Commonwealth of Virginia Sales and Use Tax Exemption Forms 2016

Understanding the Virginia Certificate of Exemption

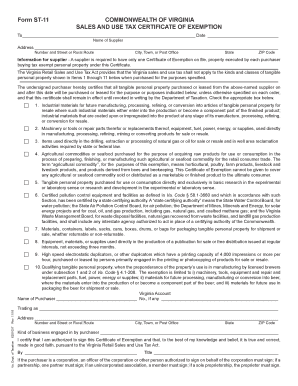

The Virginia Certificate of Exemption is a critical document used primarily for sales and use tax purposes. It allows eligible businesses to make tax-exempt purchases of goods and services. This certificate is essential for entities that qualify under specific criteria, such as non-profit organizations or government agencies. The form serves to verify that the purchase is exempt from sales tax, ensuring compliance with state tax regulations.

How to Obtain the Virginia Certificate of Exemption

To obtain the Virginia Certificate of Exemption, businesses must complete the appropriate application process. This typically involves filling out the required form, which can be accessed through the Virginia Department of Taxation's website or directly from authorized tax offices. Applicants need to provide relevant information, including their business details and the reason for seeking tax exemption. It is advisable to review all eligibility criteria before submission to ensure compliance.

Steps to Complete the Virginia Certificate of Exemption

Completing the Virginia Certificate of Exemption involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Clearly indicate the reason for the exemption on the form.

- Ensure all required signatures are obtained, as this validates the form.

- Review the completed form for accuracy before submission.

Once completed, the form can be submitted to the vendor from whom the goods or services are being purchased.

Legal Use of the Virginia Certificate of Exemption

The legal use of the Virginia Certificate of Exemption is governed by state tax laws. It is crucial that businesses use this certificate only for eligible purchases. Misuse of the exemption certificate can lead to penalties, including back taxes and fines. Therefore, it is important to understand the specific circumstances under which the certificate can be utilized to maintain compliance with Virginia tax regulations.

Key Elements of the Virginia Certificate of Exemption

The Virginia Certificate of Exemption includes several key elements that must be accurately filled out:

- Purchaser's Information: Name and address of the purchasing entity.

- Tax Identification Number: The unique identifier for the business.

- Reason for Exemption: A clear statement of why the purchase is exempt from sales tax.

- Signature: An authorized representative must sign the form to validate it.

Each of these elements is vital for ensuring the certificate's legitimacy and compliance with state requirements.

Examples of Using the Virginia Certificate of Exemption

There are various scenarios where the Virginia Certificate of Exemption can be applied:

- A non-profit organization purchasing supplies for charitable activities.

- A government agency acquiring equipment for public use.

- A business buying materials for a project that qualifies for tax exemption under state law.

These examples illustrate the diverse applications of the certificate, emphasizing its importance in facilitating tax-exempt transactions.

Quick guide on how to complete virginia sales tax exemption form st 11 2016 2019

Your assistance manual on how to prepare your Commonwealth Of Virginia Sales And Use Tax Exemption Forms

If you wish to learn how to generate and dispatch your Commonwealth Of Virginia Sales And Use Tax Exemption Forms, below are some brief instructions on how to facilitate tax submission signNowly.

To start, you simply need to register your airSlate SignNow account to modify how you handle documents online. airSlate SignNow is an incredibly user-friendly and powerful document management solution that enables you to edit, draft, and finalize your tax documents effortlessly. Using its editor, you can toggle between text, checkboxes, and electronic signatures and revert to modify answers as required. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Commonwealth Of Virginia Sales And Use Tax Exemption Forms in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our catalog to obtain any IRS tax document; browse through versions and schedules.

- Press Get form to access your Commonwealth Of Virginia Sales And Use Tax Exemption Forms in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if necessary).

- Review your document and correct any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper may increase return errors and delay reimbursements. Certainly, before e-filing your taxes, consult the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct virginia sales tax exemption form st 11 2016 2019

Create this form in 5 minutes!

How to create an eSignature for the virginia sales tax exemption form st 11 2016 2019

How to generate an eSignature for your Virginia Sales Tax Exemption Form St 11 2016 2019 in the online mode

How to generate an eSignature for the Virginia Sales Tax Exemption Form St 11 2016 2019 in Chrome

How to make an eSignature for putting it on the Virginia Sales Tax Exemption Form St 11 2016 2019 in Gmail

How to create an electronic signature for the Virginia Sales Tax Exemption Form St 11 2016 2019 straight from your mobile device

How to create an eSignature for the Virginia Sales Tax Exemption Form St 11 2016 2019 on iOS devices

How to make an eSignature for the Virginia Sales Tax Exemption Form St 11 2016 2019 on Android

People also ask

-

What is a Virginia Certificate of Exemption?

A Virginia Certificate of Exemption is a document that allows qualifying businesses to procure tax exemptions on certain purchases. It is essential for businesses that wish to save costs on taxable goods and services. The certificate can signNowly reduce expenses while ensuring compliance with state regulations.

-

How can airSlate SignNow help in obtaining a Virginia Certificate of Exemption?

airSlate SignNow streamlines the process of acquiring a Virginia Certificate of Exemption by allowing users to send, sign, and manage documents electronically. This efficient approach saves time and reduces the hassle involved in traditional paperwork. With its user-friendly interface, businesses can quickly process their exemption requests.

-

What features does airSlate SignNow offer for managing Virginia Certificate of Exemption documents?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for Virginia Certificate of Exemption documents. Users can easily create, distribute, and store their important documents while ensuring compliance with state regulations. This results in a more organized and efficient workflow.

-

Is there a cost associated with using airSlate SignNow for Virginia Certificate of Exemption processes?

airSlate SignNow provides cost-effective pricing plans suitable for businesses of all sizes, including those seeking to manage Virginia Certificate of Exemption document processes. Pricing is based on features and usage, ensuring businesses only pay for what they need. You can explore our plans to find the best fit for your requirements.

-

Are there integrations available with airSlate SignNow for managing Virginia Certificate of Exemption?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easy to manage your Virginia Certificate of Exemption alongside other business tools. These integrations allow for improved efficiency and connectivity, helping businesses streamline their document management processes. Popular integrations include CRM systems and cloud storage solutions.

-

How secure is airSlate SignNow when handling Virginia Certificate of Exemption documents?

airSlate SignNow prioritizes security, employing industry-standard encryption and secure access protocols to protect Virginia Certificate of Exemption documents. All data is stored in secure servers, ensuring compliance with regulations and safeguarding sensitive information. Users can confidently manage their documents without compromising security.

-

Can airSlate SignNow assist with remote signing of Virginia Certificate of Exemption?

Absolutely! airSlate SignNow enables remote signing of the Virginia Certificate of Exemption, allowing multiple parties to sign documents electronically without being physically present. This feature expedites the approval process and makes it easier for businesses to complete their documentation efficiently, regardless of location.

Get more for Commonwealth Of Virginia Sales And Use Tax Exemption Forms

Find out other Commonwealth Of Virginia Sales And Use Tax Exemption Forms

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now