Form CA FTB 592 a Fill Online, Printable, Fillable 2022

What is the CA FTB 592 A Form?

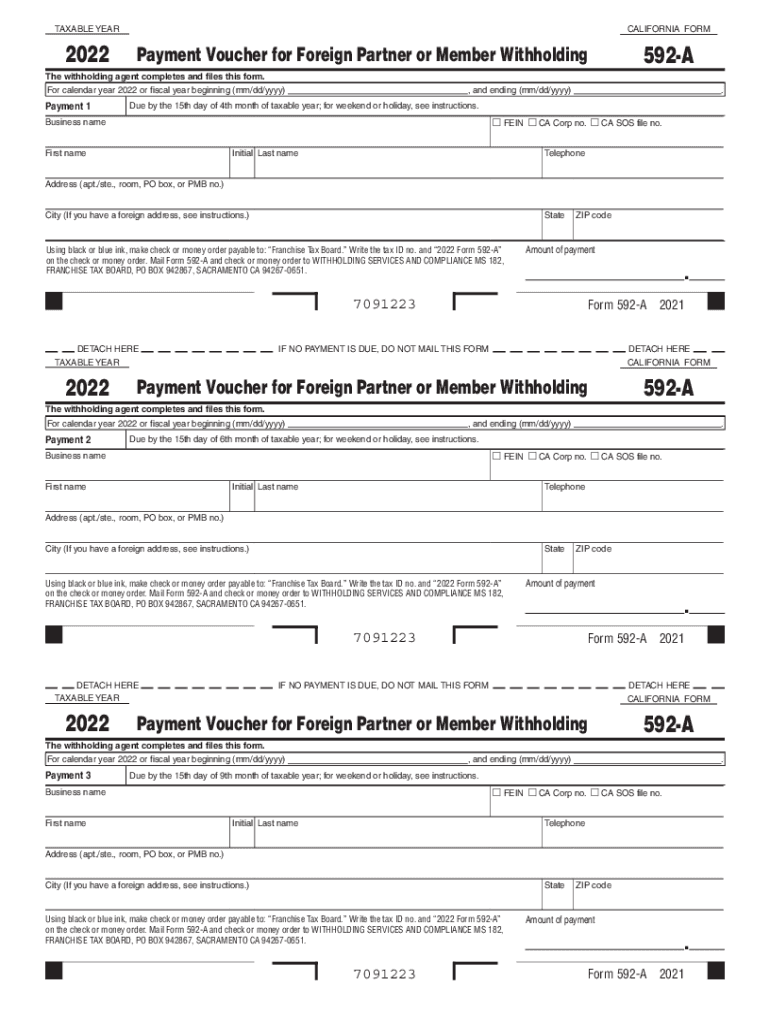

The CA FTB 592 A form is a tax document used in California to report income that is subject to withholding. It is primarily utilized by businesses and individuals who make payments to non-residents or foreign entities for services rendered within the state. This form helps ensure compliance with California tax laws by documenting the amount of income paid and the corresponding withholding tax that has been deducted. Understanding the purpose and requirements of the 592 A form is crucial for accurate tax reporting and avoiding penalties.

Steps to Complete the CA FTB 592 A Form

Completing the CA FTB 592 A form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the payee's details, the amount paid, and the withholding tax rate applicable. Next, fill out the form by entering the required information in the designated fields. Be sure to double-check for any errors or omissions, as these can lead to processing delays or penalties. Finally, submit the completed form to the California Franchise Tax Board either electronically or by mail, depending on your preference.

Legal Use of the CA FTB 592 A Form

The CA FTB 592 A form is legally binding when filled out correctly and submitted on time. It serves as a record of income paid and taxes withheld, which can be critical during audits or tax assessments. Compliance with the regulations surrounding this form helps protect both the payer and the payee from potential legal issues. It is essential to adhere to all guidelines set forth by the California Franchise Tax Board to ensure the form's validity and legal standing.

Filing Deadlines for the CA FTB 592 A Form

Filing deadlines for the CA FTB 592 A form are crucial to avoid penalties. Generally, the form must be submitted by the end of the month following the payment to the non-resident or foreign entity. For example, if a payment is made in January, the form should be filed by the end of February. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Required Documents for the CA FTB 592 A Form

To complete the CA FTB 592 A form, certain documents are required. These typically include the payee's taxpayer identification number, details of the payment made, and any previous correspondence with the California Franchise Tax Board regarding withholding. Having these documents on hand will streamline the completion process and ensure that all necessary information is accurately reported.

Examples of Using the CA FTB 592 A Form

The CA FTB 592 A form can be used in various scenarios. For instance, a business hiring a contractor from another state for services performed in California would need to report the payments made to that contractor using this form. Similarly, if a company pays royalties to a foreign entity for the use of intellectual property, the 592 A form would be required to document the income and withholding tax. Understanding these examples can help clarify when and how to use the form effectively.

Digital vs. Paper Version of the CA FTB 592 A Form

The CA FTB 592 A form is available in both digital and paper formats, allowing users to choose their preferred method of submission. The digital version offers convenience and faster processing times, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all information is accurately filled out and submitted in accordance with California tax regulations.

Quick guide on how to complete 2020 form ca ftb 592 a fill online printable fillable

Complete Form CA FTB 592 A Fill Online, Printable, Fillable effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources needed to create, edit, and eSign your documents swiftly and without complications. Handle Form CA FTB 592 A Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Form CA FTB 592 A Fill Online, Printable, Fillable effortlessly

- Obtain Form CA FTB 592 A Fill Online, Printable, Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form CA FTB 592 A Fill Online, Printable, Fillable and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form ca ftb 592 a fill online printable fillable

Create this form in 5 minutes!

People also ask

-

What is the 592a solution offered by airSlate SignNow?

The 592a solution from airSlate SignNow allows businesses to efficiently send and electronically sign documents. It simplifies the signing process while ensuring legal compliance and security. With 592a, you can streamline your workflow, reduce turnaround time, and enhance collaboration.

-

How does the pricing structure work for airSlate SignNow 592a?

AirSlate SignNow offers flexible pricing plans tailored to fit the needs of businesses using the 592a solution. Users can choose from various subscription options based on their volume of documents and features required. Visit the pricing page to explore the most cost-effective plan that meets your 592a needs.

-

What key features are included in the 592a package?

The 592a package includes robust features such as customizable templates, real-time tracking, and multi-party signing capabilities. Additionally, you can access advanced security options, audit trails, and integration with other apps. These features ensure that the 592a solution meets all your documentation needs seamlessly.

-

How can 592a benefit my business?

Implementing the 592a solution can signNowly improve your business's efficiency and productivity. By automating the document signing process with airSlate SignNow, you can reduce manual errors, save time, and improve customer satisfaction. The 592a solution ultimately leads to faster deal closures and streamlined operations.

-

What integrations are available with the 592a solution?

The 592a solution integrates with various business applications such as CRM systems and cloud storage services. This flexibility allows you to seamlessly incorporate airSlate SignNow into your existing workflows. By utilizing integrations with the 592a solution, you can enhance productivity and ensure a smooth document handling process.

-

Is the 592a solution secure for sensitive documents?

Yes, the 592a solution prioritizes security and compliance, ensuring that your sensitive documents are well protected. AirSlate SignNow uses encryption and authentication measures to safeguard eSignatures and document data. By choosing the 592a solution, you can trust that your information is secure.

-

Can I use the 592a solution on mobile devices?

Absolutely! The 592a solution is designed to be mobile-responsive, allowing you to send and sign documents on the go. Whether you're using a smartphone or tablet, airSlate SignNow ensures that the signing experience is user-friendly and accessible from any device.

Get more for Form CA FTB 592 A Fill Online, Printable, Fillable

Find out other Form CA FTB 592 A Fill Online, Printable, Fillable

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast