05 158 a TEXAS FRANCHISE TAX REPORT Page 1 2020

What is the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1

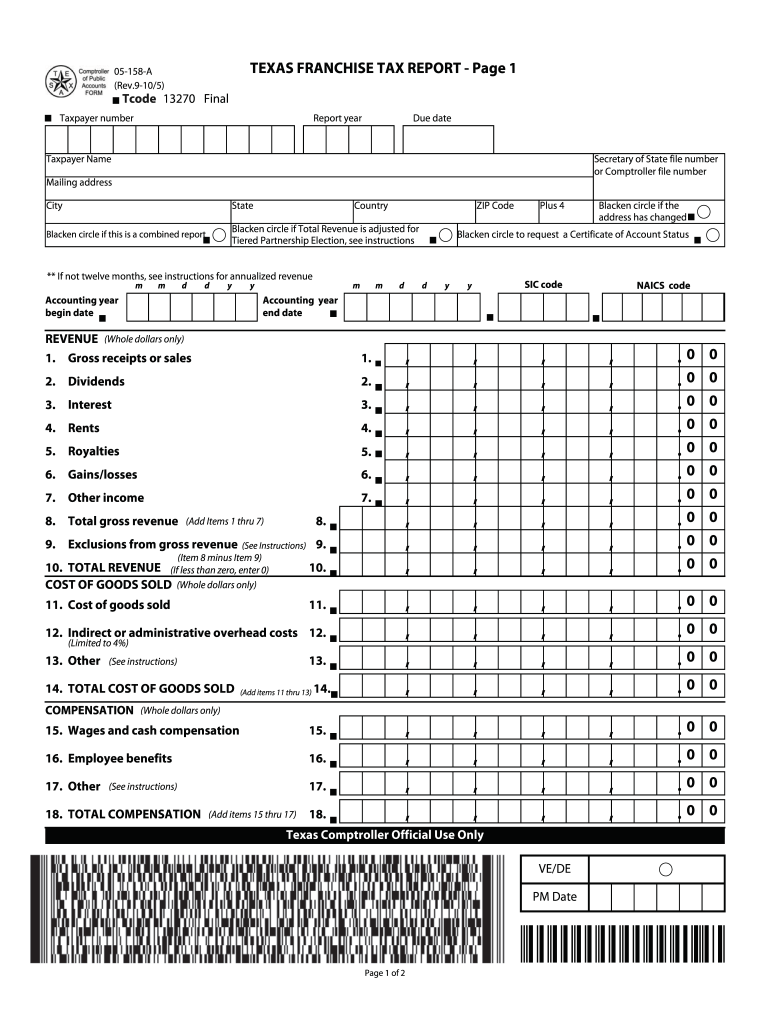

The 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 is a crucial document that businesses in Texas must complete to report their franchise tax obligations. This form is specifically designed for entities operating in Texas, including corporations and limited liability companies (LLCs). The information provided on this form helps the state assess the tax liability of the business based on its revenue and other financial metrics.

How to use the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1

Using the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 involves several steps. First, businesses need to gather their financial records, including revenue figures and expenses. Once the necessary data is compiled, the form can be filled out accurately. It is essential to ensure that all information is complete and correct, as inaccuracies can lead to penalties. After completing the form, businesses can submit it electronically or by mail, depending on their preference and the specific instructions provided by the Texas Comptroller's office.

Steps to complete the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1

Completing the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 requires careful attention to detail. Here are the steps to follow:

- Gather financial documents, including income statements and balance sheets.

- Determine the total revenue for the reporting period.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form electronically or via mail, adhering to the submission guidelines.

Legal use of the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1

The legal use of the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 is governed by Texas tax laws. This form must be filed annually by businesses that meet certain revenue thresholds. Failure to file the form can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their obligations under Texas law to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 are critical for compliance. Typically, the report is due on May 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses should mark their calendars and prepare their documents in advance to ensure timely submission.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential legal action from the state. It is essential for businesses to file their reports on time and accurately to avoid these consequences.

Quick guide on how to complete 05 158 a texas franchise tax report page 1

Complete 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 with ease

- Find 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 158 a texas franchise tax report page 1

Create this form in 5 minutes!

How to create an eSignature for the 05 158 a texas franchise tax report page 1

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the purpose of the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1?

The 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 is a crucial document for businesses operating in Texas, serving as a report to detail your franchise tax obligations. It ensures compliance with state regulations and helps you avoid penalties. Properly filing this document is essential for maintaining good standing with the Texas Comptroller.

-

How can airSlate SignNow simplify the filing of the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1?

airSlate SignNow streamlines the document signing process by allowing you to eSign the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 easily and securely. Our platform offers templates and integration features that eliminate the hassle of manual filing, making compliance faster and more efficient. With airSlate SignNow, you can manage your documents all in one place.

-

What integrations does airSlate SignNow offer for managing the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1?

airSlate SignNow integrates seamlessly with various platforms like Google Workspace, Microsoft Office, and CRM systems, enhancing workflow efficiency. These integrations allow for the automatic import and signing of documents like the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1. This connectivity means you spend less time managing documents and more time focusing on your business.

-

Is airSlate SignNow cost-effective for small businesses needing to file the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1?

Yes, airSlate SignNow is designed to be a budget-friendly solution for small businesses. Our competitive pricing plans cater to companies of all sizes, ensuring that you can efficiently manage important documents like the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 without breaking the bank. Investing in airSlate SignNow helps you save time and resources.

-

How secure is airSlate SignNow for handling the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and security protocols to protect your sensitive documents, including the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1. You can confidently manage your documents, knowing that your information is safeguarded against unauthorized access.

-

Can I customize the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1 by adding your company branding and specific details. This customization helps you present your reports professionally while ensuring compliance with necessary regulations. Tailoring documents enhances your business's credibility with stakeholders.

-

What features should I look for when using airSlate SignNow for the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1?

When using airSlate SignNow for the 05 158 A TEXAS FRANCHISE TAX REPORT Page 1, look for features like eSigning, document tracking, and audit trails. These functionalities help you monitor the signing process, keep track of edits, and ensure that you meet deadlines. A user-friendly interface also enhances your overall experience.

Get more for 05 158 A TEXAS FRANCHISE TAX REPORT Page 1

Find out other 05 158 A TEXAS FRANCHISE TAX REPORT Page 1

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney