05 158 2025-2026

What is the 05 158

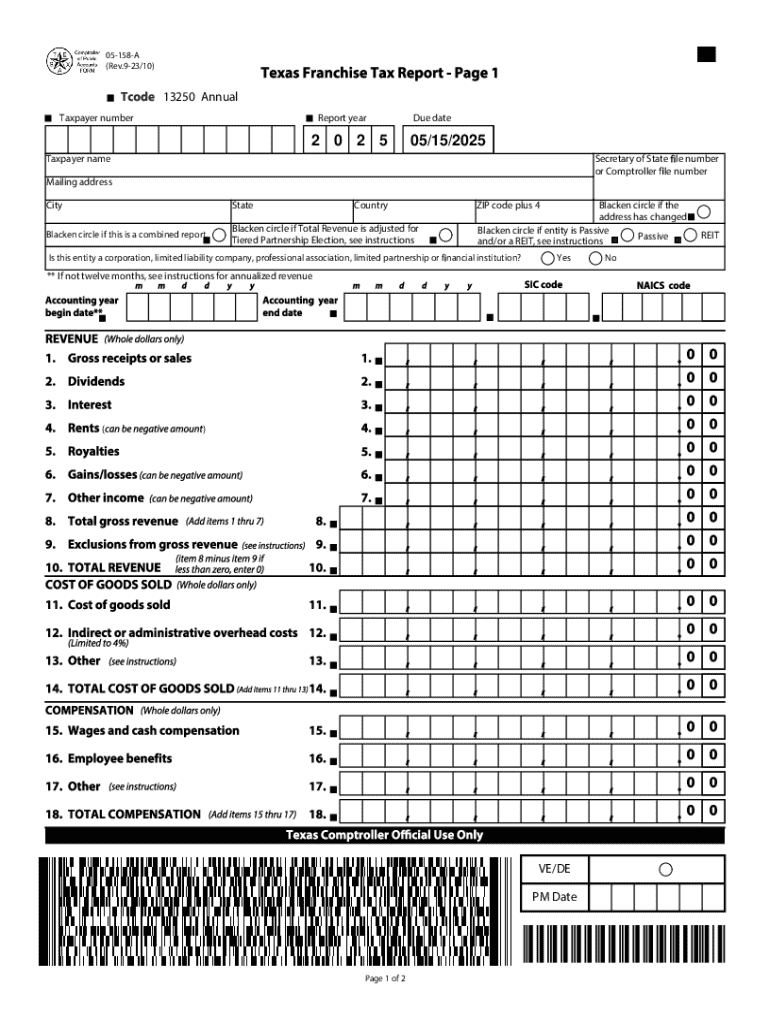

The Texas Comptroller Form 05 158, also known as the Texas Application for Exemption, is a crucial document used by organizations seeking tax-exempt status in Texas. This form is primarily utilized by entities such as nonprofit organizations, religious institutions, and other qualifying groups that aim to operate without the burden of certain state taxes. Understanding the purpose and implications of this form is essential for any organization looking to maintain compliance with state regulations while benefiting from tax exemptions.

How to obtain the 05 158

To obtain the Texas Form 05 158, organizations can visit the Texas Comptroller's official website, where the form is available for download. Additionally, physical copies can often be requested directly from the Comptroller's office. It is important for applicants to ensure they have the most current version of the form, as updates may occur periodically. Organizations should also review any accompanying guidelines or instructions provided to facilitate the application process.

Steps to complete the 05 158

Completing the Texas Form 05 158 involves several steps to ensure accuracy and compliance. First, organizations must gather necessary documentation that demonstrates their eligibility for tax exemption. This may include proof of nonprofit status, bylaws, and financial statements. Next, applicants should carefully fill out the form, providing detailed information about their organization, including its mission and activities. After completing the form, it is advisable to review all entries for completeness and accuracy before submission. Finally, the completed form can be submitted online or via mail to the Texas Comptroller's office, depending on the preferred method.

Legal use of the 05 158

The legal use of the Texas Form 05 158 is strictly regulated by state laws governing tax exemptions. Organizations must ensure that they meet the eligibility criteria outlined by the Texas Comptroller to avoid potential penalties. Misuse of the form or providing false information can result in revocation of tax-exempt status and may lead to legal consequences. Therefore, it is essential for applicants to understand the legal implications of their application and maintain transparency throughout the process.

Key elements of the 05 158

Key elements of the Texas Form 05 158 include the organization’s name, address, and federal employer identification number (EIN). Additionally, the form requires applicants to describe the nature of their activities and how they align with the requirements for tax exemption. Other important sections may include financial information, details about the governing body, and any other relevant documentation that supports the claim for tax-exempt status. Ensuring that all key elements are accurately completed is vital for a successful application.

Form Submission Methods

The Texas Form 05 158 can be submitted through various methods, allowing organizations flexibility in how they complete the process. Applicants may choose to submit the form online via the Texas Comptroller's website, which often provides a streamlined and efficient way to process applications. Alternatively, organizations can mail the completed form to the designated address provided by the Comptroller's office. In-person submissions may also be possible, depending on the office's policies and hours of operation. Each submission method has its own requirements and processing times, so organizations should choose the one that best suits their needs.

Create this form in 5 minutes or less

Find and fill out the correct 05 158

Create this form in 5 minutes!

How to create an eSignature for the 05 158

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Texas Comptroller forms and why are they important?

Texas Comptroller forms are official documents required for various state transactions, including tax filings and compliance. They ensure that businesses adhere to state regulations and maintain accurate records. Using airSlate SignNow to manage these forms simplifies the process, making it easier to stay compliant.

-

How can airSlate SignNow help with Texas Comptroller forms?

airSlate SignNow provides a user-friendly platform to create, send, and eSign Texas Comptroller forms efficiently. With its intuitive interface, you can streamline the completion and submission of these forms, reducing the time spent on paperwork. This enhances productivity and ensures that your forms are processed quickly.

-

Are there any costs associated with using airSlate SignNow for Texas Comptroller forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that facilitate the management of Texas Comptroller forms, including eSigning and document tracking. You can choose a plan that fits your budget while ensuring compliance with state requirements.

-

What features does airSlate SignNow offer for managing Texas Comptroller forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for Texas Comptroller forms. These tools help you manage your documents efficiently and ensure that all necessary signatures are obtained promptly. Additionally, you can automate reminders to keep your team on track.

-

Can I integrate airSlate SignNow with other software for Texas Comptroller forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your existing tools with the platform. This means you can easily import and export Texas Comptroller forms, enhancing your workflow and ensuring that all your documents are in one place.

-

Is airSlate SignNow secure for handling Texas Comptroller forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Texas Comptroller forms are protected. The platform uses advanced encryption and secure storage to safeguard your documents. You can trust that your sensitive information remains confidential and secure throughout the signing process.

-

How does airSlate SignNow improve the efficiency of processing Texas Comptroller forms?

By using airSlate SignNow, you can signNowly reduce the time spent on processing Texas Comptroller forms. The platform automates many steps in the document workflow, allowing for quicker approvals and submissions. This efficiency helps your business stay compliant and focused on its core operations.

Get more for 05 158

- Court forms national center for state courts

- Circuit ampamp district courts alabama administrative office of courts form

- Name of county or municipality form

- Order to appear to person under foreign subpoena form

- Court appearance notice form

- Contempt petition 490105303 form

- Rules of civil procedure alabama judicial system form

- Form c 18

Find out other 05 158

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free