Franchise Tax Account Status Home Comptroller Texas Gov 2021

Understanding the Texas Franchise Tax Account Status

The Texas Franchise Tax Account Status provides essential information regarding a business's standing with the Texas Comptroller. This status is crucial for entities that are subject to franchise tax obligations in Texas. It indicates whether a business is active, inactive, or has failed to file necessary reports. Maintaining a good standing is vital for compliance and can affect a business's ability to secure loans, contracts, and other opportunities.

Steps to Check Your Franchise Tax Account Status

To check your Franchise Tax Account Status, follow these steps:

- Visit the Texas Comptroller's official website.

- Navigate to the Franchise Tax section.

- Locate the option for checking account status.

- Enter your business name or taxpayer number.

- Review the displayed status information.

This process is straightforward and can be completed online, ensuring that you have quick access to your business's compliance status.

Required Documents for Franchise Tax Compliance

When dealing with the Texas Franchise Tax, certain documents are necessary to ensure compliance. These may include:

- Previous franchise tax returns.

- Financial statements for the current year.

- Documentation of any exemptions or deductions claimed.

- Proof of payment for any outstanding taxes.

Having these documents readily available can streamline the process of filing and maintaining your account status.

Penalties for Non-Compliance with Franchise Tax Obligations

Failure to comply with Texas franchise tax requirements can lead to significant penalties. These may include:

- Monetary fines for late filings.

- Loss of good standing status, affecting business operations.

- Potential legal action from the state.

It is essential for businesses to stay informed about their obligations and to file timely to avoid these penalties.

Form Submission Methods for Franchise Tax Filings

Businesses can submit their franchise tax forms through various methods, including:

- Online submission via the Texas Comptroller's website.

- Mailing physical copies of the forms to the appropriate address.

- In-person submission at designated Comptroller offices.

Choosing the right submission method can enhance efficiency and ensure timely processing of your filings.

Eligibility Criteria for Franchise Tax Exemptions

Certain entities may qualify for exemptions from the Texas franchise tax. Eligibility criteria typically include:

- Nonprofit organizations.

- Entities with gross receipts below a specified threshold.

- Businesses engaged in specific activities defined by Texas law.

Understanding these criteria can help businesses determine their tax obligations and potential exemptions.

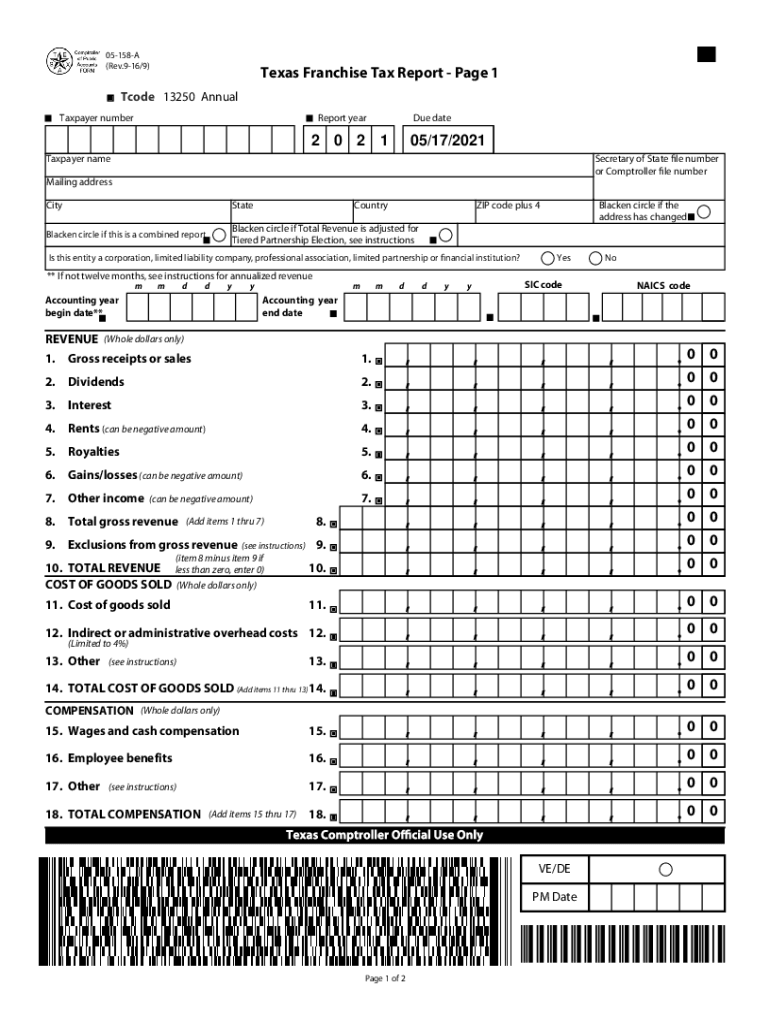

Quick guide on how to complete franchise tax account status home comptrollertexasgov

Effortlessly complete Franchise Tax Account Status Home Comptroller Texas Gov on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Franchise Tax Account Status Home Comptroller Texas Gov on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign Franchise Tax Account Status Home Comptroller Texas Gov with ease

- Locate Franchise Tax Account Status Home Comptroller Texas Gov and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Franchise Tax Account Status Home Comptroller Texas Gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct franchise tax account status home comptrollertexasgov

Create this form in 5 minutes!

How to create an eSignature for the franchise tax account status home comptrollertexasgov

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What are the key features of airSlate SignNow for following texas form 05 158 instructions 2021?

airSlate SignNow offers a range of features specifically designed to streamline the eSignature process, including customizable templates, secure document storage, and real-time collaboration tools. These features assist users in easily completing the texas form 05 158 instructions 2021 efficiently and accurately.

-

How can airSlate SignNow help me complete the texas form 05 158 instructions 2021?

With airSlate SignNow, you can fill out and sign the texas form 05 158 instructions 2021 online, saving you time and reducing errors. The platform simplifies document management and allows for easy sharing and tracking of signatures, ensuring you meet all necessary requirements.

-

Is airSlate SignNow cost-effective for businesses handling texas form 05 158 instructions 2021?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to manage the texas form 05 158 instructions 2021. With different pricing plans available, it offers great value for the features provided, which include unlimited document signing and storage.

-

What integrations does airSlate SignNow support for texas form 05 158 instructions 2021?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. These integrations facilitate easy access and management of the texas form 05 158 instructions 2021, enhancing workflow efficiency.

-

Can airSlate SignNow increase the efficiency of processing the texas form 05 158 instructions 2021?

Absolutely! Using airSlate SignNow streamlines the entire process of filling out and signing the texas form 05 158 instructions 2021 by reducing the time spent on manual tasks. Automation features allow you to send documents for signature with just a few clicks.

-

What security measures are in place when using airSlate SignNow for the texas form 05 158 instructions 2021?

airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to ensure the protection of sensitive documents like the texas form 05 158 instructions 2021. This commitment to security helps to maintain confidentiality and comply with regulatory requirements.

-

How can I get started with airSlate SignNow for the texas form 05 158 instructions 2021?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to experience the features designed for the texas form 05 158 instructions 2021 firsthand, and our user-friendly interface will help you navigate through document eSigning efficiently.

Get more for Franchise Tax Account Status Home Comptroller Texas Gov

- Assignment of lease from lessor with notice of assignment alabama form

- Alabama landlord form

- Guaranty or guarantee of payment of rent alabama form

- Letter from landlord to tenant as notice of default on commercial lease alabama form

- Residential or rental lease extension agreement alabama form

- Commercial rental lease application questionnaire alabama form

- Al application form

- Al lease form

Find out other Franchise Tax Account Status Home Comptroller Texas Gov

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online