05 158 Texas Franchise Tax Annual Report 2022

What is the 05 158 Texas Franchise Tax Annual Report

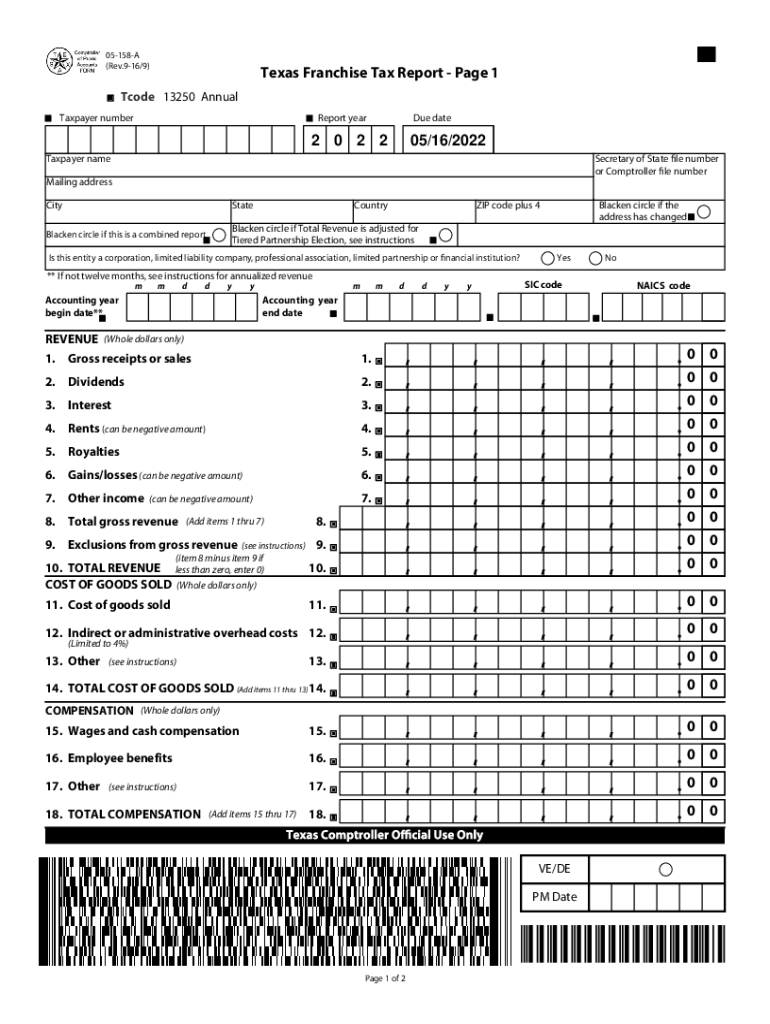

The 05 158 Texas Franchise Tax Annual Report is a document that businesses in Texas must file to report their income and calculate their franchise tax obligations. This report is essential for maintaining compliance with state tax regulations. The form is specifically designed for entities operating in Texas, including corporations, limited liability companies (LLCs), and partnerships. By submitting this report, businesses provide the Texas Comptroller of Public Accounts with necessary financial information, which helps determine their tax liability based on revenue thresholds and applicable rates.

Steps to complete the 05 158 Texas Franchise Tax Annual Report

Completing the 05 158 Texas Franchise Tax Annual Report involves several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements, balance sheets, and other necessary data for the reporting period.

- Determine eligibility: Assess whether your business meets the criteria for filing the 05 158 form, including revenue thresholds and entity type.

- Complete the form: Fill out the required sections of the form accurately, ensuring all calculations reflect your business's financial activity.

- Review for accuracy: Double-check all entries for correctness to avoid potential penalties or issues with the Texas Comptroller.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Legal use of the 05 158 Texas Franchise Tax Annual Report

The legal use of the 05 158 Texas Franchise Tax Annual Report is critical for businesses to fulfill their tax obligations. Filing this report is mandated by Texas law, and failure to do so can result in penalties, including fines and interest on unpaid taxes. Additionally, the report serves as an official record of a business's financial performance and tax compliance status. It is important to ensure that all information provided is accurate and complete, as discrepancies may lead to audits or further legal implications.

Filing Deadlines / Important Dates

Filing deadlines for the 05 158 Texas Franchise Tax Annual Report are crucial for compliance. Typically, the report is due on May 15 of each year, covering the previous calendar year. However, if May 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses should also be aware of any specific deadlines related to extensions or additional filings, ensuring they remain in good standing with the Texas Comptroller's office.

Form Submission Methods (Online / Mail / In-Person)

The 05 158 Texas Franchise Tax Annual Report can be submitted through various methods, providing flexibility for businesses. The available submission methods include:

- Online: Filing electronically through the Texas Comptroller's website is often the quickest and most efficient method.

- Mail: Businesses can print the completed form and send it via postal service to the designated address provided by the Comptroller.

- In-Person: For those who prefer direct interaction, submitting the form in person at a local Comptroller office is also an option.

Key elements of the 05 158 Texas Franchise Tax Annual Report

Understanding the key elements of the 05 158 Texas Franchise Tax Annual Report is essential for accurate completion. Important components include:

- Business Information: This section requires details about the business entity, including its name, address, and taxpayer identification number.

- Revenue Information: Businesses must report their total revenue for the year, which is critical for calculating franchise tax liability.

- Tax Calculation: The form includes sections for calculating the franchise tax based on the reported revenue and applicable rates.

- Signature: An authorized representative must sign the form, affirming that the information provided is truthful and complete.

Quick guide on how to complete 05 158 texas franchise tax 2021 annual report

Complete 05 158 Texas Franchise Tax Annual Report effortlessly on any device

Web-based document management has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage 05 158 Texas Franchise Tax Annual Report on any system using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to edit and eSign 05 158 Texas Franchise Tax Annual Report with ease

- Locate 05 158 Texas Franchise Tax Annual Report and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or redact sensitive information with the features that airSlate SignNow specifically provides for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes necessitating the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign 05 158 Texas Franchise Tax Annual Report and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 158 texas franchise tax 2021 annual report

Create this form in 5 minutes!

How to create an eSignature for the 05 158 texas franchise tax 2021 annual report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Texas Form 05 158?

The Texas Form 05 158 is used to claim benefits under specific programs in Texas. Understanding the Texas Form 05 158 instructions 2024 is crucial for accurately completing and submitting this form to ensure that your claims are processed efficiently.

-

Where can I find the Texas Form 05 158 instructions 2024?

The Texas Form 05 158 instructions 2024 can be easily found on the official Texas government website or through our airSlate SignNow platform. We also provide helpful resources and guidance tailored to the Texas Form 05 158 to assist you in completing your documentation.

-

How does airSlate SignNow simplify the completion of Texas Form 05 158?

AirSlate SignNow streamlines the process of completing the Texas Form 05 158 by offering an easy-to-use digital interface. With our platform, you can access the Texas Form 05 158 instructions 2024 directly online and eSign the document, saving time and reducing errors during submission.

-

What features does airSlate SignNow offer for electronic signatures?

Our platform provides robust features for electronic signatures, including customizable templates, secure signing, and integration options. When following the Texas Form 05 158 instructions 2024, you can simplify the signing process and maintain compliance with legal standards for digital signatures.

-

Is there a cost to use airSlate SignNow for Texas Form 05 158?

AirSlate SignNow offers various pricing plans to fit your budget while providing full access to the features needed for managing the Texas Form 05 158. We aim to deliver a cost-effective solution that empowers businesses to electronically sign documents, following the Texas Form 05 158 instructions 2024 efficiently.

-

Can I integrate airSlate SignNow with other software for seamless document management?

Yes, airSlate SignNow integrates with various applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows you to streamline your workflow while adhering to the Texas Form 05 158 instructions 2024, making document management even easier.

-

What are the benefits of using airSlate SignNow for submitting Texas Form 05 158?

Using airSlate SignNow to submit the Texas Form 05 158 provides numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. By following the Texas Form 05 158 instructions 2024 through our platform, you can ensure your submissions are timely and compliant.

Get more for 05 158 Texas Franchise Tax Annual Report

- Missouri divorce papers form

- Pet depot application form

- Indiana retirement medical benefits account form

- Lapf online statement form

- Lead based paint disclosure california pdf form

- Icse class 5 science worksheets pdf form

- Vango specialized services application form

- Info sheet for applicants for a daad scholarship httpswww daad form

Find out other 05 158 Texas Franchise Tax Annual Report

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors