Tx 05 2019

What is the Tx 05

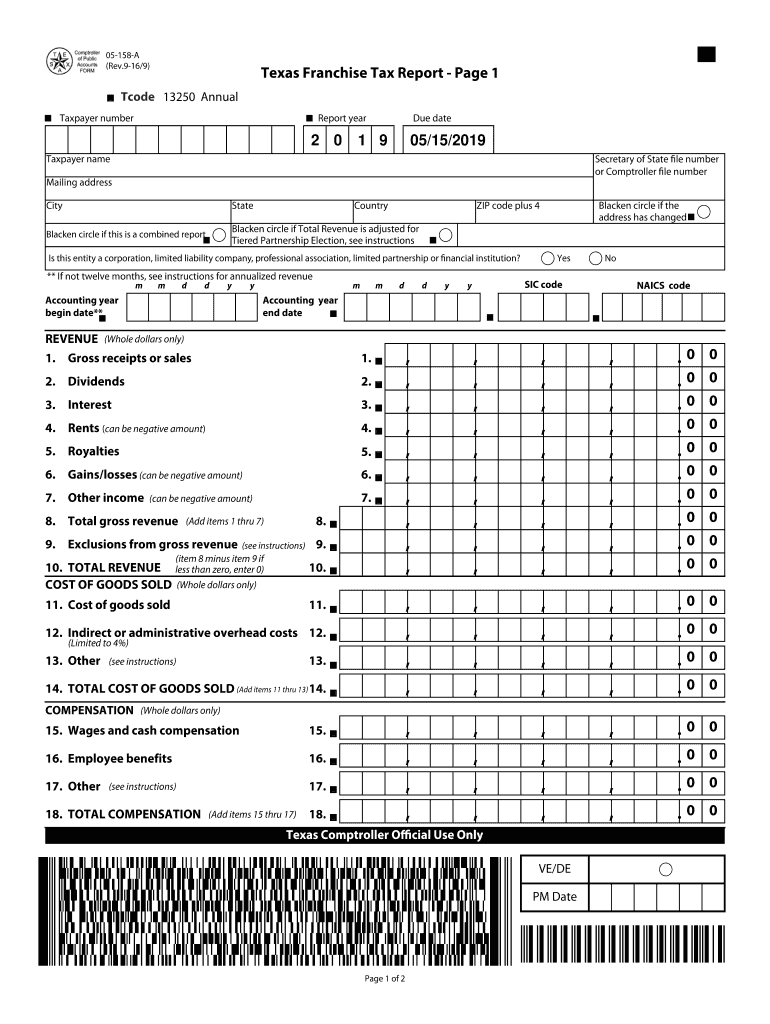

The Tx form 05 158, also known as the Texas Franchise Tax Report, is a crucial document used by businesses operating in Texas to report their franchise tax obligations. This form is required for various business entity types, including corporations, limited liability companies (LLCs), and partnerships. The information provided on the form helps the Texas Comptroller’s office assess the tax owed based on the business's revenue and other financial metrics. Understanding the purpose and requirements of the Tx form 05 158 is essential for compliance and accurate reporting.

How to use the Tx 05

Using the Tx form 05 158 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and balance sheets. Next, determine the appropriate version of the form based on your business entity type and revenue thresholds. Fill out the form by entering the required financial information, ensuring that all figures are accurate and reflect your business's financial status. Once completed, the form can be submitted electronically or via mail, depending on your preference and compliance needs.

Steps to complete the Tx 05

Completing the Tx form 05 158 requires careful attention to detail. Follow these steps:

- Gather necessary documents: Collect financial records, including revenue statements and prior tax filings.

- Determine eligibility: Confirm that your business meets the criteria for filing the Tx form 05 158.

- Fill out the form: Input all required financial data accurately, ensuring compliance with Texas tax regulations.

- Review for accuracy: Double-check all entries for correctness to avoid potential penalties.

- Submit the form: Choose your submission method—either electronically or by mail—and follow the instructions provided.

Legal use of the Tx 05

The Tx form 05 158 serves a legal purpose in ensuring that businesses comply with Texas franchise tax laws. Filing this form accurately and on time helps avoid penalties and legal repercussions. The form is legally binding, and the information provided must be truthful and complete. Businesses that fail to file or provide inaccurate information may face fines, interest on unpaid taxes, and potential legal action from the Texas Comptroller’s office.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Tx form 05 158 is vital for compliance. Typically, the form is due on May 15 of each year, but it is essential to verify any changes or extensions that may apply. Businesses should also be aware of any specific deadlines related to their entity type or revenue level, as these can affect when the form must be submitted. Keeping a calendar of important dates can help ensure timely filing and avoid penalties.

Required Documents

To complete the Tx form 05 158, certain documents are necessary. These typically include:

- Financial statements, including income statements and balance sheets.

- Prior year tax returns, if applicable.

- Documentation of any exemptions or deductions being claimed.

- Records of revenue for the reporting period.

Having these documents ready will facilitate a smoother filing process and ensure accuracy in reporting.

Quick guide on how to complete 05 158 texas franchise tax 2019 annual report 05 158 texas franchise tax 2019 annual report

Easily Prepare Tx 05 on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Tx 05 on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

Edit and Electronically Sign Tx 05 Effortlessly

- Obtain Tx 05 and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you prefer to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you select. Edit and electronically sign Tx 05 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 158 texas franchise tax 2019 annual report 05 158 texas franchise tax 2019 annual report

Create this form in 5 minutes!

How to create an eSignature for the 05 158 texas franchise tax 2019 annual report 05 158 texas franchise tax 2019 annual report

How to generate an electronic signature for your 05 158 Texas Franchise Tax 2019 Annual Report 05 158 Texas Franchise Tax 2019 Annual Report in the online mode

How to make an eSignature for the 05 158 Texas Franchise Tax 2019 Annual Report 05 158 Texas Franchise Tax 2019 Annual Report in Chrome

How to make an eSignature for putting it on the 05 158 Texas Franchise Tax 2019 Annual Report 05 158 Texas Franchise Tax 2019 Annual Report in Gmail

How to generate an electronic signature for the 05 158 Texas Franchise Tax 2019 Annual Report 05 158 Texas Franchise Tax 2019 Annual Report straight from your mobile device

How to generate an eSignature for the 05 158 Texas Franchise Tax 2019 Annual Report 05 158 Texas Franchise Tax 2019 Annual Report on iOS

How to create an electronic signature for the 05 158 Texas Franchise Tax 2019 Annual Report 05 158 Texas Franchise Tax 2019 Annual Report on Android

People also ask

-

What is the tx form 05 158 and how can it be utilized with airSlate SignNow?

The tx form 05 158 is a document used in Texas for various official purposes. Utilizing airSlate SignNow, you can easily upload, send, and eSign this form securely, ensuring compliance and efficiency in your document processing.

-

What are the key features of airSlate SignNow for managing tx form 05 158?

airSlate SignNow offers features like multi-party eSigning, customizable templates, and secure document storage, which are ideal for managing the tx form 05 158. These features help streamline the signing process and ensure all parties involved can access the document easily.

-

Is airSlate SignNow a cost-effective solution for handling tx form 05 158?

Yes, airSlate SignNow provides a cost-effective solution for handling documents such as the tx form 05 158. With flexible pricing plans and no hidden fees, organizations can save money while gaining access to powerful eSigning features.

-

Can I integrate airSlate SignNow with other apps while processing tx form 05 158?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enabling you to manage the tx form 05 158 alongside tools like CRM systems, cloud storage, and productivity software, streamlining your workflow and enhancing productivity.

-

What benefits does airSlate SignNow provide for businesses using tx form 05 158?

Using airSlate SignNow for your tx form 05 158 offers several benefits, including faster turnaround times, improved accuracy with automated workflows, and enhanced security for sensitive data. These advantages help organizations operate more efficiently and stay compliant.

-

How secure is the process of signing tx form 05 158 with airSlate SignNow?

Security is a top priority for airSlate SignNow. When signing the tx form 05 158, your documents are protected with advanced encryption, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

Can I track the status of my tx form 05 158 once sent with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your tx form 05 158 in real-time. You'll receive notifications when the document is viewed and signed, giving you complete visibility over the process.

Get more for Tx 05

- How fill in the blanks paper of beti padhao beti bachao form

- 5659layout 1qxd nalc branch 78 nalc branch78 form

- Work order vehicle history form

- Ps form odometer

- Ps form 1012 e

- Ps form 4776

- Ps form 7319 c representations and nalc branch 78 nalc branch78

- Ps form 5201 mail van inspection nalc branch 78 nalc branch78

Find out other Tx 05

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy