer Social Security And on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 8846, Credit For Employer Social Security And without hassle

- Locate Form 8846, Credit For Employer Social Security And and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misdirected documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Modify and eSign Form 8846, Credit For Employer Social Security And and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8846 credit for employer social security and

Create this form in 5 minutes!

How to create an eSignature for the form 8846 credit for employer social security and

How to generate an e-signature for a PDF online

How to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

The best way to make an e-signature for a PDF on Android

People also ask

-

What is the significance of the 8846 code in airSlate SignNow?

The 8846 code is essential for identifying specific features related to document signing and management in airSlate SignNow. It ensures users have access to the tools they need for efficient e-signing. Knowing the 8846 code can streamline your onboarding process.

-

How much does airSlate SignNow cost, and what does the 8846 tier include?

airSlate SignNow offers competitive pricing plans that include the 8846 tier, designed for small businesses. This tier provides essential features without overwhelming costs, ensuring great value for your investment. You can also benefit from cost-effective add-ons tailored to your needs.

-

What are the key features of the 8846 plan in airSlate SignNow?

The 8846 plan includes core features such as unlimited document sending, templates, and advanced e-signature capabilities. This plan is designed to simplify the signing process while ensuring compliance and security. It gives businesses everything they need to manage their documents effectively.

-

Can I integrate airSlate SignNow with other applications using the 8846 plan?

Yes, the 8846 plan allows seamless integration with various applications like CRM systems, email platforms, and cloud storage services. This feature enhances productivity by enabling users to manage documents from different tools in one place. Integration options make airSlate SignNow a versatile solution for businesses.

-

What benefits does the 8846 plan offer for small businesses?

The 8846 plan offers small businesses a cost-effective way to digitize their document workflows with user-friendly e-signature features. It enhances efficiency by reducing turnaround times and increasing accessibility. Investing in the 8846 plan can lead to considerable time savings and improved collaboration.

-

How secure is the 8846 e-signing process in airSlate SignNow?

The 8846 e-signing process is highly secure, incorporating industry-standard encryption and compliance with legal regulations. airSlate SignNow ensures that all sensitive data is protected, giving users peace of mind. Security measures enable businesses to sign documents confidently without risking data bsignNowes.

-

Is mobile access available for the 8846 plan users?

Absolutely! Users of the 8846 plan can access airSlate SignNow on mobile devices, ensuring that they can manage document signing on-the-go. The mobile-friendly interface allows for easy e-signing, making it convenient for users in various settings. This is essential for modern businesses requiring flexibility in operations.

Get more for Form 8846, Credit For Employer Social Security And

- Ct warranty deed form

- Revocation of postnuptial property agreement connecticut connecticut form

- Ct agreement 497300964 form

- Connecticut postnuptial form

- Quitclaim deed from husband and wife to an individual connecticut form

- Warranty deed from husband and wife to an individual connecticut form

- Quitclaim deed two individuals to one individual connecticut form

- Connecticut special warranty deed form

Find out other Form 8846, Credit For Employer Social Security And

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now