Form it 201 V Payment Voucher for Income Tax Returns Revised 1221 2021

What is the Form IT 201 V Payment Voucher for Income Tax Returns Revised 1221

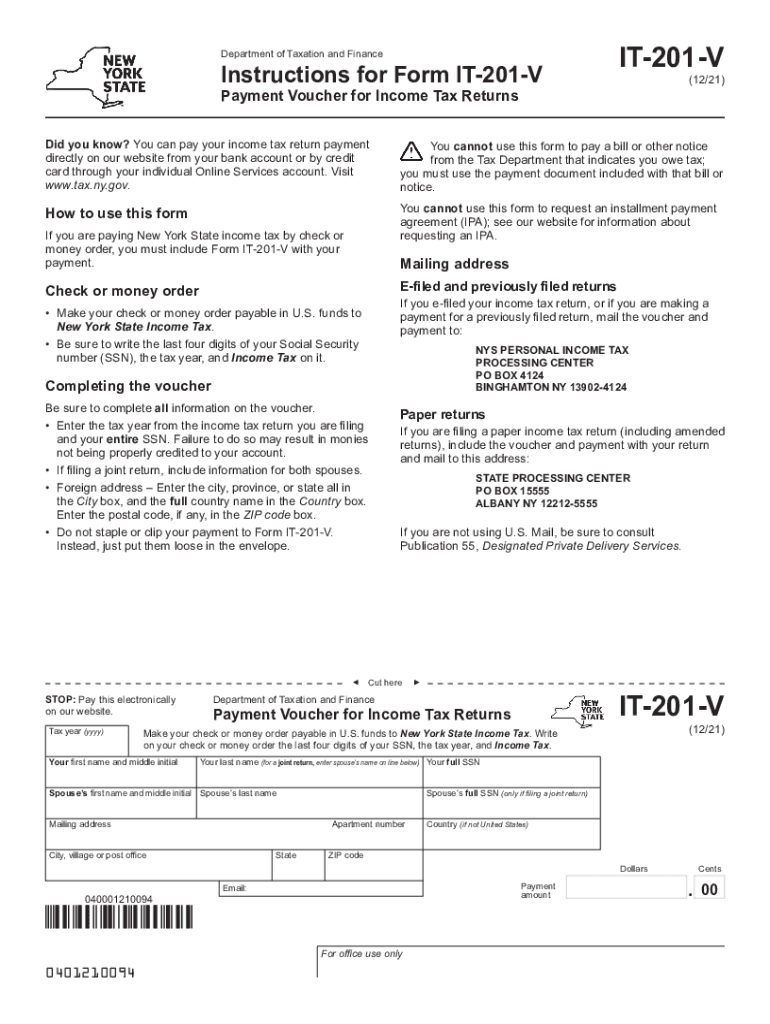

The Form IT 201 V is a payment voucher used by taxpayers in New York State to submit payments for their income tax returns. This form is specifically designed for individuals who owe tax and need to make a payment when filing their New York State income tax return, known as the NY IT 201. It serves as a record of the payment made and is essential for ensuring that the payment is properly credited to the taxpayer's account.

How to Use the Form IT 201 V Payment Voucher for Income Tax Returns Revised 1221

To use the Form IT 201 V, taxpayers should first complete their New York State income tax return. Once the total tax liability is determined, the taxpayer fills out the IT 201 V with the necessary payment information. This includes details such as the taxpayer's name, address, and the amount being paid. After completing the form, it can be submitted along with the payment via mail or electronically, depending on the chosen submission method.

Steps to Complete the Form IT 201 V Payment Voucher for Income Tax Returns Revised 1221

Completing the Form IT 201 V involves several straightforward steps:

- Gather necessary information, including your New York State income tax return details.

- Fill in your personal information, such as your name and address, on the form.

- Enter the amount of payment you are submitting.

- Review the form for accuracy to ensure all information is correct.

- Submit the completed form along with your payment, either by mail or electronically.

Legal Use of the Form IT 201 V Payment Voucher for Income Tax Returns Revised 1221

The Form IT 201 V is legally recognized as a valid method for making tax payments in New York State. To ensure its legal standing, it must be filled out completely and accurately, following all guidelines set forth by the New York State Department of Taxation and Finance. Using this form helps maintain compliance with state tax laws and provides a documented record of payment, which can be important in case of future audits or inquiries.

Key Elements of the Form IT 201 V Payment Voucher for Income Tax Returns Revised 1221

Key elements of the Form IT 201 V include:

- Taxpayer Information: Name, address, and Social Security number.

- Payment Amount: The total amount being submitted for payment.

- Tax Year: The tax year for which the payment is being made.

- Signature: The taxpayer's signature is required to validate the form.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form IT 201 V. Typically, payments should be submitted by the due date of the income tax return to avoid penalties and interest. For most taxpayers, this means payments are due on April fifteenth of the following year, unless the date falls on a weekend or holiday, in which case the deadline may be adjusted. Keeping track of these dates ensures compliance and helps avoid unnecessary fees.

Quick guide on how to complete form it 201 v payment voucher for income tax returns revised 1221

Complete Form IT 201 V Payment Voucher For Income Tax Returns Revised 1221 effortlessly on any device

The management of online documents has gained popularity among both organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without any hold-ups. Manage Form IT 201 V Payment Voucher For Income Tax Returns Revised 1221 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Form IT 201 V Payment Voucher For Income Tax Returns Revised 1221 with ease

- Locate Form IT 201 V Payment Voucher For Income Tax Returns Revised 1221 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form IT 201 V Payment Voucher For Income Tax Returns Revised 1221 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 201 v payment voucher for income tax returns revised 1221

Create this form in 5 minutes!

How to create an eSignature for the form it 201 v payment voucher for income tax returns revised 1221

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is it 201 v and how does it relate to airSlate SignNow?

it 201 v refers to our advanced version that enhances document management features in airSlate SignNow. This version is designed to streamline eSigning and ensure that businesses can efficiently send and manage documents. With it 201 v, users experience improved functionality that can signNowly boost productivity.

-

What are the key features of it 201 v?

The key features of it 201 v include advanced document editing, customizable templates, and secure eSigning capabilities. It also allows for seamless collaboration among team members. These features make it 201 v a comprehensive solution for any business looking to enhance their document workflow.

-

How much does it 201 v cost?

Pricing for it 201 v varies based on subscription plans that cater to different business needs. Generally, airSlate SignNow offers competitive pricing to ensure that businesses of all sizes can benefit from it 201 v. You can easily find detailed pricing information on our website.

-

What benefits can I expect from using it 201 v?

By utilizing it 201 v, businesses can expect improved efficiency in document handling and reduced turnaround times for eSignatures. This version enhances user experience with its intuitive interface and comprehensive features. Overall, it 201 v empowers teams to work faster and more collaboratively.

-

Is it 201 v suitable for small businesses?

Yes, it 201 v is specifically designed to be a cost-effective solution for small businesses. Its scalable features allow small teams to efficiently manage documents without the need for complex systems. Thus, small businesses can leverage the benefits of it 201 v to grow their operations.

-

Does it 201 v integrate with other applications?

Absolutely! it 201 v is built to seamlessly integrate with various popular applications such as Google Drive, Dropbox, and many CRM systems. These integrations enhance workflow efficiency, allowing businesses to manage their documents alongside existing tools. This flexibility is one of the advantages of using it 201 v.

-

What types of documents can I sign with it 201 v?

With it 201 v, you can sign a wide range of documents, including contracts, agreements, and forms. The platform supports various formats, ensuring that virtually any document can be processed and eSigned. This versatility makes it 201 v an invaluable tool for your business needs.

Get more for Form IT 201 V Payment Voucher For Income Tax Returns Revised 1221

Find out other Form IT 201 V Payment Voucher For Income Tax Returns Revised 1221

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form