State of Connecticut 403b Program Benefit Information 2019

Steps to complete the 2018 Schedule CT K-1 Instructions

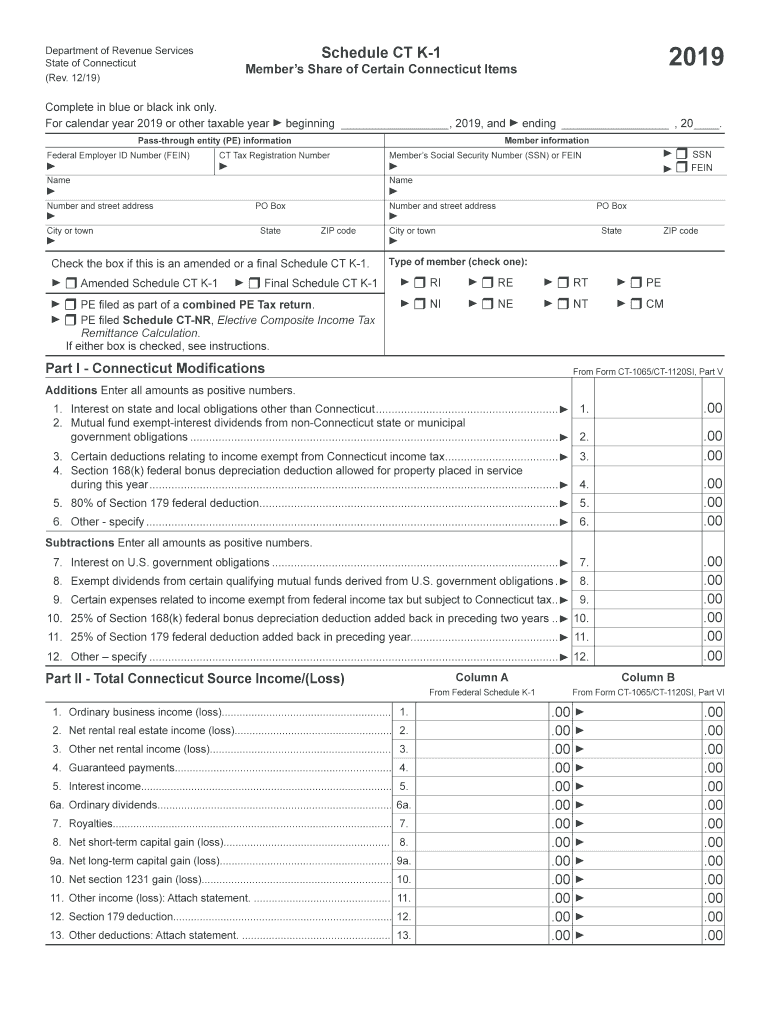

Completing the 2018 Schedule CT K-1 involves several important steps to ensure accuracy and compliance with state tax regulations. Begin by gathering all necessary information regarding the income, deductions, and credits associated with the entity you are reporting for. This includes details from the entity's federal tax return, as well as any relevant state-specific adjustments.

Next, fill out the identification section of the form, which requires the name and address of the entity, as well as the taxpayer identification number. Ensure that all entries are clear and legible to avoid processing delays. After completing the identification section, proceed to report the income distributions, deductions, and credits allocated to the partner or shareholder. Each category must be filled out accurately, reflecting the entity's financial activities for the year.

Finally, review the entire form for any errors or omissions before submitting it. This will help avoid potential penalties or issues with the Connecticut Department of Revenue Services.

Required Documents for the 2018 Schedule CT K-1

When preparing to complete the 2018 Schedule CT K-1, it is essential to have all relevant documents on hand. Key documents include:

- The federal tax return of the entity, which provides a basis for reporting income and deductions.

- Any supporting schedules that detail specific income sources or deductions.

- Prior year K-1 forms, if applicable, to ensure consistency in reporting.

- Documentation of any state-specific adjustments that may affect the reported amounts.

Having these documents readily available will streamline the completion process and help ensure that all information is accurate and compliant with state requirements.

Filing Deadlines / Important Dates for the 2018 Schedule CT K-1

Understanding the filing deadlines for the 2018 Schedule CT K-1 is crucial for compliance. The form is typically due on the same date as the entity's federal tax return. For most entities, this means the form must be filed by March 15, 2019. If an extension is filed, the deadline may be extended to September 15, 2019.

It's important to note that any K-1 forms issued to partners or shareholders must also be provided by the entity by the same due date. Failure to meet these deadlines may result in penalties, so staying aware of these dates is essential for all involved parties.

Legal use of the 2018 Schedule CT K-1 Instructions

The 2018 Schedule CT K-1 is a legally binding document used to report income, deductions, and credits from pass-through entities to their partners or shareholders. Properly completing and filing this form is essential for compliance with Connecticut tax laws. The information reported on the K-1 is used by partners or shareholders when filing their individual tax returns, making accuracy critical.

In addition, the form must adhere to the guidelines set forth by the Connecticut Department of Revenue Services, including any specific requirements for electronic submissions or paper filings. Ensuring that the form is filled out correctly and submitted on time helps to avoid legal complications and penalties.

Who Issues the 2018 Schedule CT K-1

The 2018 Schedule CT K-1 is issued by pass-through entities, which include partnerships, S corporations, and limited liability companies (LLCs) that have elected to be treated as partnerships for tax purposes. These entities are responsible for preparing and distributing the K-1 forms to their partners or shareholders.

Each partner or shareholder receives a K-1 that details their share of the entity's income, deductions, and credits. This information is essential for the recipients to accurately report their tax obligations on their individual returns. It is the responsibility of the entity to ensure that K-1 forms are issued timely and contain accurate information.

Examples of using the 2018 Schedule CT K-1 Instructions

The 2018 Schedule CT K-1 can be utilized in various scenarios, particularly for individuals involved in partnerships or S corporations. For instance, if a partner in a partnership receives a K-1, they will use the information to report their share of the partnership's income on their personal tax return. This includes any distributions received during the tax year.

Another example is for shareholders of an S corporation. They will rely on the K-1 to report their portion of the corporation's income, which may include ordinary business income, capital gains, or losses. Each example highlights the importance of accurately completing the K-1 to ensure that all partners or shareholders fulfill their tax obligations correctly.

Quick guide on how to complete state of connecticut 403b program benefit information

Effortlessly Prepare State Of Connecticut 403b Program Benefit Information on Any Device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage State Of Connecticut 403b Program Benefit Information on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Edit and eSign State Of Connecticut 403b Program Benefit Information with Ease

- Obtain State Of Connecticut 403b Program Benefit Information and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure confidential information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred way to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign State Of Connecticut 403b Program Benefit Information to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of connecticut 403b program benefit information

Create this form in 5 minutes!

How to create an eSignature for the state of connecticut 403b program benefit information

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What are the requirements for filling out the 2018 Schedule CT K 1 instructions?

To fill out the 2018 Schedule CT K 1 instructions, you will need your partnership information, including the names and addresses of partners, as well as their respective shares of income and deductions. Ensure that you have a copy of the IRS instructions for K-1s to reference while completing your forms. Having your financial statements handy can also aid in accuracy.

-

How can airSlate SignNow help with filing the 2018 Schedule CT K 1?

airSlate SignNow simplifies the process of managing and eSigning your 2018 Schedule CT K 1 documents. With its user-friendly interface, you can easily send documents to partners for their eSignatures, ensuring compliance and accuracy in your filings. This cloud-based solution reduces the hassle of printing and mailing paper forms.

-

Are there any costs associated with using airSlate SignNow for the 2018 Schedule CT K 1 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs and sizes. The pricing is designed to be cost-effective, providing value in terms of time savings and efficiency for managing your 2018 Schedule CT K 1 instructions. Many users find the investment worthwhile for the features offered.

-

What features does airSlate SignNow offer for handling tax documents like the 2018 Schedule CT K 1?

airSlate SignNow includes features such as document templates, real-time collaboration, eSigning, and secure cloud storage. These tools streamline the process of managing your 2018 Schedule CT K 1 instructions, enabling you to easily track who has signed and received forms. Additionally, the integration with other tools enhances workflow efficiency.

-

Can I integrate airSlate SignNow with other software to help with the 2018 Schedule CT K 1 instructions?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software to automate the preparation and filing of your 2018 Schedule CT K 1 instructions. This means you can seamlessly transfer data between platforms, reducing manual entry errors and saving time in the document preparation process.

-

Is airSlate SignNow compliant with tax regulations for documents like the 2018 Schedule CT K 1?

Yes, airSlate SignNow adheres to industry-standard security practices and ensures that all eSigned documents, including your 2018 Schedule CT K 1 instructions, comply with tax regulations. This dedication to compliance helps protect your sensitive information while also ensuring that you're meeting necessary legal requirements.

-

What are the benefits of using airSlate SignNow for my 2018 Schedule CT K 1 forms?

Using airSlate SignNow for your 2018 Schedule CT K 1 forms offers numerous benefits, including ease of use, time efficiency, and improved accuracy. The ability to quickly send and track documents electronically streamlines your workflow, allowing you to focus more on strategic tasks rather than paperwork. Additionally, the secure cloud storage protects your important documents.

Get more for State Of Connecticut 403b Program Benefit Information

Find out other State Of Connecticut 403b Program Benefit Information

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple