About Form 8805, Foreign Partner's Information Statement of 2020

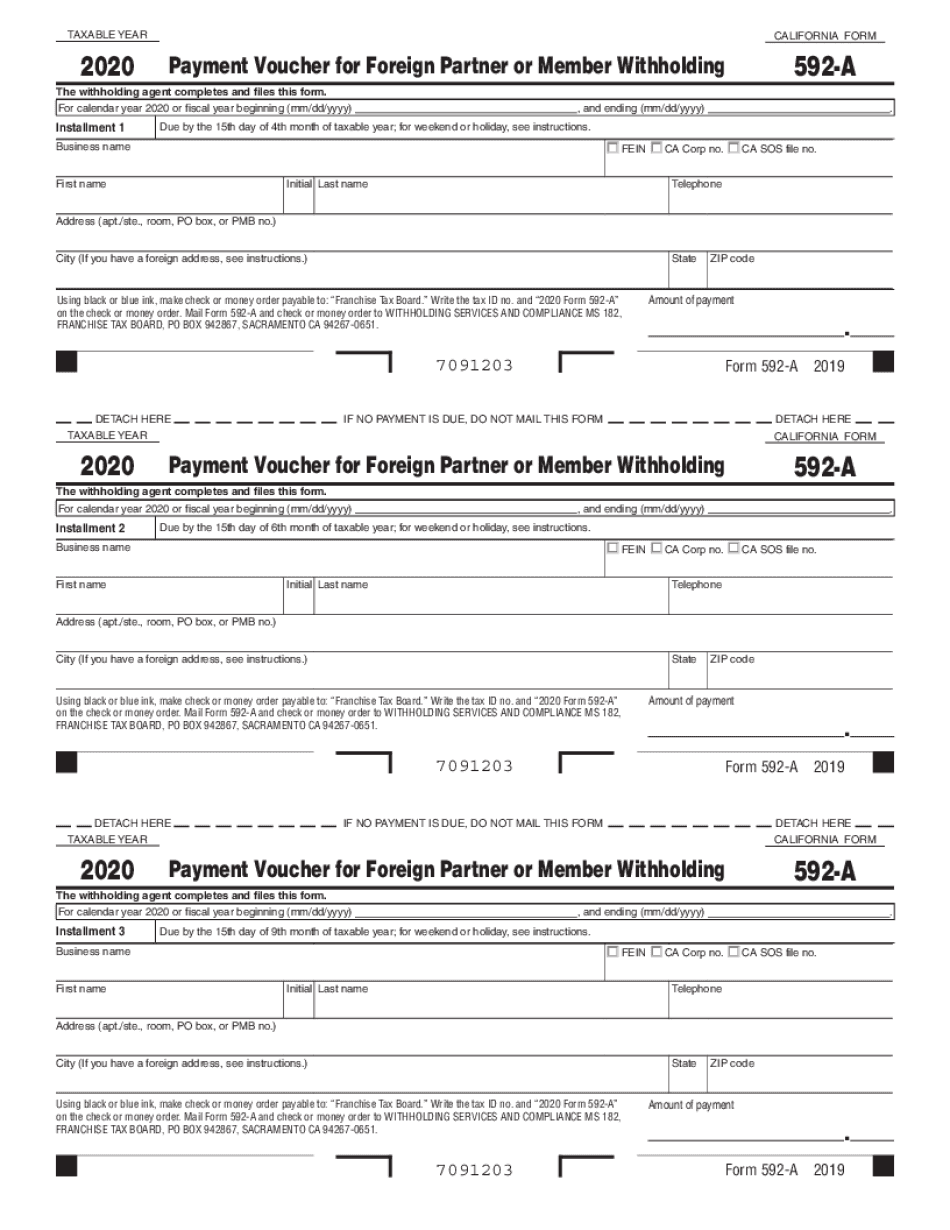

What is the 592 a foreign form?

The 592 a foreign form, officially known as the California FTB 592 a foreign form, is a tax document used by foreign partners to report income received from California sources. This form is essential for non-resident foreign entities or individuals who earn income in California, as it helps ensure compliance with state tax laws. It provides necessary information regarding the income, withholding amounts, and the foreign partner's details, which are crucial for accurate tax reporting and withholding obligations.

Steps to complete the 592 a foreign form

Completing the 592 a foreign form requires careful attention to detail to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary information: Collect details about the foreign partner, including their name, address, and taxpayer identification number.

- Report income: Clearly indicate the amount of income earned from California sources, ensuring it aligns with supporting documentation.

- Calculate withholding: Determine the appropriate withholding amount based on the income reported and applicable tax rates.

- Complete the form: Fill out all required sections of the 592 a foreign form accurately, ensuring no fields are left blank.

- Review for accuracy: Double-check all entries for correctness to avoid potential issues with the California Franchise Tax Board.

- Submit the form: Follow the designated submission methods, ensuring it is sent by the appropriate deadline.

IRS Guidelines for the 592 a foreign form

While the 592 a foreign form is a California-specific document, it is essential to be aware of the IRS guidelines that govern foreign income reporting. The IRS requires that foreign partners comply with federal tax obligations, including reporting income and withholding appropriately. Understanding these guidelines can help ensure that the information reported on the 592 a foreign form aligns with federal requirements, reducing the risk of discrepancies and penalties.

Filing deadlines for the 592 a foreign form

Timely filing of the 592 a foreign form is crucial to avoid penalties and interest. Generally, the form must be submitted by the 15th day of the fourth month following the close of the taxable year. For partnerships, this means the form is typically due on April 15 for calendar year filers. However, it is essential to verify specific deadlines for the current tax year, as they may vary based on changes in tax regulations or extensions granted by the California Franchise Tax Board.

Required documents for the 592 a foreign form

To complete the 592 a foreign form accurately, certain documents may be required. These include:

- Proof of income: Documentation showing the income earned from California sources, such as contracts or payment statements.

- Tax identification: The foreign partner's taxpayer identification number or equivalent documentation.

- Withholding certificates: Any relevant certificates that detail the withholding amounts applicable to the foreign partner.

Penalties for non-compliance with the 592 a foreign form

Failure to comply with the requirements of the 592 a foreign form can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits by the California Franchise Tax Board. It is crucial for foreign partners to understand their obligations and ensure timely and accurate submission of the form to avoid these consequences.

Quick guide on how to complete about form 8805 foreign partners information statement of

Complete About Form 8805, Foreign Partner's Information Statement Of effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it in the cloud. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle About Form 8805, Foreign Partner's Information Statement Of on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to adjust and eSign About Form 8805, Foreign Partner's Information Statement Of with ease

- Locate About Form 8805, Foreign Partner's Information Statement Of and click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that use.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from the device of your choice. Edit and eSign About Form 8805, Foreign Partner's Information Statement Of to ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8805 foreign partners information statement of

Create this form in 5 minutes!

How to create an eSignature for the about form 8805 foreign partners information statement of

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the cost of using 592 a foreign with airSlate SignNow?

The pricing for using 592 a foreign through airSlate SignNow is competitive and tailored to meet the needs of various businesses. We offer flexible subscription plans that allow you to choose an option that aligns with your budget and usage requirements. To find a plan that works for you, visit our pricing page.

-

What features does airSlate SignNow offer for 592 a foreign?

airSlate SignNow provides a range of features for 592 a foreign, including customizable templates, secure eSignature capabilities, and automated workflows. These tools streamline your document management processes, ensuring that signing documents is both efficient and compliant. Explore our features to discover how 592 a foreign can enhance your operations.

-

How can businesses benefit from using 592 a foreign with airSlate SignNow?

Using 592 a foreign with airSlate SignNow offers businesses improved efficiency and reduced turnaround times for document signing. The platform simplifies the signing process, allowing teams to focus more on their core activities rather than paperwork. With enhanced security features, you can also ensure that your documents are protected.

-

Is it easy to integrate airSlate SignNow with existing systems for 592 a foreign?

Absolutely! airSlate SignNow offers seamless integrations with various platforms, which makes it easy to incorporate 592 a foreign into your existing workflows. Whether you use CRM systems, cloud storage services, or project management tools, our integration options ensure a smooth experience.

-

Can I access airSlate SignNow on mobile devices for 592 a foreign?

Yes, airSlate SignNow is fully optimized for mobile access. You can manage your documents and eSign from any mobile device easily, allowing you to utilize 592 a foreign on the go. This flexibility enhances productivity, enabling you to send and sign documents anytime, anywhere.

-

What security measures are in place for 592 a foreign documents?

The security of your documents is a top priority at airSlate SignNow. We utilize industry-standard encryption for 592 a foreign and comply with regulations to ensure that sensitive information is protected. Furthermore, our platform provides audit trails and authentication options for added peace of mind.

-

What support options are available for users of 592 a foreign?

At airSlate SignNow, we offer robust customer support for users accessing 592 a foreign. Our resources include a detailed knowledge base, FAQs, and a dedicated support team ready to assist you via chat, email, or phone. We are committed to ensuring you have the help you need for a successful experience.

Get more for About Form 8805, Foreign Partner's Information Statement Of

Find out other About Form 8805, Foreign Partner's Information Statement Of

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile