Commonwealth of Virginia Sales and Use Tax Exemption Forms 2016

Understanding the Virginia Sales and Use Tax Exemption Forms

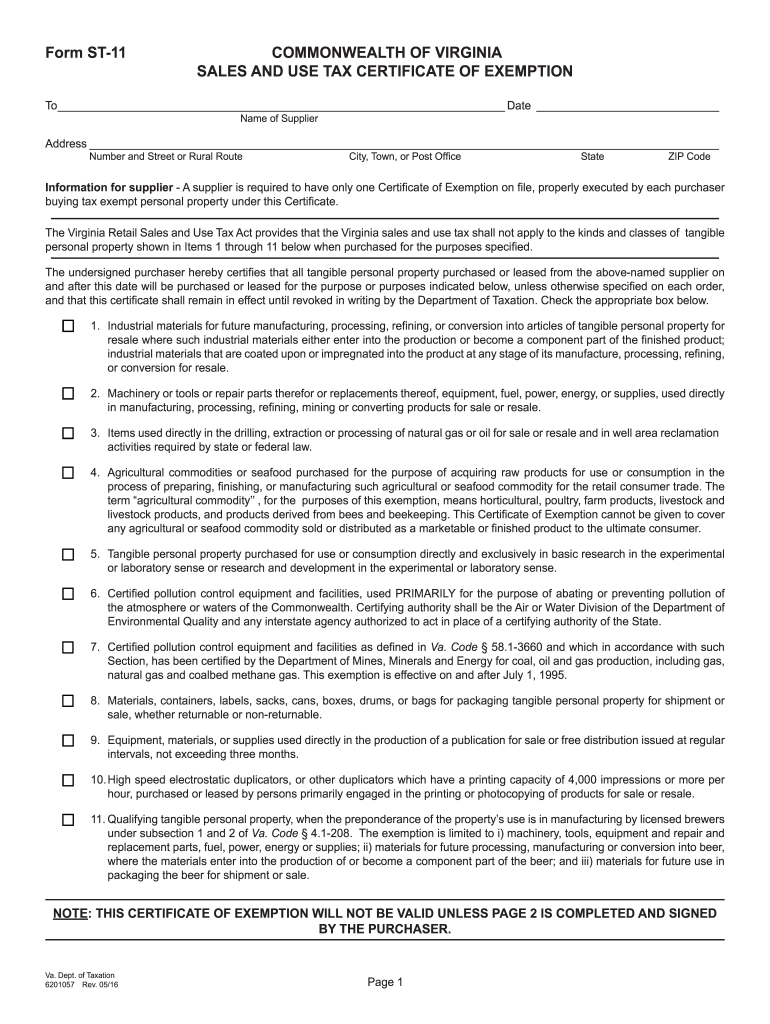

The Virginia sales and use tax exemption forms are essential documents that allow eligible individuals and businesses to claim exemptions from sales tax on certain purchases. These forms are primarily used to facilitate tax-exempt transactions, ensuring compliance with state tax regulations. The most common forms include the Virginia resale certificate, commonly referred to as the ST-11, and the Virginia sales tax exemption certificate, known as the ST-12. Each form serves a specific purpose and is designed to meet the needs of different types of tax-exempt purchases.

Steps to Complete the Virginia Sales and Use Tax Exemption Forms

Completing the Virginia sales and use tax exemption forms involves several key steps to ensure accuracy and compliance. First, identify the appropriate form based on the type of exemption needed. Next, gather all necessary information, including your business details, tax identification number, and the specific items for which you are claiming exemption. Fill out the form carefully, ensuring that all fields are completed accurately. Finally, sign and date the form before submitting it to the relevant vendor or agency. It is crucial to keep a copy for your records.

Eligibility Criteria for Virginia Sales and Use Tax Exemption

To qualify for sales and use tax exemptions in Virginia, applicants must meet specific eligibility criteria. Generally, businesses that purchase goods for resale, certain non-profit organizations, and government entities may qualify. Additionally, the items purchased must be directly related to the exempt purpose, such as inventory for resale or materials used in a non-profit’s charitable activities. It is important to review the specific guidelines provided by the Virginia Department of Taxation to ensure compliance and avoid penalties.

Legal Use of the Virginia Sales and Use Tax Exemption Forms

The legal use of the Virginia sales and use tax exemption forms is governed by state tax laws. These forms must be completed accurately and used solely for legitimate tax-exempt purposes. Misuse of these forms, such as claiming exemptions for ineligible purchases, can lead to significant penalties, including back taxes, fines, and interest. Businesses should maintain thorough records of all transactions involving exemption forms to provide documentation in case of an audit by the Virginia Department of Taxation.

Obtaining the Virginia Sales and Use Tax Exemption Forms

Obtaining the Virginia sales and use tax exemption forms is a straightforward process. These forms can be accessed online through the Virginia Department of Taxation’s official website. Additionally, businesses may request physical copies from local tax offices or download them as needed. It is advisable to ensure that you are using the most current version of the forms, as outdated forms may not be accepted for tax-exempt transactions.

Filing Deadlines and Important Dates

Filing deadlines for the Virginia sales and use tax exemption forms vary based on the type of exemption being claimed. Generally, it is recommended to submit the forms before making tax-exempt purchases to avoid complications. Businesses should stay informed about any changes in tax law that may affect filing deadlines. Keeping a calendar of important dates related to tax filings can help ensure compliance and timely submissions.

Quick guide on how to complete virginia sales tax exemption form st 11 2016 2019 443065685

Your assistance manual on how to prepare your Commonwealth Of Virginia Sales And Use Tax Exemption Forms

If you’re interested in learning how to create and submit your Commonwealth Of Virginia Sales And Use Tax Exemption Forms, here are some straightforward instructions to make tax filing signNowly easier.

To begin, you need to sign up for your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a very user-friendly and robust document solution that enables you to edit, draft, and finalize your income tax forms effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures while being able to amend details as necessary. Simplify your tax administration with enhanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Commonwealth Of Virginia Sales And Use Tax Exemption Forms within a few minutes:

- Create your account and start processing PDFs in moments.

- Use our directory to obtain any IRS tax form; browse through different versions and schedules.

- Click Get form to open your Commonwealth Of Virginia Sales And Use Tax Exemption Forms in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-recognized eSignature (if needed).

- Examine your document and correct any mistakes.

- Save modifications, print out your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper format can increase return errors and delay reimbursements. Naturally, before e-filing your taxes, verify the IRS website for declaring regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct virginia sales tax exemption form st 11 2016 2019 443065685

Create this form in 5 minutes!

How to create an eSignature for the virginia sales tax exemption form st 11 2016 2019 443065685

How to create an electronic signature for your Virginia Sales Tax Exemption Form St 11 2016 2019 443065685 online

How to generate an electronic signature for your Virginia Sales Tax Exemption Form St 11 2016 2019 443065685 in Google Chrome

How to create an eSignature for signing the Virginia Sales Tax Exemption Form St 11 2016 2019 443065685 in Gmail

How to make an electronic signature for the Virginia Sales Tax Exemption Form St 11 2016 2019 443065685 from your mobile device

How to generate an electronic signature for the Virginia Sales Tax Exemption Form St 11 2016 2019 443065685 on iOS devices

How to generate an eSignature for the Virginia Sales Tax Exemption Form St 11 2016 2019 443065685 on Android OS

People also ask

-

What is a Virginia certificate of exemption, and who needs it?

A Virginia certificate of exemption is a legal document that allows certain entities or individuals to be exempt from sales tax on specific purchases. Organizations like non-profits, government entities, and certain businesses may require this certificate to avoid unnecessary tax expenses. Understanding when and how to use the Virginia certificate of exemption is essential for compliant financial practices.

-

How can airSlate SignNow help with the Virginia certificate of exemption process?

airSlate SignNow simplifies the process of managing and signing documents, including the Virginia certificate of exemption. With our platform, you can easily create, send, and eSign your exemption forms, ensuring they are processed efficiently and securely. This streamlines your workflow, saving you time and reducing potential errors.

-

Is there a cost associated with using airSlate SignNow for the Virginia certificate of exemption?

While airSlate SignNow offers various pricing plans, utilizing the platform for your Virginia certificate of exemption is cost-effective. You'll find plans that cater to different business needs, ensuring you have access to essential features without breaking the bank. Each plan helps businesses save time and resources when processing necessary documents.

-

What features does airSlate SignNow provide for managing the Virginia certificate of exemption?

airSlate SignNow includes features such as document templates, customizable workflows, and robust security measures, all tailored for handling the Virginia certificate of exemption. These tools enable you to create standardized forms and automate the signing process, which enhances efficiency and accuracy. The platform is designed to fit the needs of both small and large organizations.

-

Are there any integrations available for managing the Virginia certificate of exemption with airSlate SignNow?

Yes, airSlate SignNow offers integrations with popular business applications, allowing you to manage your Virginia certificate of exemption alongside your other workflows seamlessly. Whether you're using CRM systems, accounting software, or cloud storage solutions, our platform helps keep your documents organized and accessible. This level of integration helps streamline your business operations effectively.

-

How secure is airSlate SignNow when handling the Virginia certificate of exemption?

Security is a top priority at airSlate SignNow, especially when dealing with important documents like the Virginia certificate of exemption. We implement advanced encryption and compliance measures to protect your sensitive information. Your documents are safeguarded through industry-standard protocols, ensuring you can sign and store them with confidence.

-

Can I track the status of my Virginia certificate of exemption documents with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of all your documents, including the Virginia certificate of exemption. You can see when a document has been sent, opened, or signed, providing you with full transparency throughout the process. This feature helps ensure that your paperwork is completed promptly and keeps all parties informed.

Get more for Commonwealth Of Virginia Sales And Use Tax Exemption Forms

- Fl410 form

- Crowd release notice example form

- Gst exemption certificate form

- Section 504 forms grand blanc schools

- Hospitalization risk assessment champ form

- Anti ragging form niser niser ac

- Www shrp comhorsemen infoapplications formsapplications forms ampamp reports racing rules shrp

- Field trip permission form deer park independent school district dpisd

Find out other Commonwealth Of Virginia Sales And Use Tax Exemption Forms

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple