Form ST 11 Commonwealth of Virginia Sales and Use Tax Certificate of Exemption 2022-2026

What is the Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption

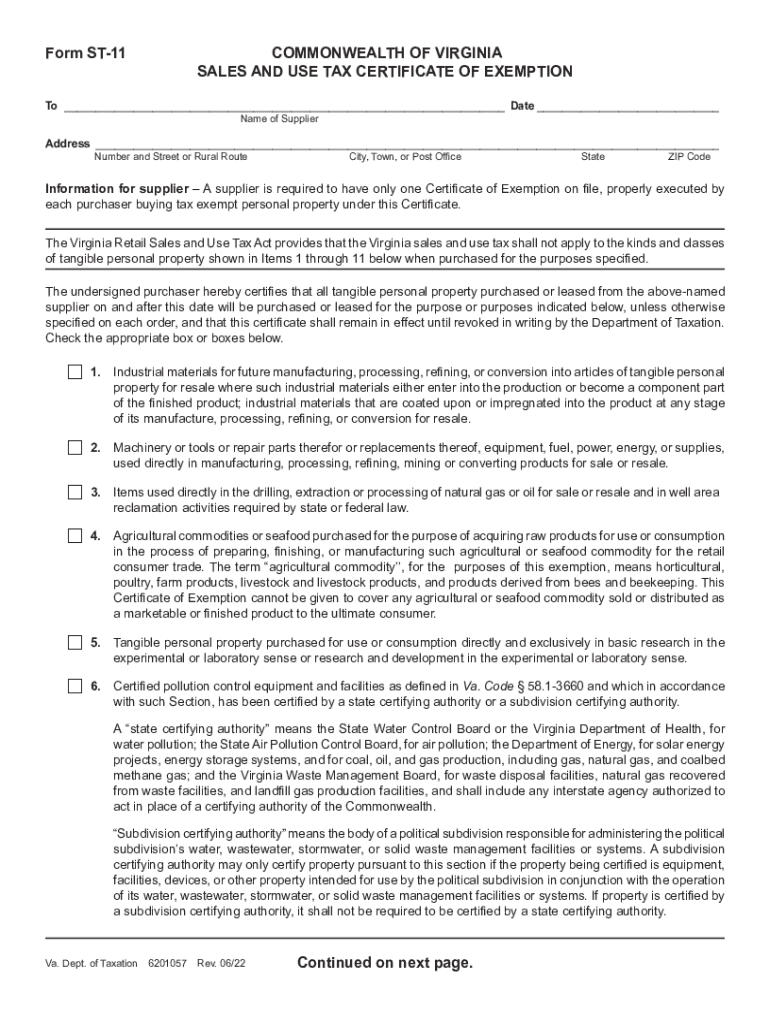

The Virginia Form ST-11 serves as the Sales and Use Tax Certificate of Exemption. This form allows eligible entities to make tax-exempt purchases in the Commonwealth of Virginia. It is primarily used by businesses and organizations that qualify for sales tax exemptions, such as non-profits, government agencies, and certain educational institutions. By providing this certificate to vendors, these entities can avoid paying sales tax on qualifying purchases, thereby reducing their operational costs.

How to use the Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption

To utilize the Virginia Form ST-11, the exempt entity must fill out the form accurately and present it to the seller at the time of purchase. The seller retains the certificate for their records, ensuring compliance with tax regulations. It is essential that the information provided on the form is complete and correct, including the name of the purchaser, the type of exemption, and a description of the items being purchased. This process helps ensure that the transaction is recognized as tax-exempt by the Virginia Department of Taxation.

Steps to complete the Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption

Completing the Virginia Form ST-11 involves several straightforward steps:

- Download the form: Obtain the latest version of Form ST-11 from the Virginia Department of Taxation website.

- Fill in your information: Provide the name of your organization, address, and the type of exemption you qualify for.

- Describe the items: Clearly list the items or services you intend to purchase tax-exempt.

- Sign and date the form: Ensure that an authorized representative of the organization signs and dates the certificate.

- Present the form: Provide the completed form to the seller at the time of purchase.

Legal use of the Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption

The legal use of the Virginia Form ST-11 is governed by state tax laws. The form must be used only for qualifying purchases that fall under the exemption categories specified by the Virginia Department of Taxation. Misuse of the form can lead to penalties, including back taxes owed and potential fines. It is crucial for entities to understand their eligibility and ensure that they are using the form in compliance with all applicable regulations.

Key elements of the Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption

Key elements of the Virginia Form ST-11 include:

- Purchaser Information: The name and address of the exempt entity.

- Type of Exemption: A clear indication of the reason for the exemption, such as non-profit status or government entity.

- Description of Purchases: Specific details about the items or services being purchased tax-exempt.

- Signature: An authorized signature from the entity confirming the accuracy of the information provided.

Eligibility Criteria

To qualify for using the Virginia Form ST-11, entities must meet specific eligibility criteria. Generally, these include being a non-profit organization, a government agency, or an educational institution. Additionally, the purchases must be directly related to the entity's exempt purpose. It is advisable for organizations to review the guidelines provided by the Virginia Department of Taxation to ensure compliance with the eligibility requirements.

Quick guide on how to complete form st 11 commonwealth of virginia sales and use tax certificate of exemption

Complete Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption effortlessly

- Obtain Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Alter and eSign Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 11 commonwealth of virginia sales and use tax certificate of exemption

Create this form in 5 minutes!

People also ask

-

What is the tax exempt form VA and how can I use it?

The tax exempt form VA is a document that allows organizations to make tax-exempt purchases in Virginia. By using the tax exempt form VA, businesses can avoid unnecessary sales tax on eligible items, thereby saving costs. Signing and submitting this form is made easy with airSlate SignNow's electronic signature capabilities.

-

How does airSlate SignNow help with the tax exempt form VA?

With airSlate SignNow, you can easily create, send, and eSign your tax exempt form VA in a secure and streamlined manner. The platform eliminates the need for physical paperwork, facilitating quicker approvals and processing. This allows businesses to manage their tax-exempt purchases more efficiently.

-

Is there a fee for using airSlate SignNow to manage the tax exempt form VA?

airSlate SignNow offers competitive pricing plans that accommodate various business sizes and needs. While there may be a subscription fee, using our service to manage the tax exempt form VA can lead to substantial savings by reducing administrative costs. You can choose a plan that best fits your budget.

-

Can I integrate airSlate SignNow with other software for managing tax exempt form VA?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management tools, enhancing your workflow related to the tax exempt form VA. This integration allows you to synchronize data and automate processes, saving time and reducing errors. Explore our integration options to see how we can streamline your tax-exempt documentation.

-

What features does airSlate SignNow offer for signing tax exempt form VA?

airSlate SignNow includes essential features such as customizable templates, audit trails, and secure cloud storage specifically for documents like the tax exempt form VA. Our platform ensures that documents are signed and stored in compliance with legal standards, keeping your transactions secure and organized. You can also track the signing status in real-time.

-

How can airSlate SignNow enhance my business's use of the tax exempt form VA?

airSlate SignNow streamlines the process of handling the tax exempt form VA by providing a user-friendly interface that simplifies document management. With quick eSigning and easy access to stored forms, businesses can expedite their procurement processes and improve their financial efficiency. This ultimately leads to better cash flow management.

-

Is airSlate SignNow secure for managing sensitive documents like tax exempt form VA?

Absolutely, airSlate SignNow prioritizes security by employing industry-standard encryption protocols for all documents, including the tax exempt form VA. You can be confident that your sensitive information is protected from unauthorized access. Our commitment to data security ensures your business remains compliant with regulations.

Get more for Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption

Find out other Form ST 11 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed