IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, and 2021

Understanding the 1099 Form CT

The 1099 Form CT is a crucial tax document used to report various types of income other than wages, salaries, and tips. This form is specifically designed for use in Connecticut and is essential for both businesses and individuals who have received income that must be reported to the state. The form helps ensure compliance with state tax regulations and provides a clear record of income received throughout the year.

Steps to Complete the 1099 Form CT

Completing the 1099 Form CT involves several key steps:

- Gather Information: Collect all necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

- Identify Income Types: Determine the type of income being reported, such as non-employee compensation, rents, or royalties.

- Fill Out the Form: Accurately enter the information into the appropriate fields on the form.

- Review for Accuracy: Double-check all entries to ensure accuracy and completeness.

- Submit the Form: File the completed form with the state of Connecticut, either electronically or by mail.

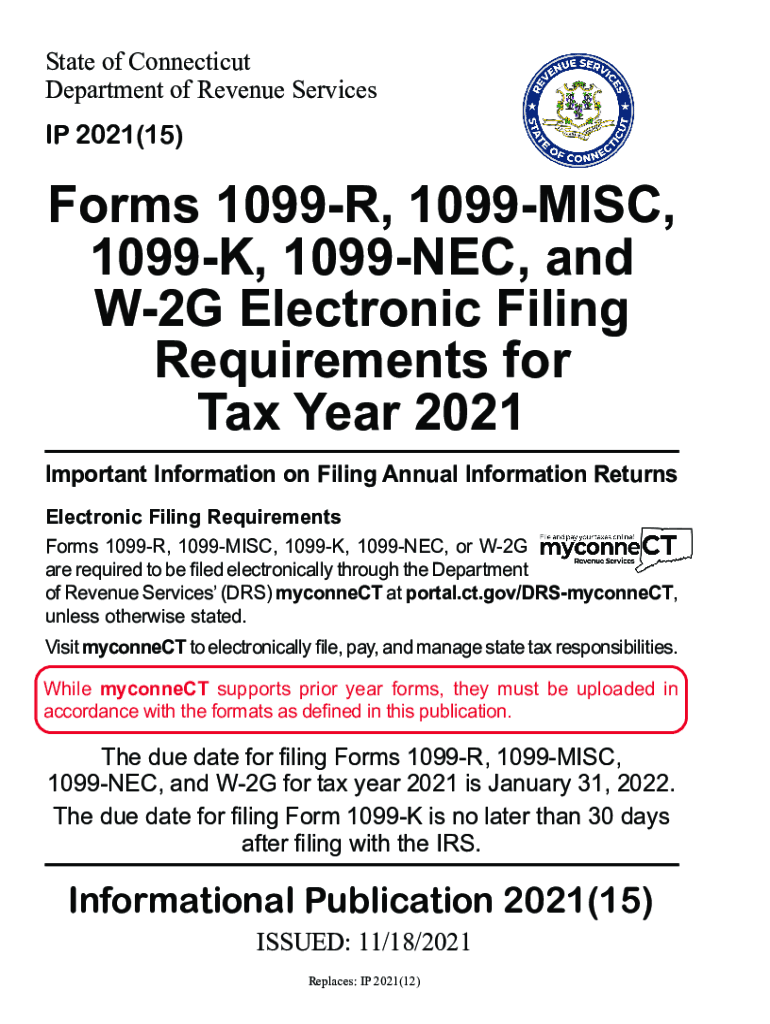

Filing Deadlines for the 1099 Form CT

Timely filing of the 1099 Form CT is essential to avoid penalties. The form must typically be submitted by January thirty-first of the year following the tax year in which the income was paid. If filing electronically, the deadline may extend to March thirty-first. It is important to stay informed about any changes to deadlines that may occur annually.

Who Issues the 1099 Form CT

The 1099 Form CT is typically issued by businesses, organizations, or individuals who have made payments to non-employees. This includes freelancers, independent contractors, and vendors. The payer is responsible for ensuring that the form is accurately completed and submitted to the state, as well as providing a copy to the recipient of the income.

Penalties for Non-Compliance with the 1099 Form CT

Failure to file the 1099 Form CT on time or inaccuracies in reporting can result in penalties. The state of Connecticut may impose fines for late submissions or incorrect information. It is crucial for businesses and individuals to adhere to filing requirements to avoid unnecessary financial repercussions.

Legal Use of the 1099 Form CT

The 1099 Form CT serves a legal purpose in documenting income for tax purposes. It is essential for maintaining compliance with state tax laws and regulations. Proper use of the form helps ensure that all income is reported accurately, which is vital for both the payer and the recipient in fulfilling their tax obligations.

Quick guide on how to complete ip 202112 forms 1099 r 1099 misc 1099 k 1099 nec and

Effortlessly prepare IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, And on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, And on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, And seamlessly

- Locate IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, And and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, And and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ip 202112 forms 1099 r 1099 misc 1099 k 1099 nec and

Create this form in 5 minutes!

How to create an eSignature for the ip 202112 forms 1099 r 1099 misc 1099 k 1099 nec and

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1099 form ct and why do I need it?

The 1099 form ct is a tax form used in Connecticut to report income earned by independent contractors and freelancers. If your business hires non-employees, completing this form is essential for compliance with state tax laws. It ensures that you accurately report payments made, helping you avoid potential penalties.

-

How can airSlate SignNow help me manage my 1099 form ct?

AirSlate SignNow simplifies the process of sending and eSigning your 1099 form ct. With our user-friendly platform, you can easily prepare, send, and securely sign documents, saving you time while ensuring compliance. Our solution helps in streamlining your workflow, particularly during tax season.

-

Is there a cost associated with using airSlate SignNow for 1099 form ct?

Yes, airSlate SignNow offers several pricing plans to fit different business needs. Each plan provides access to features that help you manage your 1099 form ct efficiently. You can choose a plan that aligns with your budget and the volume of documents you need to process.

-

What features does airSlate SignNow include for handling the 1099 form ct?

AirSlate SignNow includes features like document templates, secure eSigning, and cloud storage specifically designed to help you with your 1099 form ct. You can track document status and receive notifications once your forms are signed. This streamlines the completion and submission of necessary tax documents.

-

Can I integrate airSlate SignNow with other applications for managing my 1099 form ct?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, such as accounting and payroll systems, to help you manage your 1099 form ct efficiently. This integration allows for automatic data transfer, making it easier to handle your tax-related paperwork.

-

What are the benefits of using airSlate SignNow for my 1099 form ct?

Using airSlate SignNow for your 1099 form ct offers multiple benefits, including enhanced security, reduced processing time, and better organization of your tax documents. Our platform is designed to simplify the eSigning process, ensuring you stay compliant while also saving resources during tax preparation.

-

Is airSlate SignNow easy to use for submitting a 1099 form ct?

Yes, airSlate SignNow is designed to be user-friendly, making it easy to submit your 1099 form ct. With simple navigation and guided workflows, you can create, send, and track your forms with minimal effort. This accessibility is especially beneficial for businesses of all sizes.

Get more for IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, And

Find out other IP 12 Forms 1099 R, 1099 MISC, 1099 K, 1099 NEC, And

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online