IRS Form 8846 Walkthrough Credit for Employer FICA Taxes 2023-2026

What is the IRS Form 8846?

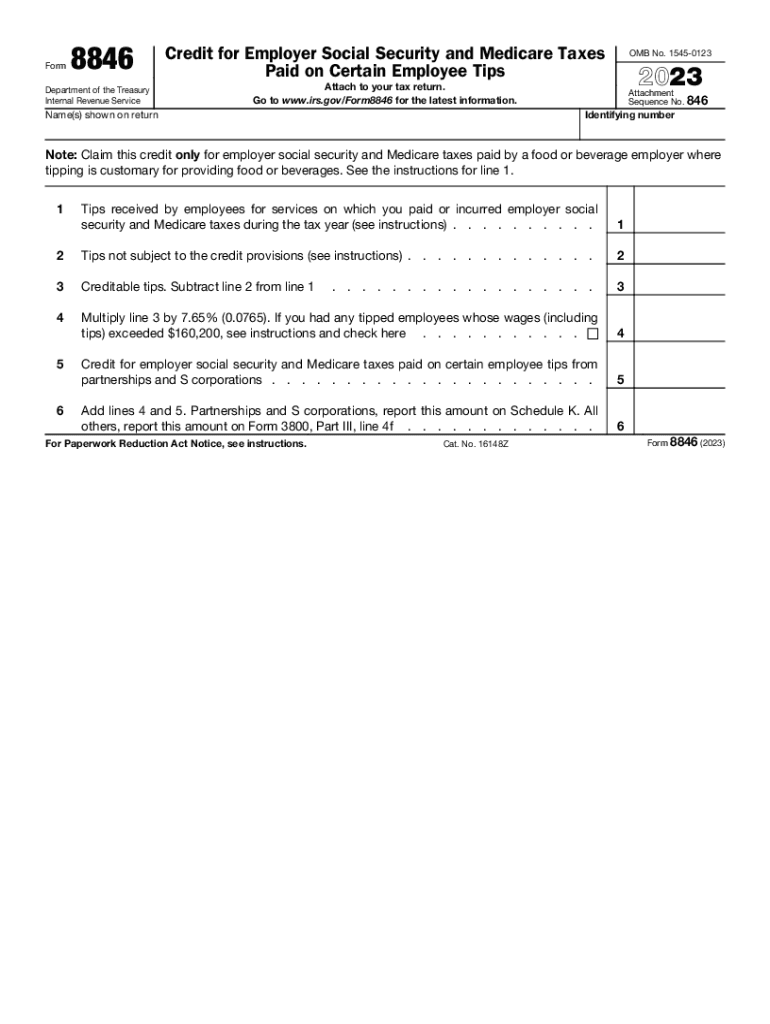

The IRS Form 8846, also known as the Tip Credit Form, is a tax document used by employers to claim a credit against their share of FICA taxes. This form is specifically designed for employers who provide certain tips to their employees. The credit allows businesses to reduce their tax liability based on the tips received by their employees, which can be particularly beneficial in the hospitality and service industries.

Eligibility Criteria for Form 8846

To qualify for the credit claimed on Form 8846, employers must meet specific criteria. The business must be a qualified employer, meaning it must have employees who receive tips and report them to the employer. Additionally, the tips must be considered "certain tips" as defined by IRS guidelines. Employers must ensure that they maintain accurate records of the tips received and reported by their employees to substantiate their claim.

Steps to Complete the IRS Form 8846

Completing the IRS Form 8846 involves several key steps:

- Gather necessary information about your business and employees, including total tips received.

- Fill out the form with accurate data regarding the number of employees who received tips and the total amount of tips reported.

- Calculate the credit amount based on the tips reported, following the IRS guidelines for the credit calculation.

- Review the completed form for accuracy before submission.

Filing Deadlines for Form 8846

Employers must be aware of the filing deadlines associated with Form 8846. Generally, this form should be filed with the employer's annual tax return. It is crucial to check the specific deadlines for the current tax year, as they may vary. Late submissions may result in penalties or the loss of the credit.

IRS Guidelines for Form 8846

The IRS provides detailed guidelines for completing and submitting Form 8846. These guidelines outline the eligibility requirements, the calculation of the credit, and the documentation needed to support the claim. Employers should refer to the IRS instructions for Form 8846 to ensure compliance and to avoid common mistakes that could lead to issues during the filing process.

Required Documents for Form 8846

When filing Form 8846, employers must have specific documents on hand. These typically include:

- Records of tips received by employees.

- Documentation showing the total wages paid to employees.

- Any other relevant financial records that support the claim for the tip credit.

Penalties for Non-Compliance with Form 8846

Failure to comply with the requirements of Form 8846 can result in penalties. Employers who do not accurately report tips or who fail to file the form may face financial repercussions, including fines and the disallowance of the credit. It is essential for employers to understand these risks and to ensure that they meet all filing requirements to avoid complications.

Quick guide on how to complete irs form 8846 walkthrough credit for employer fica taxes

Effortlessly Prepare IRS Form 8846 Walkthrough Credit For Employer FICA Taxes on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Handle IRS Form 8846 Walkthrough Credit For Employer FICA Taxes on any device with the airSlate SignNow apps for Android or iOS and streamline any document-based task today.

How to Edit and Electronically Sign IRS Form 8846 Walkthrough Credit For Employer FICA Taxes with Ease

- Obtain IRS Form 8846 Walkthrough Credit For Employer FICA Taxes and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRS Form 8846 Walkthrough Credit For Employer FICA Taxes to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8846 walkthrough credit for employer fica taxes

Create this form in 5 minutes!

How to create an eSignature for the irs form 8846 walkthrough credit for employer fica taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 8846?

airSlate SignNow is a versatile eSignature solution that streamlines document signing processes for businesses. The product, identified by the code 8846, allows users to send, sign, and manage documents efficiently, enhancing productivity and ensuring compliance.

-

How much does airSlate SignNow cost, specifically the 8846 plan?

The pricing for the airSlate SignNow solution, including the 8846 plan, varies based on the features and number of users. We offer flexible pricing options that cater to businesses of all sizes, ensuring you find a cost-effective solution that meets your needs.

-

What key features does the 8846 offering include?

The 8846 package from airSlate SignNow includes essential features like document templates, in-person signing, and advanced security protocols. Additionally, it supports various document formats, making it a comprehensive solution for all your eSignature needs.

-

How can businesses benefit from using the 8846 plan of airSlate SignNow?

By utilizing the 8846 plan of airSlate SignNow, businesses can signNowly reduce turnaround time for contract approvals, enhance user experience, and minimize paper usage. This results in faster transactions and improved environmental responsibility, adding value to your operations.

-

Is the 8846 plan compatible with other software integrations?

Yes, the 8846 plan of airSlate SignNow is designed to seamlessly integrate with a variety of third-party applications including CRM systems and cloud storage services. This allows for smooth workflows and enhanced document management across platforms.

-

What security measures does airSlate SignNow implement for the 8846 solution?

The 8846 solution from airSlate SignNow includes robust security measures such as encryption, secure access controls, and compliance with eSignature laws. These features ensure that all signed documents are safe and maintain the integrity of sensitive information.

-

What type of support can users expect with the 8846 plan?

Users of the 8846 plan can expect comprehensive customer support from airSlate SignNow, including access to a knowledge base, tutorials, and direct assistance. Our dedicated support team is here to help you navigate any questions or issues you may encounter.

Get more for IRS Form 8846 Walkthrough Credit For Employer FICA Taxes

- Oak harbor freight claim form

- Form c34 duty drawback rate of yield notification form kra go

- The center for epidemiological studies uic department of form

- Vgz declaratieformulier

- Vendor invitation email form

- Elec nj form

- Form mo ptc property tax credit claim

- Faith and life series grade 4 answer key pdf form

Find out other IRS Form 8846 Walkthrough Credit For Employer FICA Taxes

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed