Form VA DoT ST 11 Fill Online, Printable, Fillable 2021

Understanding the Virginia Sales Tax Exemption Form ST-11

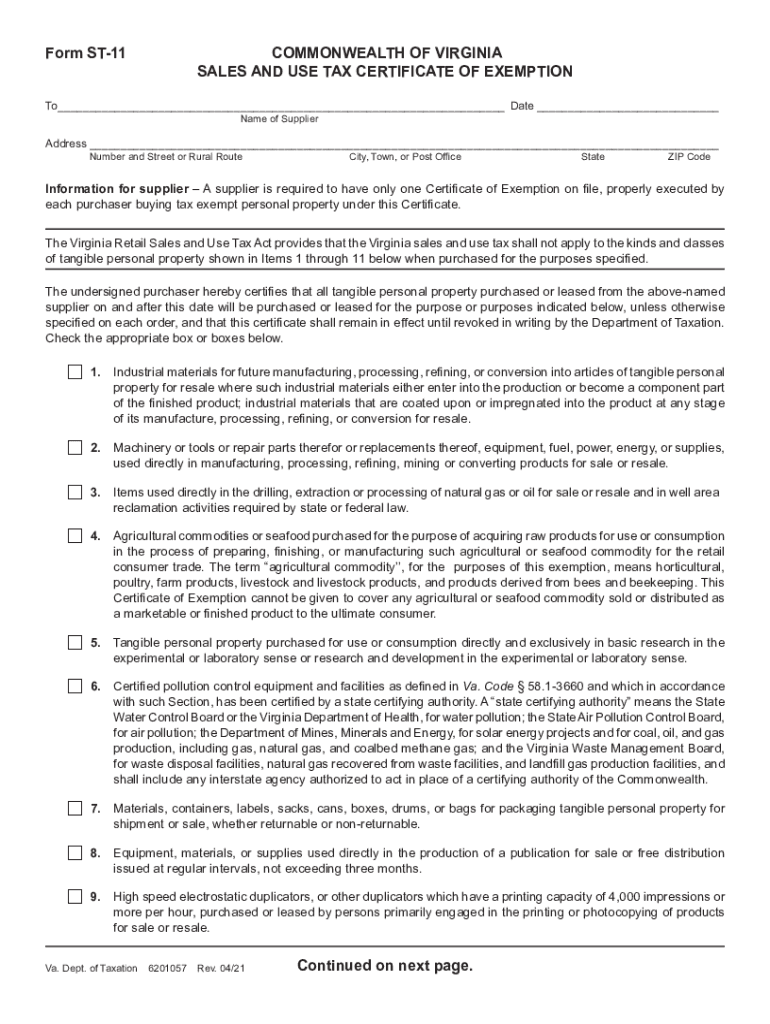

The Virginia Sales Tax Exemption Form ST-11 is a crucial document for businesses and individuals seeking to claim exemptions from sales tax for specific purchases. This form is primarily used in transactions involving goods that are intended for resale or for use in manufacturing. Understanding the purpose and proper use of this form is essential for compliance with Virginia tax regulations.

Steps to Complete the Virginia Sales Tax Exemption Form ST-11

Completing the Virginia Sales Tax Exemption Form ST-11 involves several key steps:

- Gather necessary information: Collect details such as your business name, address, and tax identification number.

- Specify the type of exemption: Indicate the reason for the exemption, such as resale or manufacturing use.

- Provide item details: List the items for which the exemption is being claimed, including descriptions and quantities.

- Sign and date the form: Ensure that the form is signed by an authorized representative of your business.

Once completed, the form can be submitted to the vendor from whom the items are being purchased.

Key Elements of the Virginia Sales Tax Exemption Form ST-11

The form includes several important sections that must be accurately filled out:

- Purchaser Information: This section requires the name and address of the purchaser claiming the exemption.

- Vendor Information: Include the name and address of the vendor from whom the purchase is made.

- Exemption Reason: Clearly state the reason for the exemption, ensuring it aligns with Virginia tax laws.

- Signature: The form must be signed by an authorized person to validate the exemption claim.

Legal Use of the Virginia Sales Tax Exemption Form ST-11

The Virginia Sales Tax Exemption Form ST-11 is legally binding when filled out correctly. It is essential to ensure that all information provided is accurate and truthful. Misuse of this form can lead to penalties, including fines and back taxes owed. Businesses should retain a copy of the completed form for their records, as it may be required for future audits or tax reviews.

Eligibility Criteria for the Virginia Sales Tax Exemption Form ST-11

To qualify for the sales tax exemption using the ST-11 form, the purchaser must meet specific criteria:

- The purchaser must be a registered business in Virginia.

- The items purchased must be intended for resale or for use in manufacturing.

- The purchaser must provide a valid Virginia tax identification number.

Ensuring eligibility before submitting the form can help avoid complications during the exemption process.

Form Submission Methods for the Virginia Sales Tax Exemption Form ST-11

The Virginia Sales Tax Exemption Form ST-11 can be submitted in various ways:

- In-Person: Present the completed form directly to the vendor at the time of purchase.

- Via Mail: Some vendors may allow submission via mail; check with them for specific instructions.

- Online: While the form itself is typically submitted in paper format, some vendors may offer digital options for processing exemptions.

It is advisable to confirm the preferred submission method with the vendor to ensure compliance.

Quick guide on how to complete 2020 form va dot st 11 fill online printable fillable

Complete Form VA DoT ST 11 Fill Online, Printable, Fillable effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form VA DoT ST 11 Fill Online, Printable, Fillable on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form VA DoT ST 11 Fill Online, Printable, Fillable with minimal effort

- Access Form VA DoT ST 11 Fill Online, Printable, Fillable and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your preference. Edit and eSign Form VA DoT ST 11 Fill Online, Printable, Fillable and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form va dot st 11 fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the 2020 form va dot st 11 fill online printable fillable

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Virginia sales tax exemption form ST-11?

The Virginia sales tax exemption form ST-11 is a document that allows businesses to purchase certain goods or services without paying sales tax. This form is typically used by organizations that qualify for tax exemptions under state law. By using the Virginia sales tax exemption form ST-11, eligible businesses can save signNowly on their expenditures.

-

Who can use the Virginia sales tax exemption form ST-11?

Organizations such as non-profits, government entities, and certain educational institutions can utilize the Virginia sales tax exemption form ST-11. Each qualifying entity must ensure they meet the criteria set by the Virginia Department of Taxation. By providing this form when making eligible purchases, these organizations can avoid incurring unnecessary sales taxes.

-

How can airSlate SignNow help with the Virginia sales tax exemption form ST-11?

airSlate SignNow simplifies the process of filling out and submitting the Virginia sales tax exemption form ST-11. With our user-friendly interface, you can easily create, eSign, and send documents securely. This streamlines the workflow for businesses managing various tax forms, providing a cost-effective and efficient solution.

-

Is there a cost associated with using the Virginia sales tax exemption form ST-11 on airSlate SignNow?

Using the Virginia sales tax exemption form ST-11 through airSlate SignNow is part of our subscription service, which offers various pricing plans to accommodate different business needs. Our plans are designed to be budget-friendly, ensuring that businesses can access essential eSignature tools without overspending. Additionally, using our platform can lead to cost savings in document handling and processing.

-

What features does airSlate SignNow offer for managing the Virginia sales tax exemption form ST-11?

airSlate SignNow provides several features for managing the Virginia sales tax exemption form ST-11, including customizable templates, automated workflows, and secure eSigning. These features help businesses to efficiently handle their documentation needs from anywhere. The ability to store and track documents ensures that you always have access to your important forms.

-

How does airSlate SignNow ensure security for the Virginia sales tax exemption form ST-11?

Security is a top priority for airSlate SignNow when it comes to handling the Virginia sales tax exemption form ST-11. We employ industry-standard encryption and secure servers to protect your documents and sensitive data. Additionally, features like two-factor authentication help ensure that only authorized users can access your forms and signatures.

-

Can the Virginia sales tax exemption form ST-11 be shared with others using airSlate SignNow?

Yes, you can easily share the Virginia sales tax exemption form ST-11 with colleagues or stakeholders using airSlate SignNow. The platform allows for streamlined collaboration, enabling multiple users to review and sign documents efficiently. This feature is particularly useful for organizations that need to involve multiple parties in the approval process.

Get more for Form VA DoT ST 11 Fill Online, Printable, Fillable

- Roofing contract for contractor arizona form

- Electrical contract for contractor arizona form

- Sheetrock drywall contract for contractor arizona form

- Flooring contract for contractor arizona form

- Agreement a land form

- Notice of intent to enforce forfeiture provisions of contact for deed arizona form

- Final notice of forfeiture and request to vacate property under contract for deed arizona form

- Buyers request for accounting from seller under contract for deed arizona form

Find out other Form VA DoT ST 11 Fill Online, Printable, Fillable

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template