Wisconsin Form Wt 7 2016

What is the Wisconsin Form Wt 7

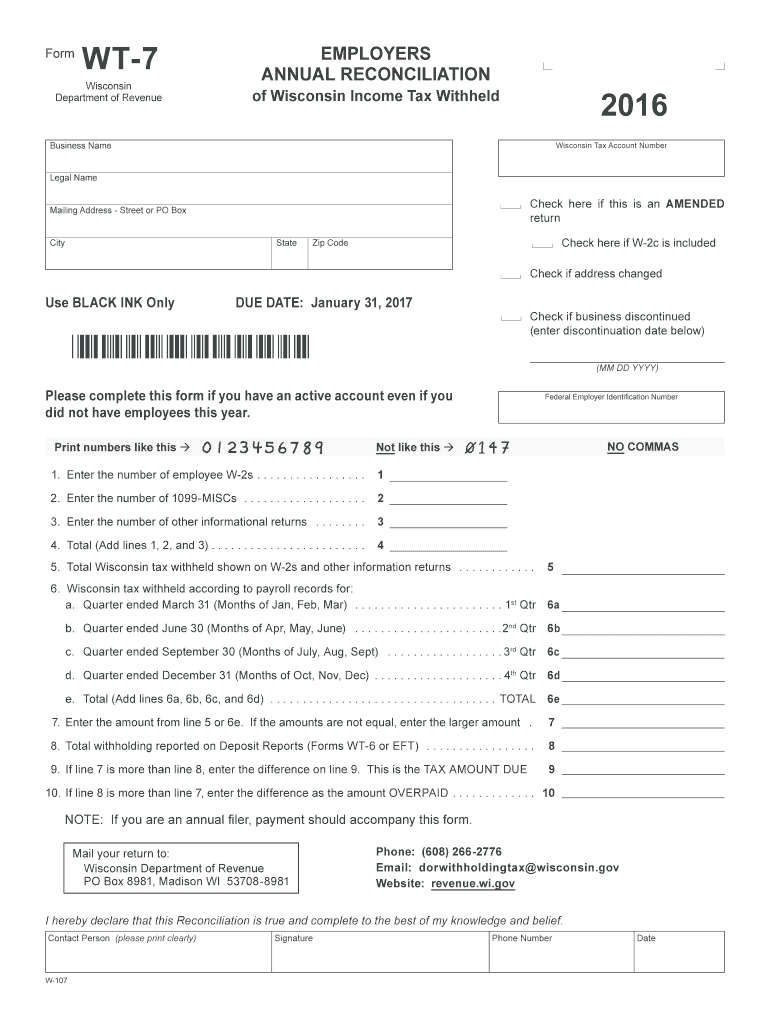

The Wisconsin Form Wt 7 is a tax form used by employers to report and remit Wisconsin withholding tax. This form is essential for businesses operating in Wisconsin, as it ensures compliance with state tax regulations. The form helps employers calculate the amount of state income tax to withhold from employees' wages and remit these amounts to the Wisconsin Department of Revenue.

How to use the Wisconsin Form Wt 7

Employers must use the Wisconsin Form Wt 7 to accurately report withholding tax amounts. To use the form, employers should first gather information about their employees' wages and the applicable withholding rates. The form requires details such as the employer's identification number, the total wages paid, and the total amount withheld. Once completed, the form should be submitted to the Wisconsin Department of Revenue, either electronically or via mail.

Steps to complete the Wisconsin Form Wt 7

Completing the Wisconsin Form Wt 7 involves several steps:

- Gather necessary employee information, including names, Social Security numbers, and wages.

- Determine the appropriate withholding rates based on employee status and income levels.

- Fill out the form with accurate totals for wages and withholding amounts.

- Review the completed form for any errors or omissions.

- Submit the form to the Wisconsin Department of Revenue by the specified deadline.

Legal use of the Wisconsin Form Wt 7

The Wisconsin Form Wt 7 is legally binding and must be filled out accurately to avoid penalties. Employers are required to adhere to state tax laws, and failure to do so can result in fines or other legal consequences. It is essential for employers to keep accurate records of all submitted forms and payments to ensure compliance with Wisconsin tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Form Wt 7 are crucial for maintaining compliance. Employers must submit the form along with their withholding payments according to the following schedule:

- Monthly filers must submit the form by the 15th of the following month.

- Quarterly filers must submit the form by the last day of the month following the end of the quarter.

- Annual filers must submit the form by January 31 of the following year.

Who Issues the Form

The Wisconsin Form Wt 7 is issued by the Wisconsin Department of Revenue. This state agency is responsible for administering tax laws and ensuring that employers comply with withholding requirements. Employers can obtain the form directly from the Department of Revenue's website or through authorized tax preparation software.

Quick guide on how to complete wisconsin form wt 7 2016

Effortlessly prepare Wisconsin Form Wt 7 on any device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow provides all the tools required to quickly create, modify, and e-sign your documents without any delays. Handle Wisconsin Form Wt 7 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to effortlessly edit and eSign Wisconsin Form Wt 7

- Locate Wisconsin Form Wt 7 and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether via email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Wisconsin Form Wt 7 to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin form wt 7 2016

Create this form in 5 minutes!

How to create an eSignature for the wisconsin form wt 7 2016

How to create an eSignature for the Wisconsin Form Wt 7 2016 in the online mode

How to make an electronic signature for the Wisconsin Form Wt 7 2016 in Chrome

How to make an electronic signature for signing the Wisconsin Form Wt 7 2016 in Gmail

How to make an electronic signature for the Wisconsin Form Wt 7 2016 straight from your smartphone

How to make an eSignature for the Wisconsin Form Wt 7 2016 on iOS

How to create an eSignature for the Wisconsin Form Wt 7 2016 on Android devices

People also ask

-

What is Wisconsin Form Wt 7?

Wisconsin Form Wt 7 is a tax form used for withholding tax reporting in the state of Wisconsin. It is essential for employers to accurately report taxes withheld from employees' wages. airSlate SignNow simplifies the process of completing and submitting Wisconsin Form Wt 7, ensuring compliance and efficiency.

-

How can airSlate SignNow help me with Wisconsin Form Wt 7?

airSlate SignNow offers a streamlined platform for electronically signing and sending Wisconsin Form Wt 7. With its user-friendly interface, you can easily fill out, sign, and share the form with the necessary parties, reducing paperwork and saving time.

-

Is there a cost associated with using airSlate SignNow for Wisconsin Form Wt 7?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that can assist with Wisconsin Form Wt 7 and other document management tasks, ensuring a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Wisconsin Form Wt 7?

airSlate SignNow includes features such as customizable templates, electronic signatures, and automated workflows specifically designed for documents like Wisconsin Form Wt 7. These features enhance efficiency, minimize errors, and ensure a smooth signing process.

-

Are there integrations available with airSlate SignNow for Wisconsin Form Wt 7?

Yes, airSlate SignNow integrates seamlessly with various applications to assist with managing Wisconsin Form Wt 7. By connecting your favorite tools, you can streamline the document workflow and maintain organization within your business processes.

-

How secure is airSlate SignNow when handling Wisconsin Form Wt 7?

airSlate SignNow prioritizes security, employing robust encryption and compliance measures to protect sensitive information. When managing Wisconsin Form Wt 7, you can trust that your data is safeguarded throughout the signing and submission process.

-

Can I track the status of Wisconsin Form Wt 7 using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your documents, including Wisconsin Form Wt 7. You can monitor the progress, see who has signed, and receive notifications, ensuring you stay updated throughout the process.

Get more for Wisconsin Form Wt 7

Find out other Wisconsin Form Wt 7

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now