Wt 7 2022-2026

What is the Wt 7

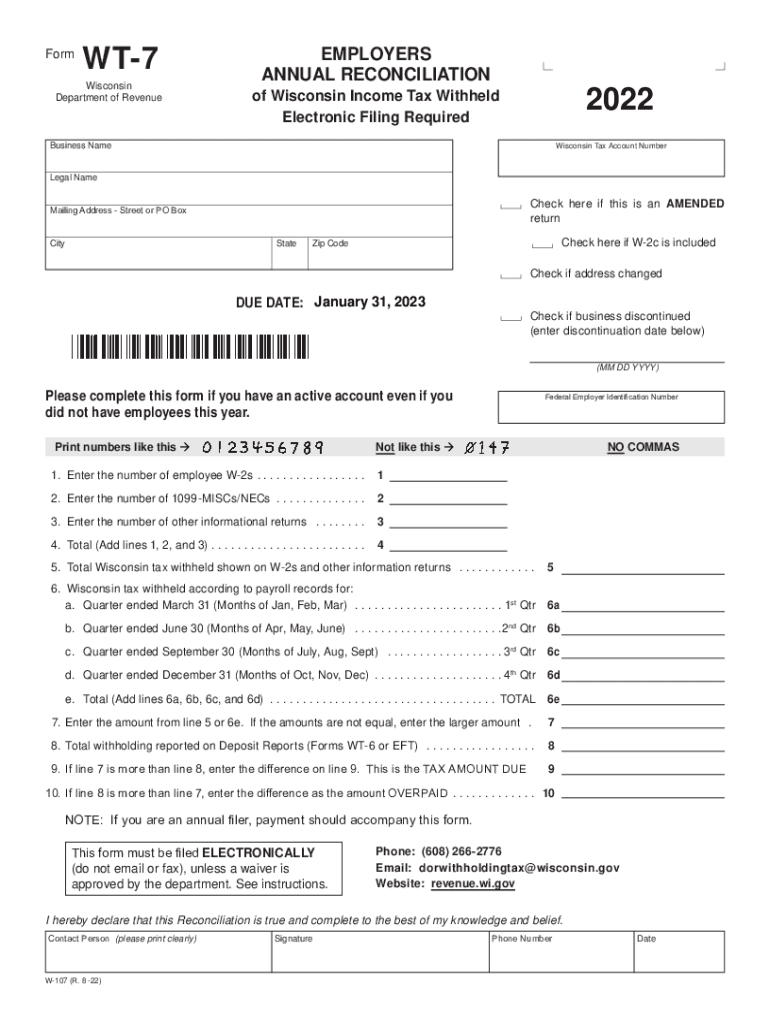

The Wt 7 is a form used in Wisconsin for employers to report and remit withholding tax. This form is essential for businesses that withhold state income tax from their employees' wages. The 2014 Wt 7 annual version allows employers to summarize their withholding tax obligations for the year, ensuring compliance with state tax regulations. Understanding this form is crucial for maintaining accurate records and fulfilling tax responsibilities.

How to use the Wt 7

Using the Wt 7 involves several steps. Employers must first gather all relevant payroll data, including the total wages paid to employees and the amount of state income tax withheld throughout the year. Once this information is collected, employers can fill out the Wt 7 form, ensuring that all sections are accurately completed. After filling out the form, it should be submitted to the Wisconsin Department of Revenue, either electronically or by mail, depending on the employer's preference and compliance requirements.

Steps to complete the Wt 7

Completing the Wt 7 requires careful attention to detail. Here are the steps to follow:

- Gather payroll records for the year, including total wages and withholding amounts.

- Obtain a blank 2014 Wt 7 form, which can be downloaded as a PDF or filled out digitally.

- Fill in the employer's information, including name, address, and tax identification number.

- Report the total wages paid and the total amount of state tax withheld in the designated sections.

- Review the completed form for accuracy before submission.

- Submit the form to the Wisconsin Department of Revenue by the deadline, either electronically or via mail.

Legal use of the Wt 7

The legal use of the Wt 7 is governed by Wisconsin tax laws. Employers are required to file this form annually to report their withholding tax obligations. Failure to submit the Wt 7 can result in penalties, including fines and interest on unpaid taxes. It is important for employers to ensure that the form is filled out correctly and submitted on time to avoid any legal repercussions.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Wt 7. The form is typically due by January 31 of the following year, allowing employers to report their withholding tax for the previous calendar year. It is essential to keep track of these dates to ensure timely submission and avoid penalties. Employers should also stay informed about any changes to deadlines that may be announced by the Wisconsin Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The Wt 7 can be submitted through various methods, providing flexibility for employers. Options include:

- Online Submission: Employers can file the Wt 7 electronically through the Wisconsin Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the state.

- In-Person Submission: Employers may also choose to deliver the form in person at their local Department of Revenue office.

Quick guide on how to complete wt 7

Prepare Wt 7 effortlessly on any device

Virtual document management has gained traction among enterprises and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without interruptions. Manage Wt 7 across any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Wt 7 with minimal effort

- Obtain Wt 7 and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Wt 7 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wt 7

Create this form in 5 minutes!

People also ask

-

What is the 2014 wt 7 and how does it work with airSlate SignNow?

The 2014 wt 7 is a powerful tool for managing and sending documents efficiently. With airSlate SignNow, you can easily eSign and manage the 2014 wt 7 documents in a secure and user-friendly interface. This integration helps streamline your workflow and ensures all your documentation needs are met with ease.

-

How can airSlate SignNow help with the 2014 wt 7 document processes?

airSlate SignNow provides a comprehensive solution for handling the 2014 wt 7 documentation by facilitating seamless eSigning and document management. It allows users to track the status of documents in real-time, reducing delays and ensuring prompt processing. This efficiency is crucial for businesses dealing with the 2014 wt 7 requirements.

-

What are the pricing options for using airSlate SignNow with the 2014 wt 7?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses managing the 2014 wt 7 documents. Whether you’re a small business or a large enterprise, there’s a plan that fits your budget and requirements. Pricing is competitive and provides value considering the robust features available for 2014 wt 7 management.

-

What features does airSlate SignNow provide for the 2014 wt 7?

When it comes to the 2014 wt 7, airSlate SignNow offers features like secure eSigning, document templates, and automated workflows. These functionalities enhance the efficiency of managing 2014 wt 7 documents, allowing businesses to focus on what matters most. The platform's user-friendly design also makes it easy for anyone to use.

-

Is the airSlate SignNow platform scalable for growing businesses handling 2014 wt 7?

Yes, airSlate SignNow is highly scalable, making it an ideal solution for businesses of all sizes handling the 2014 wt 7. As your needs grow, the platform can adapt by allowing you to add more users and features as required. This flexibility ensures you're always equipped to manage your 2014 wt 7 documentation effectively.

-

Can airSlate SignNow be integrated with other software for 2014 wt 7 document management?

Absolutely, airSlate SignNow integrates seamlessly with various software applications to enhance the management of 2014 wt 7 documents. Whether you use CRM systems or accounting software, integration options are available to create a cohesive workflow. This capability streamlines your processes and saves time.

-

What are the benefits of using airSlate SignNow for 2014 wt 7 eSigning?

Using airSlate SignNow for 2014 wt 7 eSigning brings numerous benefits, including increased speed, security, and compliance. The platform ensures your documents are legally binding and protected throughout the signing process. With an emphasis on user experience, airSlate SignNow enhances the overall efficiency of handling 2014 wt 7 documentation.

Get more for Wt 7

- Request for information from prime contractor individual nebraska

- Quitclaim deed by two individuals to corporation nebraska form

- Warranty deed from two individuals to corporation nebraska form

- Request for information from prime contractor corporation or llc nebraska

- Prime contractors information statement individual nebraska

- Quitclaim deed from individual to corporation nebraska form

- Warranty deed from individual to corporation nebraska form

- Prime contractors information statement corporation or llc nebraska

Find out other Wt 7

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF