P11D Working Sheet 2 Car and Car Fuel Benefit to 2024-2026

Understanding the P11D Working Sheet 2 Car and Car Fuel Benefit

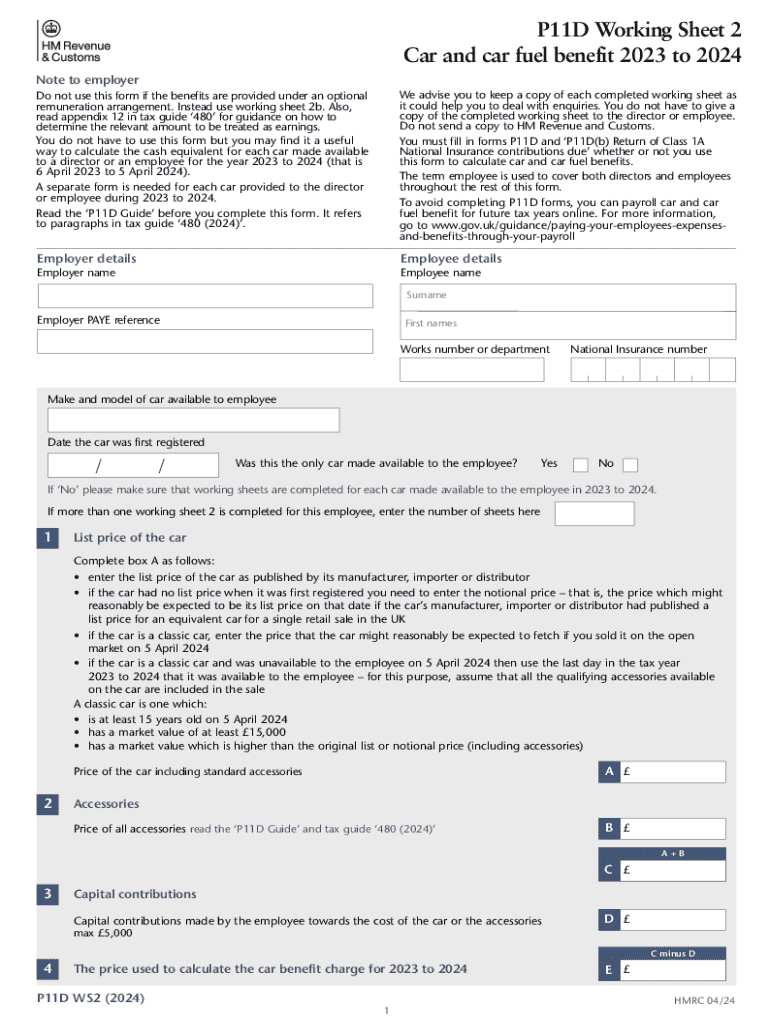

The P11D Working Sheet 2 is a crucial document used for calculating the car and car fuel benefits provided to employees. This form helps employers report the taxable benefits associated with company cars and fuel provided for personal use. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations.

The car benefit is determined based on the car's value, its CO2 emissions, and the type of fuel used. The fuel benefit applies when an employer provides fuel for private use. Both benefits are calculated separately and reported on the P11D form, impacting the employee's taxable income.

Steps to Complete the P11D Working Sheet 2 Car and Car Fuel Benefit

Completing the P11D Working Sheet 2 involves several steps to ensure accurate reporting of car and fuel benefits. Follow these steps for effective completion:

- Gather necessary information about the company car, including its list price, CO2 emissions, and fuel type.

- Determine the appropriate percentage rate based on the car's CO2 emissions to calculate the car benefit.

- Calculate the fuel benefit if applicable, using the prescribed fuel benefit charge for the tax year.

- Enter the calculated benefits on the P11D form, ensuring all figures are accurate and complete.

- Review the completed form for any discrepancies before submission.

Legal Use of the P11D Working Sheet 2 Car and Car Fuel Benefit

The P11D Working Sheet 2 must be used in compliance with IRS guidelines. Employers are legally required to report any taxable benefits provided to employees, including those related to company cars and fuel. Failure to accurately report these benefits can lead to penalties and interest on unpaid taxes.

It is essential to maintain accurate records and documentation supporting the calculations made on the P11D form. This ensures that employers can substantiate their claims in case of an audit or review by tax authorities.

Examples of Using the P11D Working Sheet 2 Car and Car Fuel Benefit

Practical examples can illustrate how to use the P11D Working Sheet 2 effectively. For instance:

If an employee has a company car valued at $30,000 with CO2 emissions of 120g/km, the employer would use the current percentage rate for that emissions band to determine the car benefit. If the rate is 20%, the car benefit would be $6,000.

For fuel benefits, if the employer provides fuel worth $2,000 for personal use, that amount is reported separately. Both figures are then included on the P11D form for the employee's tax assessment.

Required Documents for P11D Working Sheet 2 Car and Car Fuel Benefit

To complete the P11D Working Sheet 2 accurately, several documents are required:

- Details of the company car, including its purchase invoice and specifications.

- Records of fuel expenses related to the car, including receipts and invoices.

- Previous P11D forms for reference and consistency in reporting.

- Any additional documentation that supports the calculation of benefits.

Filing Deadlines for the P11D Working Sheet 2 Car and Car Fuel Benefit

Employers must adhere to specific filing deadlines for the P11D Working Sheet 2. Typically, the P11D form must be submitted to the IRS by July 6 following the end of the tax year. Employers should also provide employees with their copies of the P11D by the same date.

It is advisable to allow sufficient time for gathering necessary information and completing the form to avoid late filing penalties. Keeping track of these deadlines is crucial for maintaining compliance with tax regulations.

Quick guide on how to complete p11d working sheet 2 car and car fuel benefit to

Complete P11D Working Sheet 2 Car And Car Fuel Benefit To effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any delays. Manage P11D Working Sheet 2 Car And Car Fuel Benefit To on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign P11D Working Sheet 2 Car And Car Fuel Benefit To seamlessly

- Find P11D Working Sheet 2 Car And Car Fuel Benefit To and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tiresome form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Edit and electronically sign P11D Working Sheet 2 Car And Car Fuel Benefit To to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p11d working sheet 2 car and car fuel benefit to

Create this form in 5 minutes!

How to create an eSignature for the p11d working sheet 2 car and car fuel benefit to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a p11d form 23 24 template?

The p11d form 23 24 template is a standardized document used by employers in the UK to report employee benefits and expenses to HMRC. This template simplifies the process of completing and submitting the necessary information, ensuring compliance with tax regulations.

-

How can airSlate SignNow help with the p11d form 23 24 template?

airSlate SignNow provides an intuitive platform that allows users to easily fill out, sign, and send the p11d form 23 24 template electronically. This streamlines the process, reduces paperwork, and enhances efficiency for businesses managing employee benefits.

-

Is there a cost associated with using the p11d form 23 24 template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the p11d form 23 24 template. These plans are designed to be cost-effective, providing businesses with a valuable tool for managing their documentation needs without breaking the bank.

-

What features are included with the p11d form 23 24 template on airSlate SignNow?

The p11d form 23 24 template on airSlate SignNow includes features such as electronic signatures, customizable fields, and secure document storage. These features enhance the user experience and ensure that all necessary information is captured accurately.

-

Can I integrate the p11d form 23 24 template with other software?

Absolutely! airSlate SignNow allows for seamless integration with various software applications, making it easy to incorporate the p11d form 23 24 template into your existing workflows. This integration capability enhances productivity and ensures a smooth document management process.

-

What are the benefits of using the p11d form 23 24 template?

Using the p11d form 23 24 template offers numerous benefits, including time savings, improved accuracy, and enhanced compliance with tax regulations. By utilizing airSlate SignNow, businesses can streamline their reporting processes and reduce the risk of errors.

-

Is the p11d form 23 24 template customizable?

Yes, the p11d form 23 24 template on airSlate SignNow is fully customizable. Users can modify fields and sections to fit their specific needs, ensuring that the template aligns perfectly with their reporting requirements.

Get more for P11D Working Sheet 2 Car And Car Fuel Benefit To

- Wv 2848 west virginia state tax department authorization of form

- Cibc direct deposit form

- Hl restructuring application form

- Cara mengisi formulir kartu kredit bni

- Credit card standing instruction si form rbl bank

- Functional upper extremity levels pdf form

- 23 24 parking pass regulations and signature agreement form

- Appleton parking ticket form

Find out other P11D Working Sheet 2 Car And Car Fuel Benefit To

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation