Individual Income Tax Forms CT GOV Connecticut's 2020

What is the Individual Income Tax Form CT K-1?

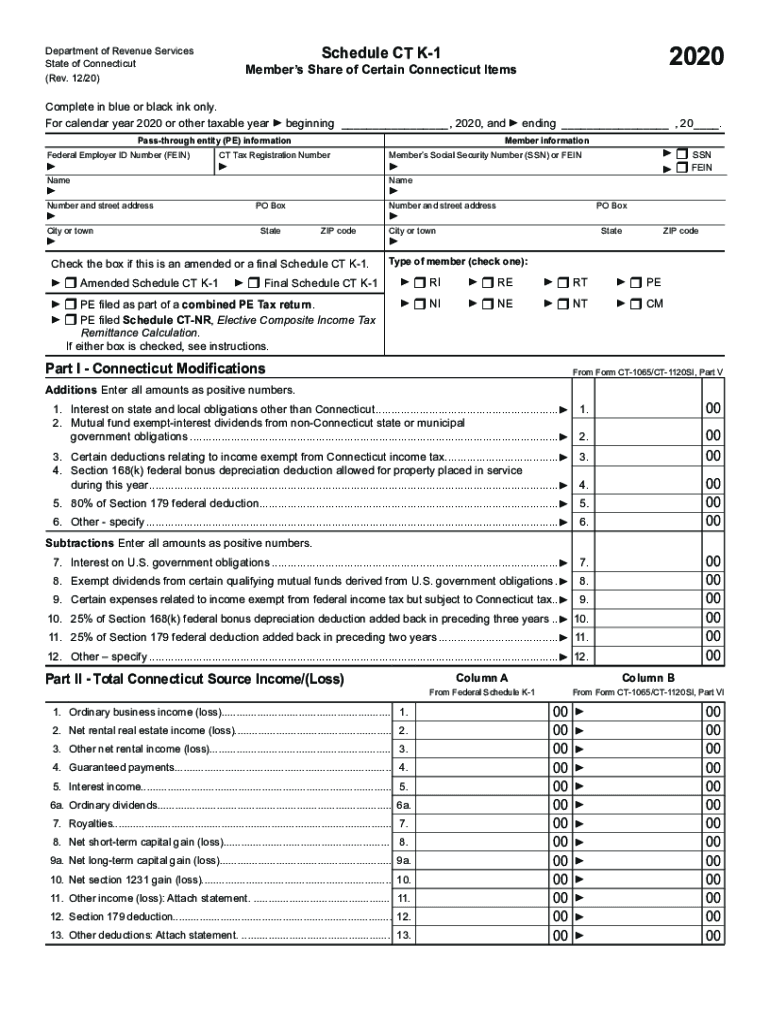

The Individual Income Tax Form CT K-1 is a tax document used in Connecticut for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it helps ensure accurate reporting of income on their personal tax returns. The CT K-1 provides detailed information about the taxpayer's share of income, losses, and other tax-related items, which must be reported on the individual's Connecticut income tax return.

Steps to Complete the Individual Income Tax Form CT K-1

Completing the CT K-1 form involves several key steps to ensure accuracy and compliance with state tax regulations. Here’s a straightforward process:

- Gather necessary documents, including prior tax returns and any relevant financial statements from the partnership or S corporation.

- Fill in your personal information, such as your name, address, and Social Security number, in the designated sections of the form.

- Enter the income, deductions, and credits provided by the entity on the form. Ensure that these figures match the information provided to you by the entity.

- Review the completed form for accuracy, ensuring all calculations are correct and all required fields are filled.

- Submit the form along with your Connecticut income tax return by the appropriate filing deadline.

Legal Use of the Individual Income Tax Form CT K-1

The CT K-1 form is legally binding and must be completed in accordance with Connecticut tax laws. It serves as an official record of income received from partnerships and S corporations. Proper use of the form ensures compliance with state tax regulations and helps avoid penalties for misreporting income. It is important to retain a copy of the CT K-1 for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates for the CT K-1

Understanding the filing deadlines for the CT K-1 is crucial for timely tax compliance. The form must be submitted by the same deadline as your personal income tax return. Typically, this is April fifteenth for most taxpayers. However, if you are unable to file by this date, you may be eligible for an extension, but it is essential to check the specific rules regarding extensions to avoid late fees.

Required Documents for Filing the CT K-1

To accurately complete the CT K-1 form, you will need several supporting documents. These may include:

- Financial statements from the partnership or S corporation.

- Previous year’s tax returns for reference.

- Any relevant tax documents that detail income sources, such as W-2s or 1099s.

Having these documents ready will streamline the process and help ensure that all information reported is accurate.

Penalties for Non-Compliance with the CT K-1

Failing to file the CT K-1 accurately or on time can result in significant penalties. These may include fines or interest on unpaid taxes. Additionally, if discrepancies are found during an audit, you may face further penalties. It is essential to ensure that the information reported on the CT K-1 is accurate and submitted by the deadline to avoid these consequences.

Quick guide on how to complete individual income tax forms ctgov connecticuts

Effortlessly complete Individual Income Tax Forms CT GOV Connecticut's on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Individual Income Tax Forms CT GOV Connecticut's on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and eSign Individual Income Tax Forms CT GOV Connecticut's with ease

- Find Individual Income Tax Forms CT GOV Connecticut's and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form—via email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Individual Income Tax Forms CT GOV Connecticut's, ensuring clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax forms ctgov connecticuts

Create this form in 5 minutes!

How to create an eSignature for the individual income tax forms ctgov connecticuts

The best way to create an e-signature for a PDF document online

The best way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is ct k 1 and how does it relate to airSlate SignNow?

The ct k 1 is a crucial tax document that provides information about income and distributions for partnerships and S corporations. airSlate SignNow streamlines the process of preparing and signing ct k 1 forms, enhancing efficiency and accuracy for businesses.

-

How much does airSlate SignNow cost for handling ct k 1 documents?

airSlate SignNow offers flexible pricing plans that are competitive for businesses needing to manage ct k 1 forms. Depending on your requirements, you can choose a plan that aligns with your budget while ensuring access to features that simplify eSigning and document management.

-

Can I integrate airSlate SignNow with accounting software for my ct k 1?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your ct k 1 forms. This integration helps automate workflows, ensuring that your financial documents are processed efficiently and accurately.

-

What features does airSlate SignNow offer for efficient ct k 1 management?

airSlate SignNow provides robust features to assist in managing ct k 1 forms, including eSigning, customizable templates, and document tracking. These tools enhance the document workflow, ensuring timely processing and secure storage of your important tax documents.

-

Is airSlate SignNow secure for signing ct k 1 documents?

Absolutely, airSlate SignNow prioritizes security and compliance, utilizing encryption and secure storage for all your ct k 1 documents. This means that you can confidently manage sensitive tax information without compromising security.

-

How quickly can I send and receive completed ct k 1 forms using airSlate SignNow?

With airSlate SignNow, sending and receiving completed ct k 1 forms is incredibly fast, usually taking just minutes. The intuitive platform allows users to request signatures and track the status of their documents in real-time, making the process efficient.

-

Do I need technical expertise to use airSlate SignNow for ct k 1?

No technical expertise is required to use airSlate SignNow for your ct k 1 documents. The platform is designed to be user-friendly, allowing anyone to easily navigate and execute document signing without any complications.

Get more for Individual Income Tax Forms CT GOV Connecticut's

- Complex will with credit shelter marital trust for large estates alaska form

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts and divorce form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts that is form

- Marital legal separation and property settlement agreement where minor children and parties may have joint property or debts form

- Alaska separation form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts effective form

- Marital legal separation and property settlement agreement where no children and parties may have joint property and or debts form

Find out other Individual Income Tax Forms CT GOV Connecticut's

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney