Connecticut Schedule K 1 2018

What is the Connecticut Schedule K-1?

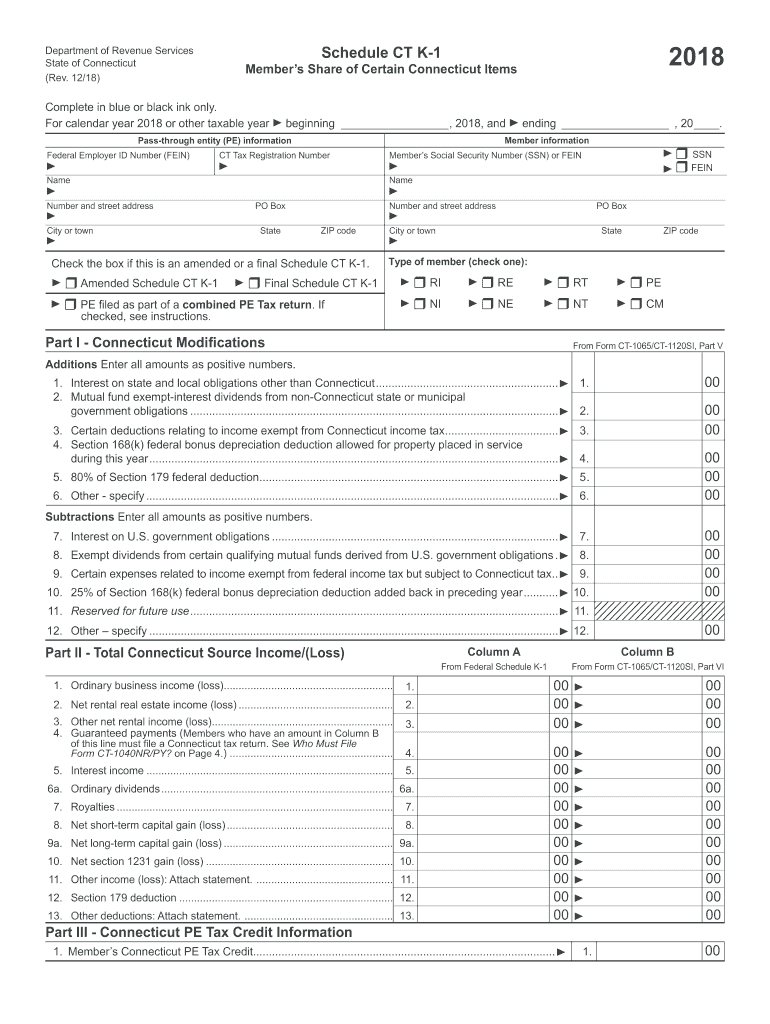

The Connecticut Schedule K-1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, and certain estates or trusts. This form is essential for individuals who receive income from these entities, as it provides detailed information needed for their personal tax returns. The K-1 form ensures that all partners or shareholders accurately report their share of the entity's income on their tax filings.

Steps to complete the Connecticut Schedule K-1

Completing the Connecticut Schedule K-1 involves several key steps:

- Gather necessary financial documents, including partnership agreements and prior tax returns.

- Fill out the entity's information, including the name, address, and Federal Employer Identification Number (FEIN).

- Report the income, deductions, and credits allocated to you from the entity. This information is typically provided by the entity in a separate statement.

- Ensure that all figures are accurate and match the entity's records to avoid discrepancies.

- Review the completed form for any errors before submission.

Legal use of the Connecticut Schedule K-1

The Connecticut Schedule K-1 is legally required for reporting income from partnerships, S corporations, and certain trusts. It must be filed with the Connecticut Department of Revenue Services as part of the state tax return process. Failure to accurately complete and file this form can lead to penalties and interest on unpaid taxes. It is crucial to ensure compliance with both state and federal tax laws when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Schedule K-1 typically align with the state tax return deadlines. Generally, the form must be submitted by the fifteenth day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Who Issues the Form?

The Connecticut Schedule K-1 is issued by partnerships, S corporations, and certain estates or trusts to their partners or shareholders. These entities are responsible for providing accurate and timely K-1 forms to ensure that recipients can report their income correctly. It is essential for recipients to verify that they receive their K-1 forms by the appropriate deadline to facilitate their own tax reporting.

Examples of using the Connecticut Schedule K-1

Individuals may encounter various scenarios in which the Connecticut Schedule K-1 is relevant:

- A partner in a limited liability company (LLC) receiving income from the business operations.

- A shareholder in an S corporation who must report their share of the corporation's income and deductions.

- An individual beneficiary of a trust receiving distributions that need to be reported on their personal tax return.

Quick guide on how to complete ct form k 1 2018 2019

Your instructional manual on preparing your Connecticut Schedule K 1

If you’re curious about how to generate and submit your Connecticut Schedule K 1, here are some straightforward guidelines to simplify your tax filing process.

To start, you need to activate your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an incredibly user-friendly and effective document management solution that enables you to modify, create, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and return to edit responses as necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your Connecticut Schedule K 1 in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; navigate through various versions and schedules.

- Click Obtain form to access your Connecticut Schedule K 1 in our editor.

- Fill in the necessary fields with your details (text, numbers, check marks).

- Utilize the Signature Tool to insert your legally-binding eSignature (if needed).

- Examine your document and correct any inaccuracies.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Keep in mind that paper filing can lead to return errors and delay your refunds. Importantly, before e-filing your taxes, ensure you review the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ct form k 1 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the ct form k 1 2018 2019

How to generate an electronic signature for the Ct Form K 1 2018 2019 in the online mode

How to generate an eSignature for your Ct Form K 1 2018 2019 in Google Chrome

How to generate an eSignature for putting it on the Ct Form K 1 2018 2019 in Gmail

How to make an eSignature for the Ct Form K 1 2018 2019 straight from your smart phone

How to create an eSignature for the Ct Form K 1 2018 2019 on iOS

How to create an eSignature for the Ct Form K 1 2018 2019 on Android devices

People also ask

-

What is a Connecticut Schedule K 1 and why is it important?

The Connecticut Schedule K 1 is a tax document issued to partners in a partnership, detailing each partner's share of income, deductions, and credits. Understanding your Connecticut Schedule K 1 is crucial for accurate tax reporting and compliance, ensuring you pay the correct amount of tax on your earnings.

-

How does airSlate SignNow facilitate the signing of Connecticut Schedule K 1 documents?

airSlate SignNow offers a streamlined platform that allows users to easily send, receive, and eSign Connecticut Schedule K 1 documents. With its user-friendly interface, you can quickly prepare your tax documents for signature, reducing the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for Connecticut Schedule K 1 document management?

airSlate SignNow offers various pricing plans to suit different business needs, making it an affordable choice for managing Connecticut Schedule K 1 documents. You can choose from monthly or annual subscriptions, each designed to provide comprehensive features without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for Connecticut Schedule K 1 management?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage your Connecticut Schedule K 1 documents efficiently. This integration streamlines your workflow, enabling you to send documents directly from your accounting platform.

-

What features does airSlate SignNow provide for handling Connecticut Schedule K 1 forms?

airSlate SignNow includes essential features such as templates for Connecticut Schedule K 1 forms, eSignature capabilities, and document tracking. These tools help ensure that your tax documents are signed promptly and securely.

-

Is airSlate SignNow compliant with Connecticut tax regulations for Schedule K 1?

Absolutely! airSlate SignNow is designed to comply with state and federal regulations, including those pertaining to the Connecticut Schedule K 1. Our platform ensures that your documents meet the necessary legal standards for tax filing.

-

How does airSlate SignNow enhance the security of my Connecticut Schedule K 1 documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures to protect your Connecticut Schedule K 1 documents, ensuring that sensitive information remains confidential and secure throughout the signing process.

Get more for Connecticut Schedule K 1

- Absence request form drove primary school drove pri swindon sch

- Earthquake scavenger hunt form

- Form ct 3 snew york s corporation franchise tax returnct3s

- Application for galls on russell cave form

- Motor vehicle claim form tiaib

- Formulir klaim rawat jalan prudential 448469948

- Contraindications to led light therapy form

- Labour contract template form

Find out other Connecticut Schedule K 1

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement