Form 592 a Payment Voucher for Foreign Partner or Member 2021

What is the California 592 A Payment Voucher for Foreign Partner or Member

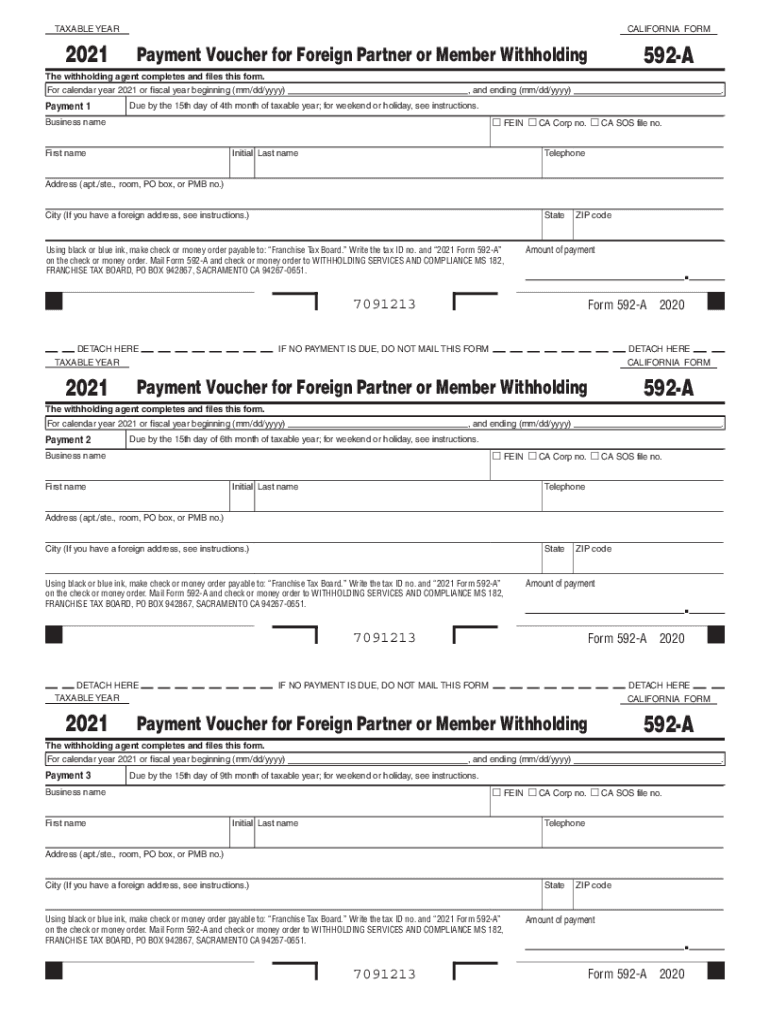

The California 592 A Payment Voucher is a crucial document used by foreign partners or members of a partnership to report and pay California state income tax on income derived from California sources. This form is specifically designed for non-resident partners or members who receive income from a partnership that operates in California. By utilizing the 592 A voucher, these individuals can ensure compliance with California tax regulations, thereby avoiding potential penalties.

How to Use the California 592 A Payment Voucher for Foreign Partner or Member

To effectively use the California 592 A Payment Voucher, foreign partners or members must complete the form accurately. It is essential to provide all required information, including the name, address, and taxpayer identification number of the partner or member. The form also requires details regarding the partnership and the amount of tax owed. Once completed, the voucher should be submitted along with the payment to the California Franchise Tax Board, ensuring that all deadlines are met to avoid late fees.

Steps to Complete the California 592 A Payment Voucher for Foreign Partner or Member

Completing the California 592 A Payment Voucher involves several key steps:

- Gather necessary information, including personal and partnership details.

- Fill out the form, ensuring all fields are completed accurately.

- Calculate the total tax owed based on the income received.

- Review the form for any errors or omissions.

- Submit the completed voucher along with the payment to the California Franchise Tax Board.

Key Elements of the California 592 A Payment Voucher for Foreign Partner or Member

The California 592 A Payment Voucher includes several critical elements that must be accurately filled out:

- Taxpayer Information: Name, address, and taxpayer identification number of the foreign partner or member.

- Partnership Information: Name and address of the partnership generating the income.

- Income Details: Amount of income received from the partnership.

- Tax Calculation: Total amount of California state tax owed based on the income reported.

Legal Use of the California 592 A Payment Voucher for Foreign Partner or Member

The California 592 A Payment Voucher is legally binding when completed and submitted according to state regulations. It serves as a formal declaration of tax liability for foreign partners or members, ensuring compliance with California tax laws. To maintain its legal standing, it is important to adhere to all filing deadlines and provide accurate information. Failure to do so may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely submission of the California 592 A Payment Voucher is essential to avoid penalties. The filing deadline typically aligns with the partnership's tax return due date. It is advisable to check the California Franchise Tax Board's official schedule for specific dates each tax year, as they may vary. Staying informed about these deadlines ensures that foreign partners or members remain compliant with state tax obligations.

Quick guide on how to complete 2021 form 592 a payment voucher for foreign partner or member

Effortlessly prepare Form 592 A Payment Voucher For Foreign Partner Or Member on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Form 592 A Payment Voucher For Foreign Partner Or Member on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Form 592 A Payment Voucher For Foreign Partner Or Member effortlessly

- Obtain Form 592 A Payment Voucher For Foreign Partner Or Member and then select Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redacted sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Modify and eSign Form 592 A Payment Voucher For Foreign Partner Or Member and guarantee outstanding communication throughout every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 592 a payment voucher for foreign partner or member

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 592 a payment voucher for foreign partner or member

The way to make an e-signature for a PDF document in the online mode

The way to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is California 592 A and how does it relate to eSigning documents?

California 592 A refers to specific regulations governing electronic signatures in California. Understanding California 592 A is crucial for businesses looking to adopt eSigning solutions like airSlate SignNow. By complying with California 592 A, companies can ensure their electronic signatures are legally valid and enforceable.

-

How much does it cost to use airSlate SignNow for California 592 A compliant eSigning?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses, ensuring compliance with California 592 A. Pricing typically ranges from monthly subscriptions to yearly plans, providing flexibility for users. For exact pricing details, it's best to visit our pricing page or contact our sales team for a personalized quote.

-

What features does airSlate SignNow provide to ensure compliance with California 592 A?

airSlate SignNow includes features like secure storage, audit trails, and user authentication to comply with California 592 A standards. These features guarantee that all electronic signatures are securely captured and verifiable. By incorporating these elements, businesses can trust that their eSigning practices are in alignment with legal requirements.

-

What are the benefits of using airSlate SignNow for California 592 A eSigning?

Using airSlate SignNow for California 592 A eSigning enhances productivity by streamlining document workflows. It allows businesses to quickly send, sign, and manage documents while ensuring compliance with state regulations. Additionally, the user-friendly interface makes it accessible for anyone, regardless of technical expertise.

-

Can airSlate SignNow integrate with other applications while complying with California 592 A?

Yes, airSlate SignNow seamlessly integrates with various applications including CRM, cloud storage, and project management tools, all while adhering to California 592 A requirements. These integrations enhance document management efficiency. Businesses can leverage their existing software tools while ensuring all eSigning processes remain compliant.

-

Is airSlate SignNow suitable for small businesses in California regarding California 592 A?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal solution for small businesses in California. By supporting compliance with California 592 A, small businesses can confidently adopt eSigning without overwhelming costs or complexities. This empowers them to enhance their operational efficiency and customer satisfaction.

-

What security measures does airSlate SignNow have for California 592 A compliance?

airSlate SignNow employs advanced security measures such as encryption, multi-factor authentication, and secure data storage, ensuring compliance with California 592 A. These safeguards protect sensitive information during the eSigning process. Customers can rest assured that their data remains confidential and secure.

Get more for Form 592 A Payment Voucher For Foreign Partner Or Member

- Delaware assumption agreement of mortgage and release of original mortgagors form

- Delaware notices resolutions simple stock ledger and certificate form

- Delaware will form

- Florida promissory note in connection with sale of vehicle or automobile 481379371 form

- Florida painting contract for contractor form

- Florida commercial contract form

- Florida brick mason contract for contractor form

- Florida final notice of forfeiture and request to vacate property under contract for deed form

Find out other Form 592 A Payment Voucher For Foreign Partner Or Member

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy