P11D Working Sheet 2 Car and Car Fuel Benefit to GOV 2023

Understanding the P11D Working Sheet 2 Car and Car Fuel Benefit

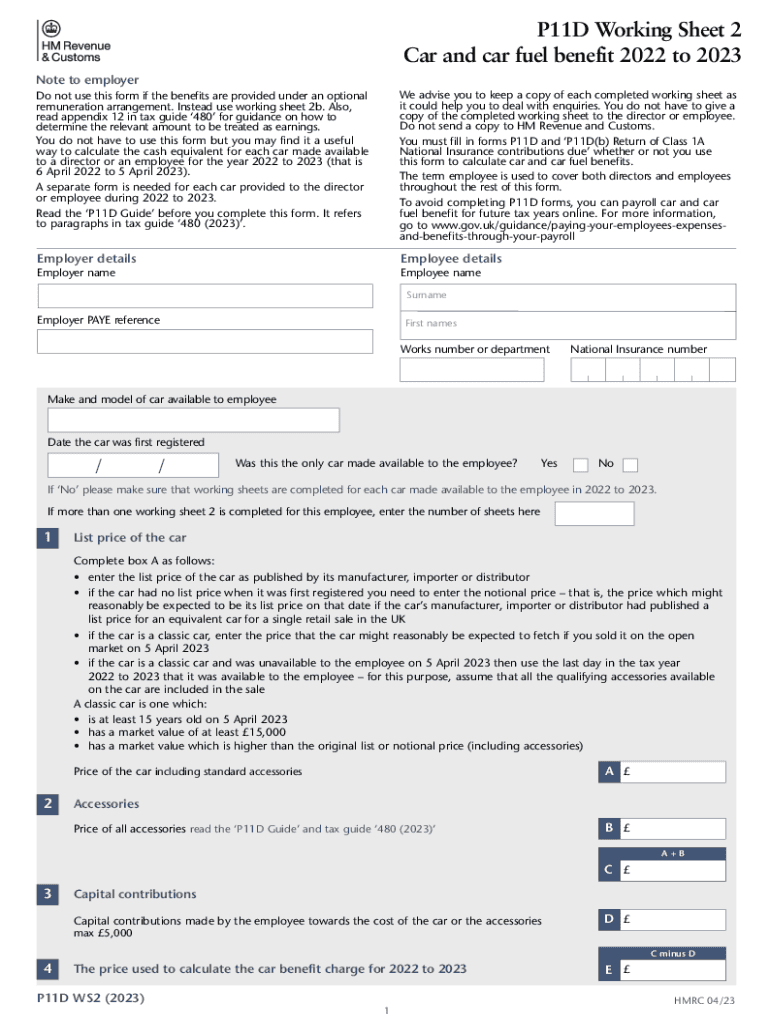

The P11D Working Sheet 2 is a crucial document for businesses in the U.S. that need to report employee benefits related to company cars and fuel. This form helps employers calculate the taxable value of these benefits, ensuring compliance with IRS regulations. The car benefit is based on the car's list price, CO2 emissions, and the employee's income tax rate, while the fuel benefit applies when the employer pays for fuel used for personal journeys. Understanding these calculations is essential for accurate reporting and tax compliance.

Steps to Complete the P11D Working Sheet 2

Completing the P11D Working Sheet 2 involves several key steps:

- Gather necessary information about the employee and the vehicle, including the list price and CO2 emissions.

- Determine the appropriate tax rate based on the employee's income.

- Calculate the car benefit using the provided formulas, which factor in the vehicle's emissions and list price.

- Calculate the fuel benefit if applicable, based on the cost of fuel provided for personal use.

- Compile the results and ensure all calculations are accurate before submission.

Legal Use of the P11D Working Sheet 2

The P11D Working Sheet 2 is legally recognized as a valid document for reporting employee benefits in the U.S. To ensure its legal standing, it must be completed accurately and submitted within the designated timeframe. Compliance with IRS regulations is essential, as inaccuracies could lead to penalties. Employers should maintain proper records and documentation to support the information reported on the form.

Filing Deadlines and Important Dates

Timely submission of the P11D Working Sheet 2 is crucial to avoid penalties. The IRS typically sets specific deadlines for filing these forms, which may vary each tax year. Employers should be aware of these dates and plan accordingly to ensure all necessary information is compiled and submitted on time. Keeping a calendar of important tax dates can help in managing these deadlines effectively.

Required Documents for Completing the P11D Working Sheet 2

To complete the P11D Working Sheet 2 accurately, certain documents are required:

- Employee records, including salary and tax information.

- Details of the company car, including its list price and CO2 emissions.

- Receipts or records of fuel expenses if the employer covers fuel costs for personal use.

- Previous P11D forms for reference, if applicable.

Examples of Using the P11D Working Sheet 2

Employers can benefit from practical examples to understand how to complete the P11D Working Sheet 2. For instance, if an employee drives a company car valued at $30,000 with CO2 emissions of 120 g/km, the employer would apply the relevant tax rate to calculate the car benefit. If the employer also covers personal fuel costs, they would calculate the fuel benefit based on the total fuel expenses incurred. These examples can guide employers in accurately reporting benefits and ensuring compliance.

Quick guide on how to complete p11d working sheet 2 car and car fuel benefit to gov

Prepare P11D Working Sheet 2 Car And Car Fuel Benefit To GOV effortlessly on any gadget

Web-based document management has surged in popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage P11D Working Sheet 2 Car And Car Fuel Benefit To GOV on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign P11D Working Sheet 2 Car And Car Fuel Benefit To GOV with ease

- Obtain P11D Working Sheet 2 Car And Car Fuel Benefit To GOV and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Edit and eSign P11D Working Sheet 2 Car And Car Fuel Benefit To GOV and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p11d working sheet 2 car and car fuel benefit to gov

Create this form in 5 minutes!

How to create an eSignature for the p11d working sheet 2 car and car fuel benefit to gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the p11d form PDF, and why do I need it?

The p11d form PDF is a document that employers in the UK use to report benefits and expenses provided to employees. Completing this form accurately is essential for compliance with tax regulations. By using our eSigning tools, you can easily fill out and send the p11d form PDF to ensure timely submissions.

-

How can airSlate SignNow help me manage p11d form PDFs?

airSlate SignNow provides an efficient platform to create, edit, and eSign your p11d form PDFs. With our user-friendly interface, you can streamline the entire process, from filling out the form to obtaining signatures. This makes it easier to manage compliance and stay organized.

-

Is there a cost associated with using airSlate SignNow for p11d form PDFs?

Yes, airSlate SignNow offers flexible pricing plans based on your business needs. While some features are free, premium options for managing p11d form PDFs come at a competitive price. This cost-effective solution ensures you get value while simplifying your documentation process.

-

Can I integrate airSlate SignNow with my existing software to manage p11d form PDFs?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, allowing you to manage p11d form PDFs directly from the tools you already use. This enhances your workflow and ensures that all your documents are easily accessible and manageable.

-

What are the main benefits of using airSlate SignNow for eSigning p11d form PDFs?

Using airSlate SignNow for eSigning p11d form PDFs offers numerous benefits, including improved efficiency and reduced turnaround time. Our platform also provides advanced security features to protect your documents, ensuring that sensitive information remains confidential throughout the signing process.

-

Is it easy to use airSlate SignNow for creating a p11d form PDF?

Yes, airSlate SignNow is designed to be user-friendly, allowing anyone to create a p11d form PDF quickly. With intuitive tools and templates, you can customize your documents without technical expertise, making document preparation straightforward and hassle-free.

-

How does airSlate SignNow ensure the security of my p11d form PDFs?

airSlate SignNow takes security seriously by employing industry-standard encryption and compliance measures to protect your p11d form PDFs. Our platform ensures that all data is secure during transmission and storage, giving you peace of mind that your sensitive information is well-protected.

Get more for P11D Working Sheet 2 Car And Car Fuel Benefit To GOV

Find out other P11D Working Sheet 2 Car And Car Fuel Benefit To GOV

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure