Wisconsin Form Wt 7 2015

What is the Wisconsin Form Wt 7

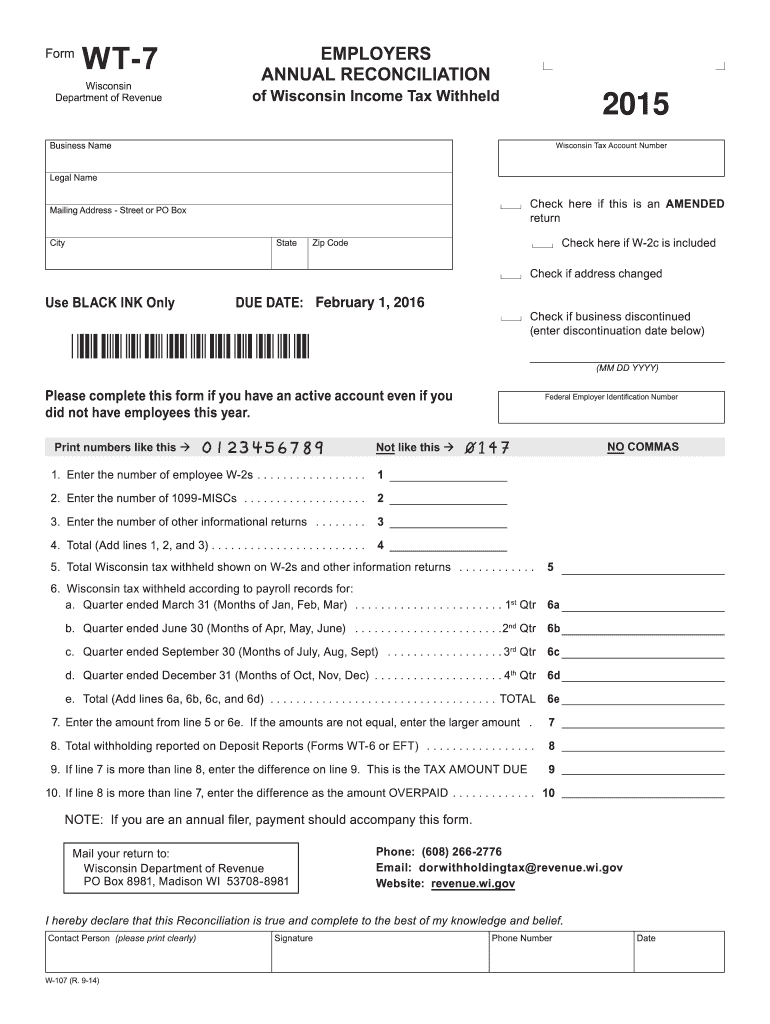

The Wisconsin Form Wt 7 is a tax form used by employers in the state of Wisconsin to report employee wage information. This form is specifically designed for withholding tax purposes, allowing employers to calculate and remit the appropriate amount of state income tax from employee wages. The form plays a crucial role in ensuring compliance with Wisconsin tax laws and facilitates the accurate reporting of income for both employers and employees.

How to use the Wisconsin Form Wt 7

To use the Wisconsin Form Wt 7, employers must first gather the necessary information about their employees, including names, addresses, Social Security numbers, and wage amounts. Once this information is collected, employers can accurately fill out the form, detailing the amount of state income tax withheld from each employee's wages. After completing the form, it should be submitted to the Wisconsin Department of Revenue, either electronically or via mail, depending on the employer's preference.

Steps to complete the Wisconsin Form Wt 7

Completing the Wisconsin Form Wt 7 involves several key steps:

- Gather employee information: Collect details such as names, addresses, and Social Security numbers.

- Calculate withholding amounts: Determine the state income tax to be withheld based on employee wages.

- Fill out the form: Enter the collected information and withholding amounts accurately on the form.

- Review for accuracy: Double-check all entries to ensure compliance with Wisconsin tax regulations.

- Submit the form: Send the completed form to the Wisconsin Department of Revenue, following the appropriate submission method.

Legal use of the Wisconsin Form Wt 7

The Wisconsin Form Wt 7 is legally binding when filled out and submitted according to state regulations. Employers must ensure that the information provided is accurate and complete to avoid penalties or legal issues. The form must be submitted in a timely manner to comply with state tax laws, and any discrepancies may lead to audits or fines. Utilizing electronic tools for form submission can enhance security and compliance with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Form Wt 7 can vary depending on the employer's reporting schedule. Generally, employers must submit their withholding tax forms on a quarterly basis. It is essential to stay informed about specific deadlines to avoid late fees or penalties. Employers should consult the Wisconsin Department of Revenue's website or official communications for the most accurate and up-to-date information regarding filing dates.

Who Issues the Form

The Wisconsin Form Wt 7 is issued by the Wisconsin Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers and taxpayers. Employers can obtain the form directly from the Department of Revenue's website or through official state publications. It is important for employers to use the most current version of the form to ensure compliance with any updates or changes in tax regulations.

Quick guide on how to complete wisconsin form wt 7 2015

Effortlessly Complete Wisconsin Form Wt 7 on Any Device

Managing documents online has gained signNow traction among companies and individuals alike. It serves as a superb eco-friendly alternative to conventional printed and signed documentation, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Wisconsin Form Wt 7 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Wisconsin Form Wt 7 seamlessly

- Find Wisconsin Form Wt 7 and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize key parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Wisconsin Form Wt 7 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin form wt 7 2015

Create this form in 5 minutes!

How to create an eSignature for the wisconsin form wt 7 2015

How to generate an electronic signature for your Wisconsin Form Wt 7 2015 in the online mode

How to create an eSignature for the Wisconsin Form Wt 7 2015 in Google Chrome

How to create an electronic signature for signing the Wisconsin Form Wt 7 2015 in Gmail

How to make an eSignature for the Wisconsin Form Wt 7 2015 from your mobile device

How to create an eSignature for the Wisconsin Form Wt 7 2015 on iOS devices

How to create an electronic signature for the Wisconsin Form Wt 7 2015 on Android devices

People also ask

-

What is Wisconsin Form Wt 7 and who needs it?

Wisconsin Form Wt 7 is a tax form used by employers to report employee wage withholding. Any business operating in Wisconsin that has employees is required to submit this form to ensure proper tax compliance. Using airSlate SignNow can simplify the process of preparing and eSigning this important document.

-

How can airSlate SignNow help with Wisconsin Form Wt 7?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning Wisconsin Form Wt 7 electronically. This not only streamlines the filing process but also ensures that the form is securely stored and easily accessible. With templates and automated workflows, preparing this form becomes hassle-free.

-

What are the pricing options for using airSlate SignNow for Wisconsin Form Wt 7?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs, starting with a free trial. This allows businesses to evaluate the platform's capabilities for managing documents like Wisconsin Form Wt 7 without initial commitment. Additional features can be unlocked through affordable subscription plans.

-

Is airSlate SignNow compliant with Wisconsin's regulations for Form Wt 7?

Yes, airSlate SignNow is designed to comply with Wisconsin's regulations for electronic signatures and document handling. The platform ensures that all eSigned documents, including Wisconsin Form Wt 7, meet legal standards, giving users peace of mind regarding compliance.

-

Can I integrate airSlate SignNow with other tools for managing Wisconsin Form Wt 7?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing your workflow for managing Wisconsin Form Wt 7. Whether you use accounting software or HR platforms, these integrations can help automate the process and save time.

-

What benefits does airSlate SignNow provide for managing Wisconsin Form Wt 7?

Using airSlate SignNow for Wisconsin Form Wt 7 offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. The platform's user-friendly interface allows for easy collaboration, while secure cloud storage ensures your documents are safe and readily available when needed.

-

How does the eSigning process work for Wisconsin Form Wt 7 on airSlate SignNow?

The eSigning process for Wisconsin Form Wt 7 on airSlate SignNow is simple and efficient. Users can upload the form, add necessary fields for signatures, and send it to recipients for eSigning. Once signed, the document is automatically stored in the cloud, making it easy to access and manage.

Get more for Wisconsin Form Wt 7

Find out other Wisconsin Form Wt 7

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed