W 107 Form WT 7, Employers Annual Reconciliation of Wisconsin Income Tax Withheld 2021

What is the W-107 Form WT 7?

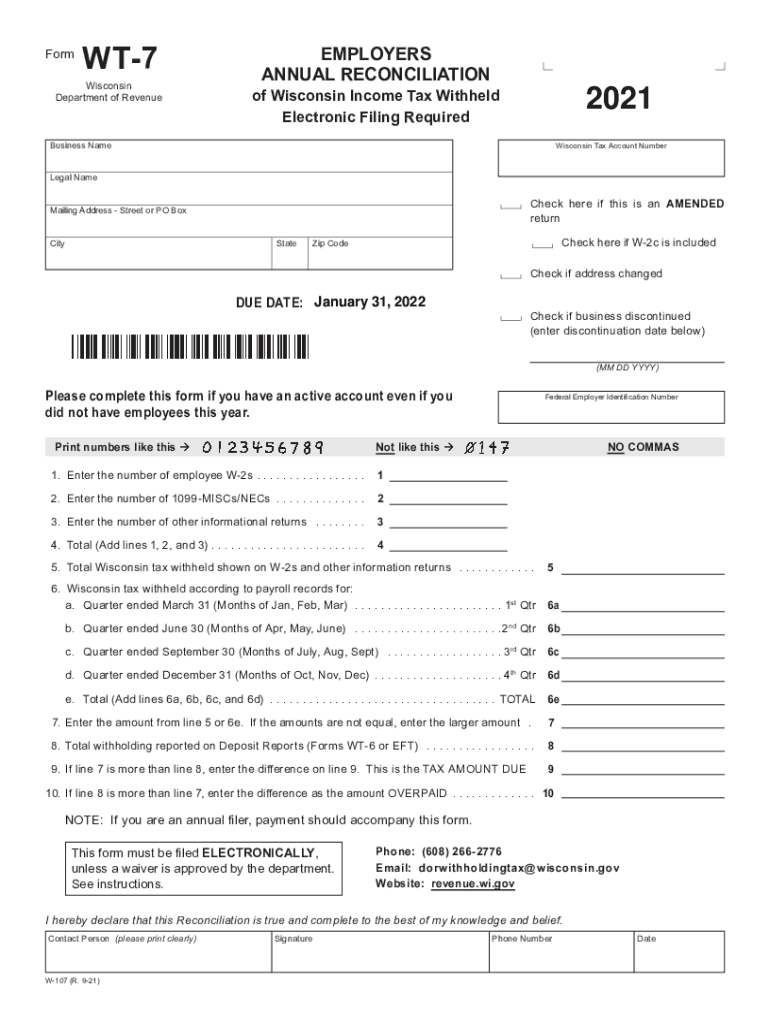

The W-107 Form WT 7, also known as the Employers Annual Reconciliation of Wisconsin Income Tax Withheld, is a crucial document for employers in Wisconsin. It serves to reconcile the total amount of state income tax withheld from employees throughout the year with the amounts reported and paid to the Wisconsin Department of Revenue. This form ensures that employers accurately report their withholding obligations and maintain compliance with state tax laws.

How to use the W-107 Form WT 7

Using the W-107 Form WT 7 involves several key steps. Employers must first gather all relevant payroll records for the year, including the total wages paid and the total state income tax withheld. Once this information is compiled, the employer can fill out the form, ensuring that all figures align with the data reported on individual employee W-2 forms. After completing the form, it must be submitted to the Wisconsin Department of Revenue by the designated deadline to avoid penalties.

Steps to complete the W-107 Form WT 7

Completing the W-107 Form WT 7 requires careful attention to detail. Here are the essential steps:

- Gather all payroll records for the year, including W-2 forms for each employee.

- Calculate the total wages paid to employees and the total amount of state income tax withheld.

- Fill out the W-107 Form WT 7, ensuring all information is accurate and corresponds with payroll records.

- Review the completed form for any errors or omissions.

- Submit the form to the Wisconsin Department of Revenue by the specified deadline.

Legal use of the W-107 Form WT 7

The legal use of the W-107 Form WT 7 is essential for employers to fulfill their tax obligations in Wisconsin. This form must be filed annually to report the total income tax withheld from employees. Failure to submit the form can result in penalties, including fines and interest on unpaid taxes. Compliance with the filing requirements helps maintain good standing with state tax authorities.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the W-107 Form WT 7. Typically, the form is due by January 31 of the following year after the tax year ends. It is crucial for employers to mark this date on their calendars to ensure timely submission and avoid any potential penalties for late filing.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the W-107 Form WT 7 can lead to significant penalties. Employers who fail to file the form by the deadline may face fines imposed by the Wisconsin Department of Revenue. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden. It is vital for employers to adhere to the filing schedule to avoid these consequences.

Quick guide on how to complete 2021 w 107 form wt 7 employers annual reconciliation of wisconsin income tax withheld

Effortlessly Prepare W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld on Any Device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and safely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Handle W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld with Ease

- Find W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional signature in ink.

- Review the information and click on the Done button to save your updates.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 w 107 form wt 7 employers annual reconciliation of wisconsin income tax withheld

Create this form in 5 minutes!

How to create an eSignature for the 2021 w 107 form wt 7 employers annual reconciliation of wisconsin income tax withheld

The way to create an e-signature for your PDF online

The way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow's wt 7 solution?

The wt 7 solution offers robust features such as customizable templates, real-time tracking, and secure eSigning capabilities. With its user-friendly interface, businesses can effortlessly manage their document workflows and enhance collaboration. Additionally, wt 7 integrates seamlessly with various applications to streamline processes.

-

How can I benefit from using the airSlate SignNow wt 7?

Using the airSlate SignNow wt 7, businesses can signNowly reduce the time spent on document management. The solution simplifies eSigning, allowing for faster approvals and improved compliance. By maximizing efficiency, wt 7 helps businesses focus on core activities and boost overall productivity.

-

What is the pricing structure for airSlate SignNow's wt 7?

The pricing structure for wt 7 is flexible and tailored to meet the needs of various businesses. Plans typically range from basic to premium options, each offering a unique set of features. Customers can choose a plan that best fits their budget and requirements, ensuring cost-effectiveness.

-

Is the airSlate SignNow wt 7 secure for sensitive documents?

Yes, the wt 7 solution prioritizes security, employing advanced encryption methods to protect sensitive documents. airSlate SignNow complies with industry standards, ensuring that your data remains safe throughout the signing process. Businesses can confidently use wt 7 to handle confidential information.

-

What integrations are available with airSlate SignNow's wt 7?

The wt 7 solution integrates with a wide range of applications, including CRMs, cloud storage services, and productivity tools. This connectivity allows businesses to sync their workflows efficiently and eliminates the need for manual data entry. With wt 7, users can enhance their existing software ecosystem.

-

Can I customize templates with the airSlate SignNow wt 7?

Absolutely! The wt 7 solution allows users to create and customize templates to suit their specific needs. This feature enhances consistency across documents while saving time during the eSigning process. Custom templates in wt 7 streamline workflows and reduce the chances of errors.

-

How does airSlate SignNow's wt 7 improve team collaboration?

The wt 7 solution enhances team collaboration by enabling real-time document sharing and editing. Team members can track the status of documents, provide comments, and collaborate seamlessly all within the platform. This collaborative approach ensures everyone is on the same page and speeds up decision-making.

Get more for W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld

Find out other W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy