it 201 V Form 2017

What is the It 201 V Form

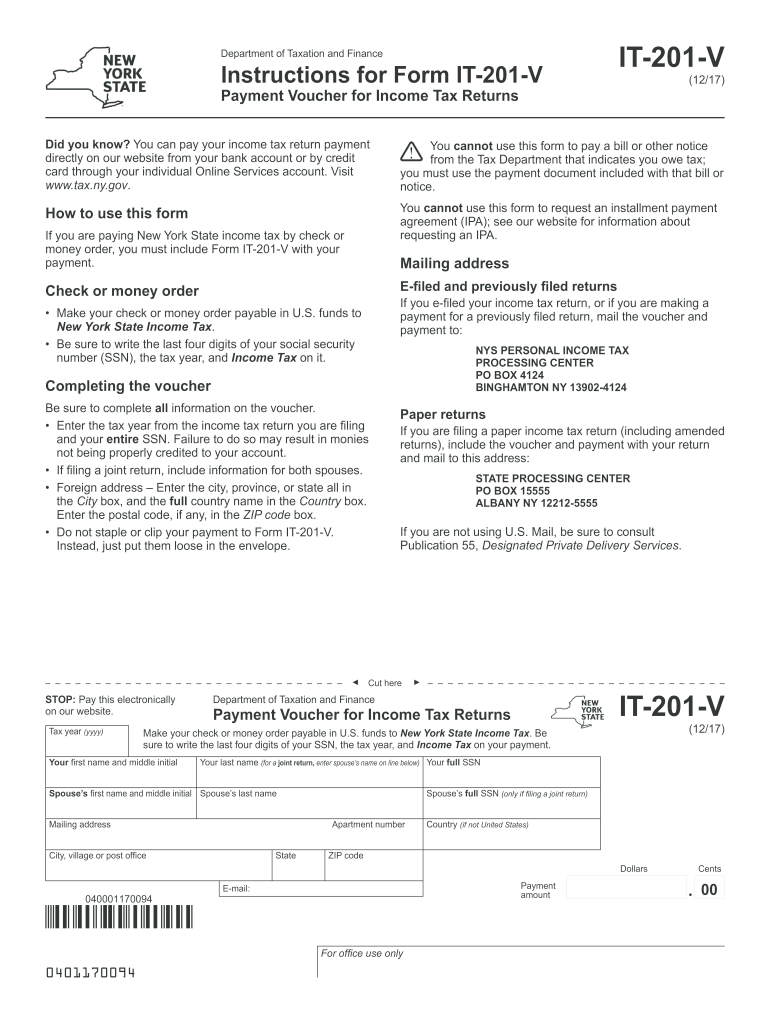

The It 201 V Form is a payment voucher used by taxpayers in New York State to submit their tax payments. This form is specifically designed for individuals who need to make a payment with their personal income tax return. It serves as a record of the payment made and is essential for ensuring that the payment is properly credited to the taxpayer's account.

How to use the It 201 V Form

To use the It 201 V Form, taxpayers must first complete their income tax return. After determining the amount owed, they can fill out the voucher with the necessary details, including their name, address, and the payment amount. It is important to ensure that all information is accurate to avoid delays in processing. The completed form should be submitted along with the payment, either by mail or electronically, depending on the chosen submission method.

Steps to complete the It 201 V Form

Completing the It 201 V Form involves several straightforward steps:

- Gather necessary documents, including your completed income tax return.

- Fill in your personal information, such as name, address, and Social Security number.

- Indicate the amount of tax payment you are submitting.

- Review the form for accuracy to ensure all information is correct.

- Submit the form along with your payment to the appropriate tax authority.

Legal use of the It 201 V Form

The It 201 V Form is legally recognized as a valid method for submitting tax payments in New York State. It is important for taxpayers to use this form correctly to ensure compliance with state tax laws. Using the form as intended helps avoid penalties and ensures that tax payments are processed efficiently.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the It 201 V Form. Generally, the filing deadline for personal income tax returns in New York is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to submit the It 201 V Form along with any payments by this deadline to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the It 201 V Form. Payments can be made online through the New York State Department of Taxation and Finance website, which offers a secure portal for electronic submissions. Alternatively, taxpayers may choose to mail the completed form along with their payment to the appropriate address. In-person submissions may also be possible at designated tax offices, although this option may vary based on local regulations and availability.

Quick guide on how to complete it 201 v 2017 form

Your assistance manual on how to prepare your It 201 V Form

If you’re wondering how to finalize and submit your It 201 V Form, here are some concise instructions on how to simplify tax declaration.

First, you simply need to establish your airSlate SignNow account to transform how you manage documentation online. airSlate SignNow is an incredibly user-friendly and robust document solution that allows you to modify, draft, and finalize your tax papers effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, and revisit to edit responses as necessary. Streamline your tax handling with sophisticated PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your It 201 V Form in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your It 201 V Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Follow this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can increase errors in returns and slow down reimbursements. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 201 v 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

The Mh CET 2017 application forms were released yesterday. Is it better to fill out the form now or later?

No hard and fast rule for that!It would be better if you fill it early as possible.Because later the traffic will go on increasing and these Government websites are more likely to crash when the traffic is high.fill the forms in initial days if you can..

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the it 201 v 2017 form

How to generate an electronic signature for the It 201 V 2017 Form in the online mode

How to make an electronic signature for the It 201 V 2017 Form in Chrome

How to make an electronic signature for putting it on the It 201 V 2017 Form in Gmail

How to generate an electronic signature for the It 201 V 2017 Form from your smart phone

How to make an electronic signature for the It 201 V 2017 Form on iOS

How to make an eSignature for the It 201 V 2017 Form on Android

People also ask

-

What is the It 201 V Form and how can airSlate SignNow assist with it?

The It 201 V Form is a tax form used for filing income tax returns in New York. airSlate SignNow simplifies the process of completing and eSigning the It 201 V Form, allowing users to manage their tax documents efficiently and securely online.

-

How does airSlate SignNow ensure the security of my It 201 V Form?

airSlate SignNow prioritizes your data security with state-of-the-art encryption and compliance with industry standards. When you eSign your It 201 V Form, rest assured that your sensitive information is protected throughout the process.

-

Can I integrate airSlate SignNow with other applications for my It 201 V Form?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easier to manage your documentation. You can connect tools like Google Drive or Dropbox to access and store your It 201 V Form alongside your other important files.

-

What features does airSlate SignNow offer for managing the It 201 V Form?

airSlate SignNow provides a range of features tailored for the It 201 V Form, including customizable templates, easy eSigning, and document tracking. These features streamline the process, making it quick and hassle-free to handle your tax forms.

-

Is airSlate SignNow a cost-effective solution for managing my It 201 V Form?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using our platform, you can save on printing and postage costs associated with the It 201 V Form, making it a smart investment.

-

What are the benefits of using airSlate SignNow for the It 201 V Form?

Using airSlate SignNow for your It 201 V Form offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our solution eliminates the need for physical paperwork, allowing for quicker submissions and reducing the risk of errors.

-

How can I get started with airSlate SignNow for my It 201 V Form?

Getting started with airSlate SignNow is simple! Just sign up for an account, and you can begin creating and eSigning your It 201 V Form within minutes. Our user-friendly interface makes it easy for anyone to navigate and utilize all available features.

Get more for It 201 V Form

- Follow link for fingerprint declaration form and state bar of montana

- Listing information sheet

- Thebulletin poe4us org form

- Bexar county pretrial services form

- Cobb county business license 191 lawrence street marietta ga form

- Acls course roster form multi regional training center heartsmartcpr

- Independent savings redemption form

- Hayes safety building 33 hazen drive concord nh 03305 form

Find out other It 201 V Form

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation