Form 592 a Payment Voucher for Foreign Partner or Member 2023

What is the Form 592 A Payment Voucher For Foreign Partner Or Member

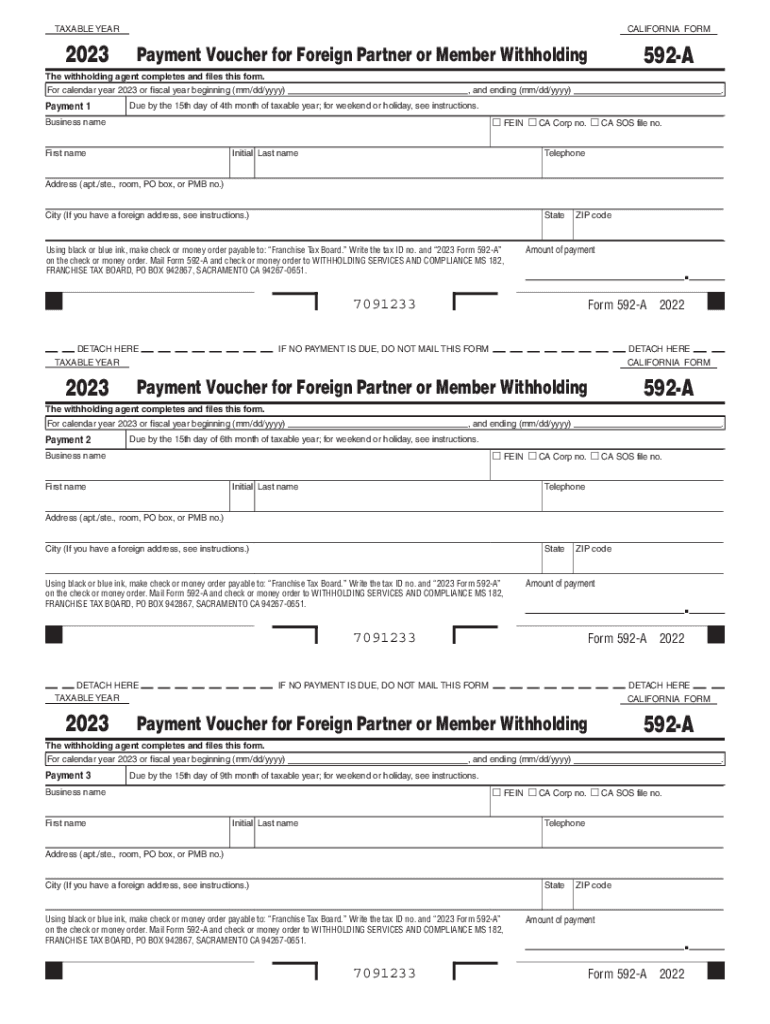

The Form 592 A Payment Voucher is specifically designed for use by foreign partners or members of a partnership in California. This form serves as a payment voucher for withholding tax purposes, ensuring that the correct amount of tax is remitted to the California Franchise Tax Board (FTB) on behalf of foreign partners. The form is essential for compliance with California tax regulations, as it allows foreign entities to meet their tax obligations when they receive income from California sources.

How to use the Form 592 A Payment Voucher For Foreign Partner Or Member

Using the Form 592 A Payment Voucher involves several straightforward steps. First, ensure you have the correct version of the form for the tax year you are filing. Next, fill in the necessary information, including the names and addresses of the foreign partners, the amount of income subject to withholding, and the corresponding tax amount. Once completed, the form should be submitted along with the payment to the FTB. It is important to keep a copy for your records and to ensure that the payment is made by the due date to avoid penalties.

Steps to complete the Form 592 A Payment Voucher For Foreign Partner Or Member

Completing the Form 592 A Payment Voucher involves the following steps:

- Obtain the latest version of the form from the California FTB website.

- Enter the name, address, and taxpayer identification number of the foreign partner.

- List the total income subject to withholding and calculate the tax due.

- Include any additional information requested on the form.

- Review the completed form for accuracy before submission.

Legal use of the Form 592 A Payment Voucher For Foreign Partner Or Member

The legal use of the Form 592 A Payment Voucher is governed by California tax laws. This form must be accurately completed and submitted to ensure compliance with withholding requirements for foreign partners. Failure to use the form correctly can result in penalties and interest on unpaid taxes. It is crucial to understand the legal implications of withholding tax and to maintain proper documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 A Payment Voucher are critical to avoid penalties. Generally, the payment is due on the 15th day of the fourth month following the close of the partnership's taxable year. For partnerships that operate on a calendar year, this means the due date is typically April 15. It is important to check for any specific updates or changes to deadlines each tax year, as these can vary based on legislative changes or other factors.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 592 A Payment Voucher can lead to significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal action by the California FTB. It is essential for foreign partners to understand their obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete 2023 form 592 a payment voucher for foreign partner or member

Easily Prepare Form 592 A Payment Voucher For Foreign Partner Or Member on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can effortlessly locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly without delays. Manage Form 592 A Payment Voucher For Foreign Partner Or Member on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and Electronically Sign Form 592 A Payment Voucher For Foreign Partner Or Member with Ease

- Locate Form 592 A Payment Voucher For Foreign Partner Or Member and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that require reprinting of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 592 A Payment Voucher For Foreign Partner Or Member and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 592 a payment voucher for foreign partner or member

Create this form in 5 minutes!

How to create an eSignature for the 2023 form 592 a payment voucher for foreign partner or member

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow in 2024?

airSlate SignNow offers a competitive pricing structure for businesses looking to streamline their document management. For 2024, you can explore various plans starting from affordable monthly rates that cater to different business sizes and needs. Whether you require basic features or advanced capabilities, airSlate SignNow has a pricing tier that aligns with your budget for 592 2024.

-

What are the key features of airSlate SignNow for 2024?

In 2024, airSlate SignNow delivers essential features such as electronic signatures, document templates, and workflow automation. These features help businesses save time and reduce errors in their document processes. With its intuitive interface, airSlate SignNow makes it easy for anyone to send and sign documents efficiently, contributing to your team's productivity in 592 2024.

-

How does airSlate SignNow improve document security?

Security is a priority for airSlate SignNow, especially in 2024. The platform uses advanced encryption techniques and complies with regulations like GDPR and HIPAA to ensure your documents are protected. With airSlate SignNow, you can trust that your sensitive information is safe as you manage your eSigning needs for 592 2024.

-

What benefits can businesses expect from using airSlate SignNow?

Businesses can expect numerous benefits from using airSlate SignNow, especially in 2024. The platform enhances efficiency, reduces paper waste, and accelerates the document signing process, enabling faster decision-making. By integrating airSlate SignNow into your workflow, you can streamline operations and improve overall efficiency for 592 2024.

-

Does airSlate SignNow integrate with other software platforms?

Yes, airSlate SignNow seamlessly integrates with various popular software platforms, enhancing your existing workflow in 2024. Whether you use CRM systems, cloud storage solutions, or project management tools, the integrations allow for a smooth transition to digital document handling. This integration capability ensures that your business processes are optimized for 592 2024.

-

Is airSlate SignNow easy to use for new users?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for new users to navigate the platform in 2024. With a clean interface and helpful resources, you can quickly learn how to send and sign documents without a steep learning curve. This ease of use is particularly beneficial for teams onboarding for 592 2024.

-

What support options are available for airSlate SignNow users?

Users of airSlate SignNow can take advantage of robust support options available in 2024. From comprehensive online resources and tutorials to dedicated customer service representatives, help is always at hand. This commitment to customer support ensures you can effectively utilize airSlate SignNow for your document needs in 592 2024.

Get more for Form 592 A Payment Voucher For Foreign Partner Or Member

Find out other Form 592 A Payment Voucher For Foreign Partner Or Member

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free