P11D Working Sheet 2 GOV UK 2021

What is the P11D Working Sheet?

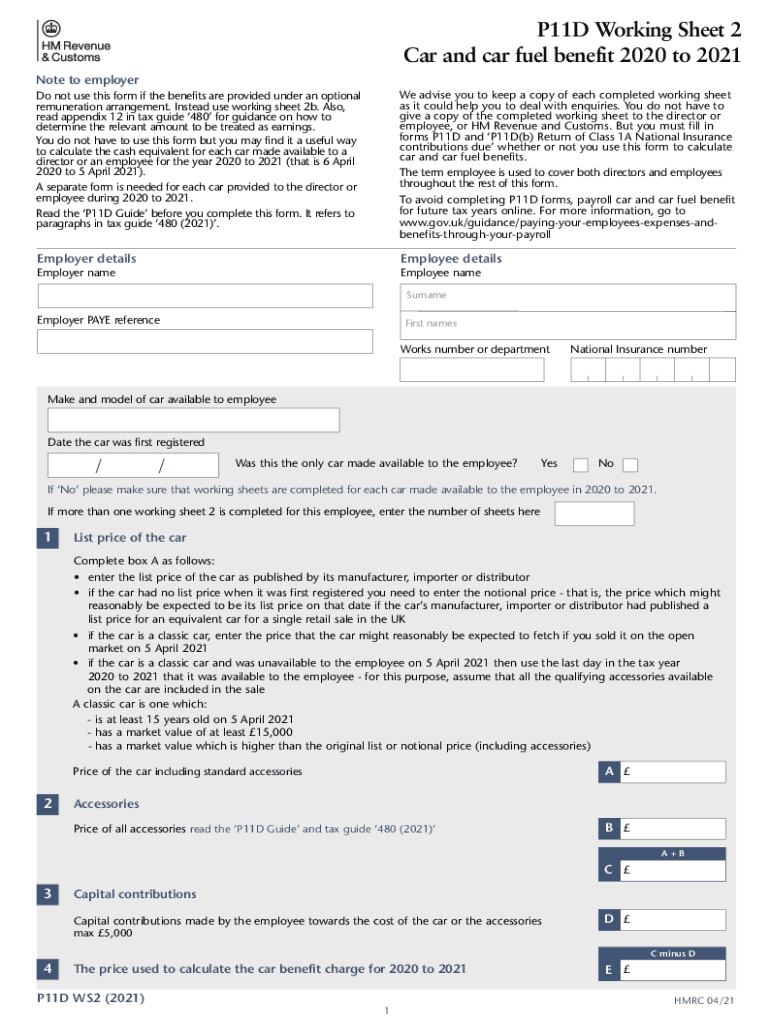

The P11D working sheet is a document used in the United Kingdom for reporting employee benefits and expenses. It is essential for employers to accurately complete this form to comply with tax regulations. The P11D working sheet provides a structured format for detailing various benefits provided to employees, such as company cars, health insurance, and other perks. This information is crucial for calculating the taxable benefits that employees must report on their tax returns.

Steps to Complete the P11D Working Sheet

Completing the P11D working sheet involves several key steps:

- Gather necessary information about employee benefits, including the type and value of each benefit provided.

- Fill in the employee's details, including their name, National Insurance number, and the tax year.

- Detail each benefit in the appropriate sections of the form, ensuring accurate values are reported.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to HM Revenue and Customs (HMRC) by the specified deadline.

Legal Use of the P11D Working Sheet

The P11D working sheet must be completed in accordance with UK tax laws. Employers are legally required to report any benefits provided to employees to ensure proper taxation. Failure to comply with these regulations can result in penalties or fines. It is important for employers to maintain accurate records and to submit the P11D working sheet within the designated time frame to avoid any legal repercussions.

Examples of Using the P11D Working Sheet

Employers may encounter various scenarios when using the P11D working sheet, such as:

- Reporting a company car provided to an employee, including details about the car’s value and CO2 emissions.

- Documenting health insurance benefits that cover employees and their families.

- Listing any loans or advances given to employees, specifying the amount and terms.

These examples illustrate the diverse range of benefits that must be accounted for on the P11D working sheet.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines associated with the P11D working sheet. Typically, the completed form must be submitted to HMRC by July six of the tax year following the reporting period. Employers should also keep in mind that any tax due on the reported benefits must be paid by the same deadline to avoid interest and penalties.

Required Documents

To complete the P11D working sheet accurately, employers should gather the following documents:

- Employee records detailing benefits provided during the tax year.

- Invoices or receipts for any expenses reimbursed to employees.

- Documentation related to company assets used by employees, such as vehicles or equipment.

Having these documents on hand will facilitate a smoother completion process and ensure compliance with tax regulations.

Quick guide on how to complete p11d working sheet 2 govuk

Easily Prepare P11D Working Sheet 2 GOV UK on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct version and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly without delays. Manage P11D Working Sheet 2 GOV UK on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign P11D Working Sheet 2 GOV UK Effortlessly

- Locate P11D Working Sheet 2 GOV UK and click Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign P11D Working Sheet 2 GOV UK to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p11d working sheet 2 govuk

Create this form in 5 minutes!

How to create an eSignature for the p11d working sheet 2 govuk

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is a P11D working sheet?

A P11D working sheet is an essential document that helps employers manage and report expenses and benefits provided to employees. It simplifies the P11D process, ensuring accurate tax calculations and compliance. Using a P11D working sheet can help streamline your payroll and tax reporting.

-

How does airSlate SignNow facilitate the P11D working sheet process?

AirSlate SignNow allows you to easily create, send, and eSign your P11D working sheet online. The platform offers intuitive templates and tools to ensure that all required information is captured accurately. With airSlate SignNow, managing your P11D working sheet becomes a hassle-free experience.

-

What features does airSlate SignNow offer for managing P11D working sheets?

AirSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning options. These features simplify the creation and management of your P11D working sheet. Additionally, you can track document status and receive notifications, enhancing your efficiency.

-

Is airSlate SignNow affordable for small businesses needing P11D working sheet solutions?

Yes, airSlate SignNow is a cost-effective solution for businesses of all sizes, including small businesses needing P11D working sheet management. The pricing plans are designed to cater to different budget levels while providing essential features. This makes it an ideal choice for small businesses looking to streamline their document processes.

-

Can I integrate airSlate SignNow with other software for P11D working sheet management?

Absolutely! airSlate SignNow offers integrations with popular accounting and payroll software, enabling seamless data transfers. This is particularly beneficial for managing your P11D working sheet, as it ensures all financial information is consistently updated and accurate across platforms.

-

What are the benefits of using airSlate SignNow for my P11D working sheet?

Using airSlate SignNow for your P11D working sheet brings numerous benefits, including enhanced accuracy, improved collaboration, and reduced processing time. The platform enables you to efficiently manage documents and eliminates the need for physical paperwork. This can lead to signNow time and cost savings for your business.

-

Is my data secure when using airSlate SignNow for P11D working sheets?

Yes, data security is a top priority at airSlate SignNow. The platform utilizes advanced encryption and robust security protocols to protect the integrity of your P11D working sheet and other sensitive information. You can trust that your data is safeguarded while you manage your documents electronically.

Get more for P11D Working Sheet 2 GOV UK

Find out other P11D Working Sheet 2 GOV UK

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe