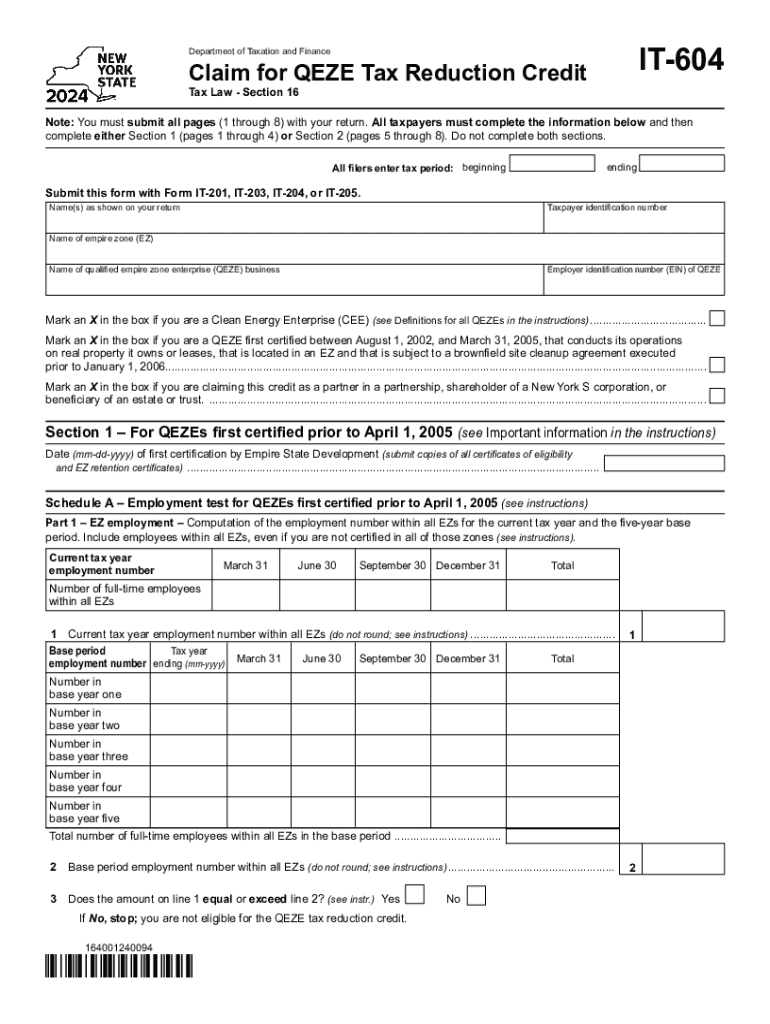

Form it 604 Claim for QEZE Tax Reduction Credit Tax Year 2024-2026

What is the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

The Form IT 604 is a tax form used by eligible businesses in New York to claim the Qualified Empire Zone Enterprise (QEZE) Tax Reduction Credit. This credit is designed to encourage economic development in designated areas by providing tax relief to businesses that meet specific criteria. The form allows businesses to report their eligibility and calculate the amount of credit they can claim for a particular tax year.

How to use the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

To effectively use the Form IT 604, businesses must first determine their eligibility for the QEZE Tax Reduction Credit. This involves reviewing the criteria set forth by the New York State Department of Taxation and Finance. Once eligibility is confirmed, businesses should complete the form by providing necessary information, including their business details, the amount of credit being claimed, and any supporting documentation required to substantiate their claim.

Steps to complete the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

Completing the Form IT 604 involves several key steps:

- Gather all necessary financial documents and records related to your business operations.

- Review the eligibility criteria for the QEZE Tax Reduction Credit to ensure compliance.

- Fill out the form with accurate information, including business name, address, and tax identification number.

- Calculate the credit amount based on the guidelines provided by the New York State Department of Taxation and Finance.

- Attach any required supporting documentation that verifies your eligibility.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the QEZE Tax Reduction Credit, businesses must meet specific eligibility criteria, including:

- Being located in a designated Empire Zone.

- Maintaining a minimum level of business activity within the zone.

- Meeting employment requirements as specified by the state.

- Filing the appropriate tax returns and forms in a timely manner.

Form Submission Methods

The Form IT 604 can be submitted through various methods, ensuring convenience for businesses. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Required Documents

When submitting the Form IT 604, businesses must include certain documents to support their claim. These may include:

- Proof of business location within the Empire Zone.

- Financial statements that demonstrate eligibility criteria are met.

- Any additional documentation requested by the tax authority to validate the claim.

Create this form in 5 minutes or less

Find and fill out the correct form it 604 claim for qeze tax reduction credit tax year 772088708

Create this form in 5 minutes!

How to create an eSignature for the form it 604 claim for qeze tax reduction credit tax year 772088708

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

The Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year is a tax form used by eligible businesses to claim a reduction in their tax liability under the Qualified Empire Zone Enterprise (QEZE) program. This form helps businesses benefit from tax incentives designed to promote economic growth in designated areas.

-

How can airSlate SignNow help with the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year. Our user-friendly interface simplifies the process, ensuring that all necessary information is accurately captured and securely transmitted.

-

What are the pricing options for using airSlate SignNow for the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large enterprise, our cost-effective solutions ensure that you can efficiently manage your Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year without breaking the bank.

-

What features does airSlate SignNow offer for managing the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

With airSlate SignNow, you can easily create, edit, and eSign the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year. Our platform includes features like document templates, real-time tracking, and secure storage, making it easier for businesses to manage their tax forms efficiently.

-

Are there any benefits to using airSlate SignNow for the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

Using airSlate SignNow for the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year streamlines the entire process, saving you time and reducing errors. Our platform enhances collaboration among team members and ensures compliance with tax regulations, ultimately leading to a smoother filing experience.

-

Can I integrate airSlate SignNow with other software for the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to connect your existing tools for managing the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year. This integration capability enhances workflow efficiency and ensures that all your data is synchronized.

-

Is airSlate SignNow secure for handling the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year is handled with the utmost care. Our platform employs advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

- Plumbing contractor package nevada form

- Brick mason contractor package nevada form

- Roofing contractor package nevada form

- Electrical contractor package nevada form

- Sheetrock drywall contractor package nevada form

- Flooring contractor package nevada form

- Trim carpentry contractor package nevada form

- Fencing contractor package nevada form

Find out other Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure