DUE DATE UPDATE Wisconsin Department of Revenue 2020

What is the due date update for Wisconsin Department of Revenue?

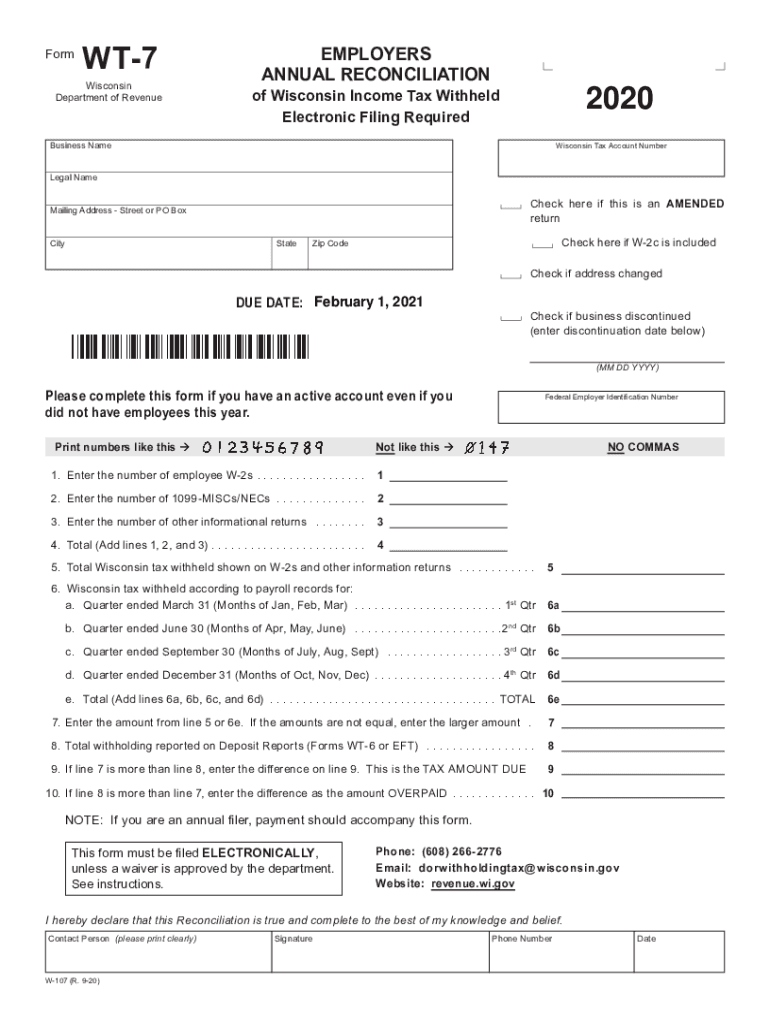

The due date update for the Wisconsin Department of Revenue refers to the specific deadlines set for filing various tax forms, including the Wisconsin Form W-T. These updates are crucial for taxpayers to ensure compliance with state tax regulations. The state often adjusts these deadlines based on legislative changes or administrative needs. Understanding these due dates helps individuals and businesses avoid penalties and ensure timely submissions.

Filing deadlines and important dates

Filing deadlines for the Wisconsin Form W-T are typically aligned with the state’s tax year. For most taxpayers, the due date for submitting this form is the same as the federal tax return deadline, which is generally April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes announced by the Wisconsin Department of Revenue to avoid missing these critical dates.

Steps to complete the due date update for Wisconsin Department of Revenue

Completing the due date update involves several key steps:

- Review the latest announcements from the Wisconsin Department of Revenue regarding due dates.

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill out the Wisconsin Form W-T accurately, ensuring all information is current and complete.

- Submit the form electronically or via mail, depending on your preference and the options available.

- Keep a copy of the submitted form and any confirmation received for your records.

Legal use of the due date update for Wisconsin Department of Revenue

The legal use of the due date update is essential for maintaining compliance with Wisconsin tax laws. Taxpayers are required to adhere to these deadlines to avoid penalties, interest, and potential audits. Understanding the legal implications of missing a deadline can help individuals and businesses take proactive measures to ensure timely compliance. The Wisconsin Department of Revenue provides resources to assist taxpayers in understanding their obligations.

Who issues the form?

The Wisconsin Form W-T is issued by the Wisconsin Department of Revenue. This agency is responsible for administering state tax laws and providing guidance to taxpayers. They regularly update forms and instructions to reflect changes in tax legislation and policy. Taxpayers can access the form and related resources directly from the department's official website or through authorized tax professionals.

Penalties for non-compliance

Failure to comply with the due dates set by the Wisconsin Department of Revenue can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is vital for taxpayers to understand these consequences and take necessary actions to file their forms on time. Staying informed about due dates and requirements can greatly reduce the risk of incurring penalties.

Quick guide on how to complete due date update wisconsin department of revenue

Complete DUE DATE UPDATE Wisconsin Department Of Revenue seamlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it digitally. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents efficiently without delays. Manage DUE DATE UPDATE Wisconsin Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign DUE DATE UPDATE Wisconsin Department Of Revenue effortlessly

- Find DUE DATE UPDATE Wisconsin Department Of Revenue and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign DUE DATE UPDATE Wisconsin Department Of Revenue while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct due date update wisconsin department of revenue

Create this form in 5 minutes!

How to create an eSignature for the due date update wisconsin department of revenue

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Wisconsin Form W T and why is it important?

The Wisconsin Form W T is a tax document used for withholding tax purposes in the state of Wisconsin. It is essential for employers to ensure proper tax withholding and compliance. Completing the form accurately helps businesses avoid penalties and ensures employees are correctly taxed.

-

How can airSlate SignNow help with the Wisconsin Form W T?

airSlate SignNow streamlines the process of sending and eSigning the Wisconsin Form W T. With our easy-to-use platform, you can securely manage documents and collect electronic signatures from employees, ensuring prompt completion and submission. This makes tax compliance more efficient for your business.

-

What features does airSlate SignNow offer for managing the Wisconsin Form W T?

Our platform includes features such as document templates, customizable workflows, and secure cloud storage. These tools enable businesses to create and manage the Wisconsin Form W T effectively. Additionally, integrated tracking and notifications help keep your team updated on the signing process.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin Form W T?

Yes, airSlate SignNow offers various pricing plans to cater to the needs of different businesses. These plans provide access to all features necessary for managing documents, including the Wisconsin Form W T. You can choose a plan that fits your budget and requirements, ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with other software for handling the Wisconsin Form W T?

Absolutely! airSlate SignNow seamlessly integrates with popular business applications, allowing you to manage the Wisconsin Form W T alongside your existing systems. This integration enhances your workflow, making it easier to automate document processes and synchronize your data.

-

What are the benefits of using airSlate SignNow for the Wisconsin Form W T?

Using airSlate SignNow for the Wisconsin Form W T offers several benefits, including improved efficiency and reduced paperwork. The platform's electronic signature capabilities expedite the signing process, while compliance features ensure you're meeting state tax requirements. This can signNowly streamline your tax operations.

-

How secure is the process of signing the Wisconsin Form W T with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect your documents, including the Wisconsin Form W T, throughout the signing process. Our compliance with industry standards ensures that your sensitive information remains safe and confidential.

Get more for DUE DATE UPDATE Wisconsin Department Of Revenue

- Notice of intent to enforce forfeiture provisions of contact for deed washington form

- Final notice of forfeiture and request to vacate property under contract for deed washington form

- Buyers request for accounting from seller under contract for deed washington form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed washington form

- General notice of default for contract for deed washington form

- Washington seller disclosure form

- Seller disclosure agreement 497429217 form

- Contract for deed sellers annual accounting statement washington form

Find out other DUE DATE UPDATE Wisconsin Department Of Revenue

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later