Instructions for Form CT 604 Claim for QEZE Tax Reduction 2022

What is the Instructions for Form IT-604 Claim for QEZE Tax Reduction

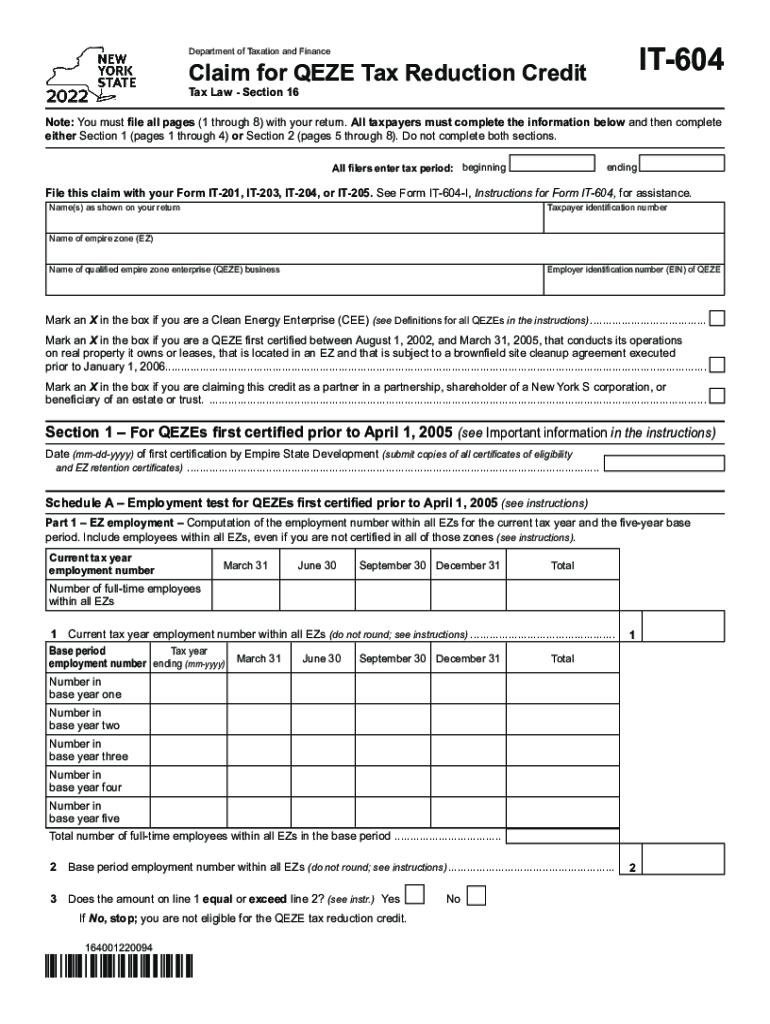

The Instructions for Form IT-604 Claim for QEZE Tax Reduction provide essential guidelines for businesses seeking tax benefits under the Qualified Empire Zone Enterprise (QEZE) program. This form is specifically designed for entities operating within designated zones in New York State, allowing them to claim reductions on their tax liabilities. Understanding these instructions is crucial for ensuring compliance with state tax regulations and maximizing potential savings.

Steps to Complete the Instructions for Form IT-604 Claim for QEZE Tax Reduction

Completing the Instructions for Form IT-604 involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including proof of eligibility for the QEZE program.

- Carefully read the instructions to understand the requirements and sections of the form.

- Fill out the form accurately, providing all requested information, such as business details and tax identification numbers.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Eligibility Criteria for Form IT-604 Claim for QEZE Tax Reduction

To qualify for the tax reduction under Form IT-604, businesses must meet specific eligibility criteria. These criteria typically include:

- Being located within a designated QEZE zone in New York State.

- Meeting the employment and investment requirements set forth by the state.

- Maintaining compliance with all applicable tax regulations.

It is essential for businesses to verify their eligibility before completing the form to ensure they can successfully claim the tax reduction.

Key Elements of the Instructions for Form IT-604 Claim for QEZE Tax Reduction

The key elements of the Instructions for Form IT-604 include detailed explanations of the necessary information required for the form, guidelines on how to calculate the tax reduction, and any supporting documentation that must be submitted. Additionally, the instructions outline the process for appealing a denial of the claim, should it occur. Understanding these elements is vital for a successful submission.

Filing Deadlines for Form IT-604 Claim for QEZE Tax Reduction

Filing deadlines for Form IT-604 are critical to ensure timely submission and avoid penalties. Typically, the form must be submitted by the due date of the tax return for the year in which the claim is made. It is advisable for businesses to keep track of these deadlines and prepare their documentation in advance to ensure compliance.

Form Submission Methods for IT-604 Claim for QEZE Tax Reduction

Businesses can submit Form IT-604 through various methods, including:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Each method has specific guidelines and requirements, so it is important to choose the one that best fits the business's needs.

Quick guide on how to complete instructions for form ct 604 claim for qeze tax reduction

Prepare Instructions For Form CT 604 Claim For QEZE Tax Reduction effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Instructions For Form CT 604 Claim For QEZE Tax Reduction on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Instructions For Form CT 604 Claim For QEZE Tax Reduction without difficulty

- Find Instructions For Form CT 604 Claim For QEZE Tax Reduction and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form CT 604 Claim For QEZE Tax Reduction and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 604 claim for qeze tax reduction

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 604 claim for qeze tax reduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 604 solution offered by airSlate SignNow?

The IT 604 solution from airSlate SignNow is designed to streamline your document management process. It allows businesses to send, sign, and manage documents online with ease. This cloud-based solution is cost-effective and suited for various industries, making document signing simple and secure.

-

How does airSlate SignNow's IT 604 help in reducing costs?

Utilizing the IT 604 feature, businesses can signNowly cut down on paper costs and related expenses. With its electronic signing capabilities, you eliminate printing, mailing, and storage costs associated with traditional document handling. This not only saves money but also boosts overall efficiency.

-

What are the key features of the IT 604 solution?

The IT 604 solution includes features such as customizable templates, real-time tracking, and secure storage for your documents. Additionally, it supports multiple formats and offers a user-friendly interface for both senders and signers. These features collectively enhance workflow efficiency and document management.

-

Can IT 604 integrate with other software applications?

Yes, airSlate SignNow's IT 604 integrates seamlessly with numerous business applications, enhancing its functionality. You can connect it with software like CRM systems, cloud storage services, and productivity tools. This integration capability ensures a smoother workflow across platforms.

-

What are the benefits of using the IT 604 solution for my business?

The primary benefits of using the IT 604 solution include enhanced efficiency, reduced turnaround time for document signing, and improved security. With airSlate SignNow, you can manage your documents digitally, which also contributes to a greener environment. Ultimately, it helps businesses save time and focus on core operations.

-

Is airSlate SignNow's IT 604 user-friendly?

Absolutely! The IT 604 solution has been designed with user experience in mind, providing an intuitive interface for users of all technical levels. This means that your team can quickly learn to navigate the platform, ensuring a smooth transition to digital document management.

-

What type of support is available for users of IT 604?

Users of the IT 604 solution can access comprehensive customer support via multiple channels. airSlate SignNow offers email support, live chat, and an extensive knowledge base to help answer your queries. This support ensures that you can maximize the benefits of the platform efficiently.

Get more for Instructions For Form CT 604 Claim For QEZE Tax Reduction

- Name change notification form south carolina

- Sc affidavit form

- Commercial building or space lease south carolina form

- Sc legal documents form

- Guardian documents 497325789 form

- South carolina bankruptcy form

- Bill of sale with warranty by individual seller south carolina form

- Bill of sale with warranty for corporate seller south carolina form

Find out other Instructions For Form CT 604 Claim For QEZE Tax Reduction

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile