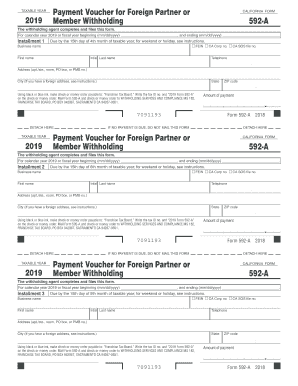

592a 2019

What is the 592a?

The 592a form, also known as the California FTB 592a foreign form, is a tax document used by the California Franchise Tax Board (FTB) to report withholding on payments made to foreign entities. This form is essential for ensuring that the correct amount of tax is withheld from payments made to non-residents or foreign businesses operating within California. The 592a form is particularly relevant for entities that are making payments subject to California withholding tax, including dividends, interest, rents, and royalties.

How to use the 592a

Using the 592a form involves several steps to ensure compliance with California tax regulations. First, the payer must determine if the payment to a foreign entity is subject to withholding. If it is, the payer should complete the 592a form, providing details such as the recipient's name, address, and taxpayer identification number. The form must be submitted to the FTB along with the payment, ensuring that the appropriate withholding tax is remitted. It’s important to keep a copy of the completed form for your records, as it serves as proof of compliance with tax withholding requirements.

Steps to complete the 592a

Completing the 592a form requires careful attention to detail. Follow these steps:

- Gather necessary information about the foreign entity, including their name, address, and taxpayer identification number.

- Identify the type of payment being made and whether it falls under California withholding tax regulations.

- Fill out the 592a form accurately, ensuring all required fields are completed.

- Calculate the appropriate withholding amount based on the payment type and applicable tax rates.

- Submit the completed form along with the payment to the California FTB.

Legal use of the 592a

The legal use of the 592a form is governed by California tax laws, which require withholding on certain payments to foreign entities. To ensure the form is legally binding, it must be filled out correctly and submitted in accordance with the FTB's guidelines. The form serves as documentation that the payer has complied with withholding requirements, which can protect them from potential penalties or audits by tax authorities. Understanding the legal implications of using the 592a is vital for businesses engaging with foreign entities.

Filing Deadlines / Important Dates

Filing deadlines for the 592a form are crucial to avoid penalties. Generally, the form must be submitted by the due date of the payment being made to the foreign entity. This typically aligns with the payment schedule outlined by the California FTB. It is essential to stay informed about any changes to deadlines, especially during tax season, to ensure timely compliance and avoid unnecessary fees.

Required Documents

To complete the 592a form, certain documents may be required. These typically include:

- The foreign entity's taxpayer identification number.

- Documentation supporting the payment type (e.g., invoices, contracts).

- Any previous correspondence with the FTB regarding withholding requirements.

Having these documents ready can streamline the process of completing and submitting the 592a form.

Who Issues the Form

The 592a form is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's tax laws and ensuring compliance among taxpayers. They provide resources and guidance on how to properly complete and submit the form, making it easier for businesses to meet their tax obligations.

Quick guide on how to complete 592a

Effortlessly Prepare 592a on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as a fantastic eco-friendly alternative to traditional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all essential tools to create, modify, and eSign your documents swiftly without delays. Handle 592a on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Quickly Modify and eSign 592a with Ease

- Obtain 592a and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors requiring new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign 592a to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 592a

Create this form in 5 minutes!

How to create an eSignature for the 592a

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is 592 a foreign in the context of airSlate SignNow?

The term '592 a foreign' refers to the efficient management of documents across borders using airSlate SignNow. This platform simplifies the signing process for foreign documents, ensuring compliance and security while facilitating international business transactions.

-

How does airSlate SignNow handle 592 a foreign document signing?

AirSlate SignNow offers a streamlined process for signing 592 a foreign documents by providing secure eSignature options that meet international standards. Users can easily upload, send, and track the signing of foreign documents, making cross-border transactions hassle-free.

-

What are the pricing plans for using airSlate SignNow for 592 a foreign documents?

The pricing plans for airSlate SignNow are designed to be flexible and affordable, catering to all business sizes. Users can select from various subscription tiers to access features tailored for managing 592 a foreign documents without breaking the bank.

-

Does airSlate SignNow include features specifically for 592 a foreign transactions?

Yes, airSlate SignNow is equipped with features tailored for 592 a foreign transactions, such as multilingual support and customizable templates. These features enhance user experience and facilitate quicker processing of international agreements.

-

Can I integrate airSlate SignNow with other tools while handling 592 a foreign documents?

Absolutely! airSlate SignNow offers seamless integrations with a wide range of applications, allowing you to manage your 592 a foreign documents alongside your existing tools. This integration capability streamlines workflows and enhances productivity.

-

What benefits does airSlate SignNow offer for implementing 592 a foreign document solutions?

Implementing airSlate SignNow for 592 a foreign documents brings numerous benefits, including reduced turnaround times and lower costs. The platform's automation features further enhance efficiency, allowing businesses to focus on growth while ensuring compliance.

-

Is airSlate SignNow secure for handling sensitive 592 a foreign documents?

Yes, airSlate SignNow prioritizes security and employs advanced encryption protocols to protect all signed 592 a foreign documents. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for 592a

Find out other 592a

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template