State Income Tax Filing 2022

What is the State Income Tax Filing

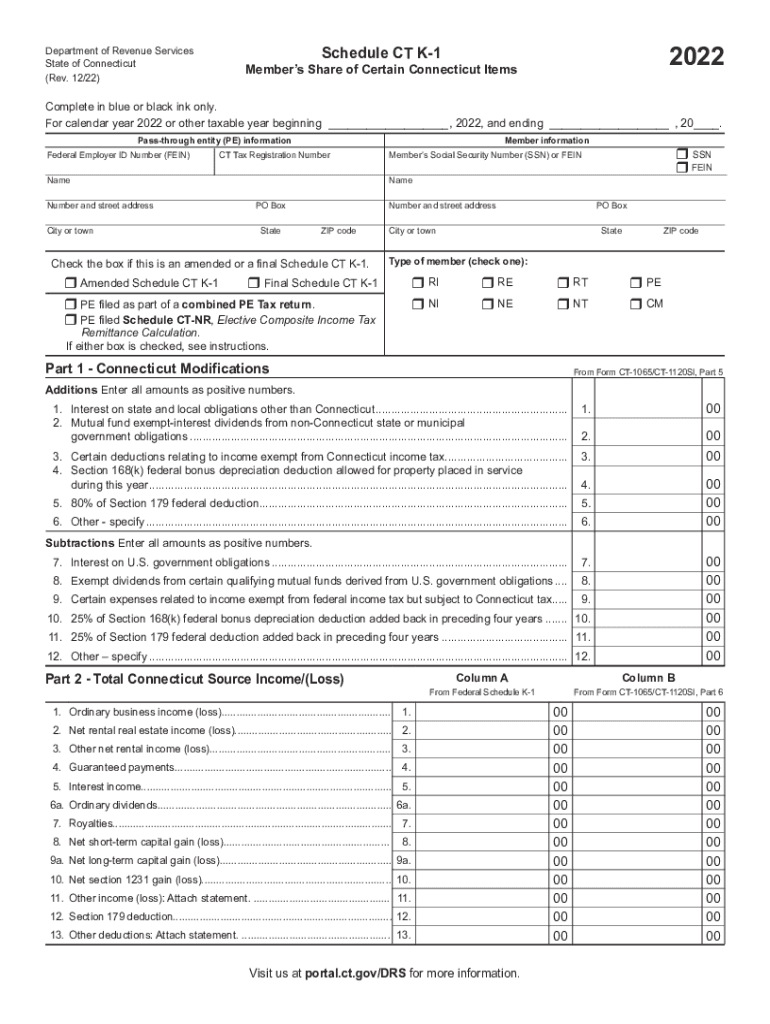

The State Income Tax Filing refers to the process by which residents of Connecticut report their income to the state government for tax purposes. This filing is essential for determining the amount of state income tax owed based on the taxpayer's earnings, deductions, and credits. The form commonly used for this purpose is the CT-1040, which must be completed accurately to ensure compliance with state tax laws. Understanding the requirements and implications of this filing is crucial for all taxpayers in Connecticut.

Steps to complete the State Income Tax Filing

Completing the State Income Tax Filing involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status: Identify whether you will file as single, married filing jointly, married filing separately, or head of household.

- Complete the form: Fill out the CT-1040 form, ensuring all income, deductions, and credits are accurately reported.

- Review your submission: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the form: File your completed form electronically or by mail, adhering to the state’s deadlines.

Legal use of the State Income Tax Filing

The legal use of the State Income Tax Filing is governed by Connecticut tax laws, which require all residents to report their income accurately. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is essential to understand that e-filing is recognized as a legal method of submission, provided that the electronic signatures comply with state regulations. Utilizing a trusted platform for e-filing can enhance the legality and security of your submission.

Filing Deadlines / Important Dates

Taxpayers in Connecticut must adhere to specific deadlines for filing their state income tax returns. The standard deadline for filing the CT-1040 is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, taxpayers may request an extension, which typically allows for an additional six months to file, although any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the State Income Tax Filing, certain documents are necessary to support the information reported on the tax form. These include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of deductions, such as mortgage interest statements

- Proof of any tax credits claimed

- Previous year’s tax return for reference

Who Issues the Form

The CT-1040 form is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The DRS provides resources and guidance for filling out the form correctly, as well as information on any changes to tax laws that may affect filing requirements.

Quick guide on how to complete state income tax filing

Prepare State Income Tax Filing effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage State Income Tax Filing on any platform through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign State Income Tax Filing without hassle

- Obtain State Income Tax Filing and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign State Income Tax Filing while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state income tax filing

Create this form in 5 minutes!

How to create an eSignature for the state income tax filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct schedule feature in airSlate SignNow?

The ct schedule feature in airSlate SignNow allows users to easily organize and manage their document signing processes. With this feature, you can set specific dates and times for when documents need to be signed, ensuring timely completion of your tasks. This helps streamline workflows and increases efficiency in document management.

-

How does airSlate SignNow support team collaboration with the ct schedule?

AirSlate SignNow enhances team collaboration through its ct schedule feature, allowing multiple users to access and sign documents as per predetermined schedules. This ensures that all team members are aligned and aware of when their input is required. By using the ct schedule, teams can maintain better communication and accountability.

-

Is there a cost associated with utilizing the ct schedule feature?

Using the ct schedule feature is included in airSlate SignNow’s pricing plans, offering great value for businesses looking to streamline their document workflows. Pricing varies based on the selected plan, but it provides access to this powerful scheduling capability. Businesses can choose a plan that best fits their needs to utilize the ct schedule efficiently.

-

What benefits does the ct schedule provide for document management?

The ct schedule provides numerous benefits for document management, including improved time management and increased productivity. By allowing users to set specific signing times, it reduces delays and ensures that documents are processed promptly. Additionally, the ct schedule helps in tracking the signing status in real-time, improving overall document flow.

-

Can I integrate the ct schedule feature with other applications?

Yes, airSlate SignNow offers integration capabilities with various applications to enhance the functionality of the ct schedule feature. This includes popular tools such as CRM systems and project management software, allowing for seamless workflows. Integrating these tools means you can automate reminders and updates related to your ct schedule.

-

How can airSlate SignNow's ct schedule help remote teams?

The ct schedule feature is particularly beneficial for remote teams, as it allows members to sign documents from anywhere at scheduled times. This flexibility ensures that all participants can adhere to the signing timeline, no matter their location. By utilizing the ct schedule, remote teams can improve their efficiency and collaboration in document handling.

-

What makes airSlate SignNow's ct schedule stand out from competitors?

AirSlate SignNow's ct schedule stands out due to its user-friendly interface and cost-effective pricing. Unlike many competitors, it provides a robust scheduling capability without complicated processes, making it accessible for all users. The efficiency and reliability of the ct schedule feature also position airSlate SignNow as a leader in e-signature solutions.

Get more for State Income Tax Filing

- Instructions for cost of living adjustment worksheet minnesota form

- Discovery interrogatories and requests for production for custody matter minnesota form

- Mn documents form

- Mn dissolution with form

- Guaranty or guarantee of payment of rent minnesota form

- Custody litigation client information form minnesota

- Mn custody order form

- Esrd death notification form

Find out other State Income Tax Filing

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online