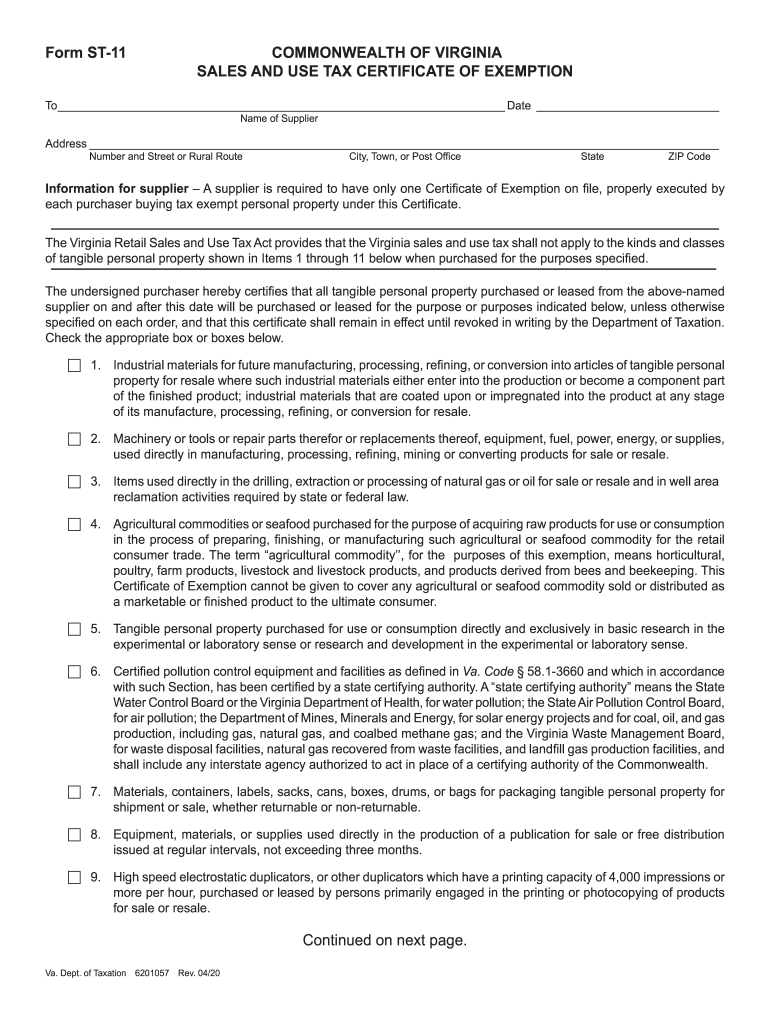

Information for Supplier a Supplier is Required to Have Only One Certificate of Exemption on File, Properly Executed by 2020

Understanding the Virginia Retail Sales and Use Tax Form ST-9

The Virginia Retail Sales and Use Tax Form ST-9 is a crucial document for businesses in Virginia that seek to claim a sales tax exemption. This form is primarily used by suppliers to certify that a purchaser is exempt from paying sales tax on certain transactions. It is essential for suppliers to maintain accurate records of this exemption certificate to comply with state regulations.

Steps to Complete the Virginia Retail Sales and Use Tax Form ST-9

Filling out the ST-9 form involves several important steps:

- Provide the purchaser's name and address accurately.

- Indicate the type of exemption being claimed, ensuring it aligns with state guidelines.

- Include the supplier's name and address, as well as their sales tax registration number.

- Sign and date the form to validate the exemption claim.

It is important to ensure that all information is correct to avoid any issues with tax compliance.

Legal Use of the Virginia Retail Sales and Use Tax Form ST-9

The ST-9 form serves as a legal document that protects both the purchaser and the supplier from potential sales tax liabilities. When properly executed, it provides evidence that the transaction qualifies for an exemption under Virginia law. Suppliers must keep this form on file for their records and may need to present it during audits or inquiries from the Virginia Department of Taxation.

Required Documents for the Virginia Retail Sales and Use Tax Form ST-9

To complete the ST-9 form, certain documents may be required:

- Proof of the purchaser's tax-exempt status, such as a federal tax exemption letter.

- Documentation that supports the nature of the exempt purchase.

These documents help substantiate the exemption and ensure compliance with state tax regulations.

Filing Deadlines for the Virginia Retail Sales and Use Tax Form ST-9

There are no specific filing deadlines for the ST-9 form itself, as it is typically provided at the time of purchase. However, suppliers should ensure that they collect and maintain the form for each exempt transaction to comply with state tax laws. It is advisable to keep these records for at least three years, as this is the standard period for tax audits in Virginia.

Penalties for Non-Compliance with the Virginia Retail Sales and Use Tax Form ST-9

Failure to properly execute or maintain the ST-9 form can lead to significant penalties for both suppliers and purchasers. If the Virginia Department of Taxation determines that a sale was improperly exempted, the supplier may be held liable for the unpaid sales tax, along with interest and penalties. It is crucial for businesses to understand their obligations under the law to avoid these consequences.

Quick guide on how to complete information for supplier a supplier is required to have only one certificate of exemption on file properly executed by

Manage Information For Supplier A Supplier Is Required To Have Only One Certificate Of Exemption On File, Properly Executed By seamlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It serves as a perfect environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Information For Supplier A Supplier Is Required To Have Only One Certificate Of Exemption On File, Properly Executed By on any device with airSlate SignNow's Android or iOS applications and simplify your document operations today.

Steps to modify and electronically sign Information For Supplier A Supplier Is Required To Have Only One Certificate Of Exemption On File, Properly Executed By with ease

- Locate Information For Supplier A Supplier Is Required To Have Only One Certificate Of Exemption On File, Properly Executed By and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Produce your eSignature with the Sign tool, a process that takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your method of sharing the form, via email, text message (SMS), or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced files, the hassle of manual form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Information For Supplier A Supplier Is Required To Have Only One Certificate Of Exemption On File, Properly Executed By while ensuring smooth communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information for supplier a supplier is required to have only one certificate of exemption on file properly executed by

Create this form in 5 minutes!

How to create an eSignature for the information for supplier a supplier is required to have only one certificate of exemption on file properly executed by

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the VA retail sales and use tax form ST 9?

The VA retail sales and use tax form ST 9 is a document used by retailers in Virginia to report and remit taxes on the sales of tangible personal property. This form helps businesses comply with state tax regulations, ensuring that all applicable taxes are collected and submitted on time.

-

How do I complete the VA retail sales and use tax form ST 9?

To complete the VA retail sales and use tax form ST 9, you need to gather your sales data, including total sales, tax collected, and exemptions applicable. The form requires specific information regarding your business and tax details, ensuring thorough and accurate reporting to the Virginia tax authorities.

-

Where can I find the VA retail sales and use tax form ST 9?

The VA retail sales and use tax form ST 9 can be downloaded directly from the Virginia Department of Taxation's website. This ensures you have the most current version of the form, along with any updates or changes in tax rates or reporting requirements.

-

What are the penalties for not filing the VA retail sales and use tax form ST 9?

Failing to file the VA retail sales and use tax form ST 9 can result in signNow penalties, including fines and interest on unpaid taxes. Timely submission is crucial to avoid these consequences and ensure compliance with state tax laws.

-

How can airSlate SignNow help me with the VA retail sales and use tax form ST 9?

airSlate SignNow simplifies the process of completing and submitting the VA retail sales and use tax form ST 9 by providing easy-to-use eSignature capabilities. This ensures that all required signatures are efficiently collected and stored, making tax submission stress-free and organized.

-

Is there a cost associated with using airSlate SignNow for the VA retail sales and use tax form ST 9?

Yes, there is a subscription fee for using airSlate SignNow. However, the investment is often offset by increased efficiency and reduced paper handling, making it a cost-effective solution for managing the VA retail sales and use tax form ST 9.

-

Can airSlate SignNow integrate with my existing accounting software for the VA retail sales and use tax form ST 9?

Absolutely! airSlate SignNow offers a range of integrations with popular accounting software, which can streamline the data entry process associated with the VA retail sales and use tax form ST 9. This integration helps ensure accuracy and saves time by automating data transfer.

Get more for Information For Supplier A Supplier Is Required To Have Only One Certificate Of Exemption On File, Properly Executed By

- Foundation contractor package vermont form

- Plumbing contractor package vermont form

- Brick mason contractor package vermont form

- Roofing contractor package vermont form

- Electrical contractor package vermont form

- Sheetrock drywall contractor package vermont form

- Flooring contractor package vermont form

- Trim carpentry contractor package vermont form

Find out other Information For Supplier A Supplier Is Required To Have Only One Certificate Of Exemption On File, Properly Executed By

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form