Instructions for Form it 201 V Payment Voucher for Income Tax Returns Revised 1222 2022

What is the IT 201 V Payment Voucher for Income Tax Returns?

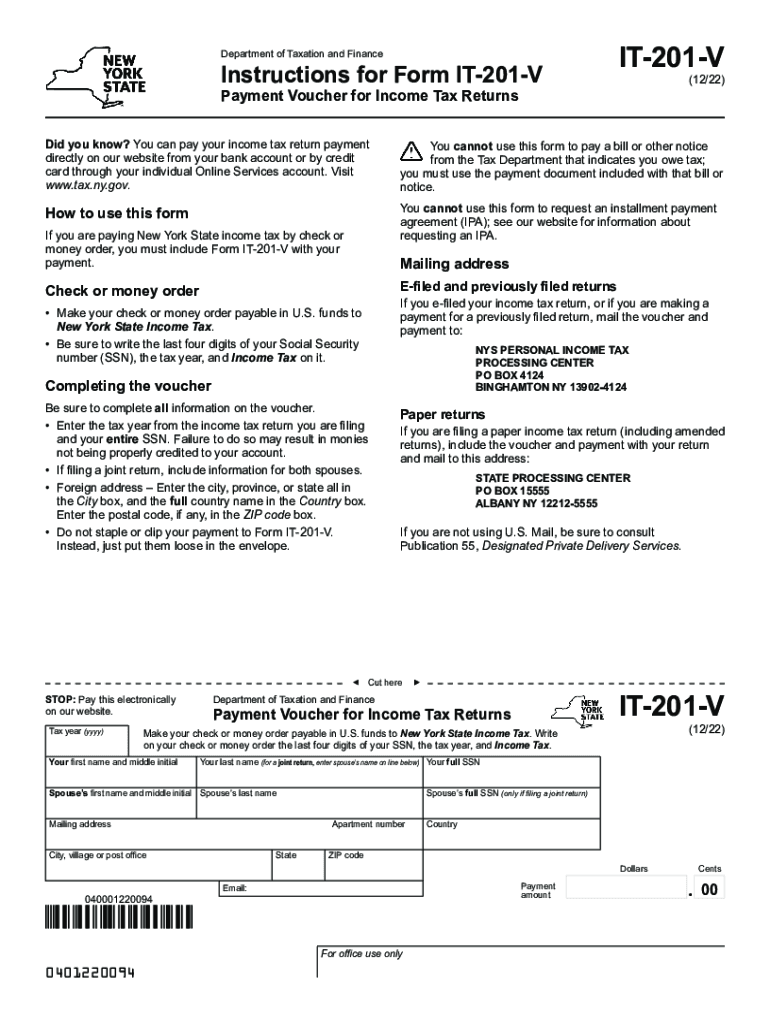

The IT 201 V Payment Voucher is a form used by taxpayers in New York State to submit their income tax payments. This voucher is specifically designed for individuals who owe taxes and need to make a payment when filing their income tax returns. It ensures that the payment is properly credited to the taxpayer's account, facilitating a smooth processing of their tax obligations. The form is essential for maintaining compliance with state tax laws and avoiding potential penalties.

Steps to Complete the IT 201 V Payment Voucher

Completing the IT 201 V Payment Voucher involves several straightforward steps:

- Begin by downloading the form from the official New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying and ensure it matches the amount owed on your tax return.

- Review all information for accuracy to prevent any processing delays.

- Sign and date the voucher to validate your payment.

Once completed, the voucher should be submitted along with your payment, either online or via mail.

Legal Use of the IT 201 V Payment Voucher

The IT 201 V Payment Voucher is legally binding when filled out and submitted according to New York State tax regulations. It serves as an official record of payment, which can be used to verify compliance with tax obligations. To ensure legal validity, taxpayers must adhere to the guidelines set forth by the New York State Department of Taxation and Finance, including proper completion and submission methods.

Form Submission Methods for the IT 201 V Payment Voucher

Taxpayers have multiple options for submitting the IT 201 V Payment Voucher:

- Online Submission: Payments can be made electronically through the New York State Department of Taxation and Finance website, allowing for immediate processing.

- Mail Submission: Taxpayers can also print the completed voucher and mail it along with their payment to the designated address provided on the form.

- In-Person Submission: Payments can be made in person at certain state tax offices, where taxpayers can receive immediate confirmation of their payment.

Filing Deadlines for the IT 201 V Payment Voucher

It is crucial for taxpayers to be aware of the filing deadlines associated with the IT 201 V Payment Voucher. Typically, payments are due on the same date as the income tax return, which is usually April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should always check the New York State Department of Taxation and Finance for any updates or changes to deadlines.

Key Elements of the IT 201 V Payment Voucher

Understanding the key elements of the IT 201 V Payment Voucher is essential for accurate completion:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Payment Amount: The exact amount being paid must be clearly indicated.

- Signature: The taxpayer must sign and date the voucher to confirm the payment.

- Submission Method: Indicate how the payment will be submitted, whether online, by mail, or in person.

Quick guide on how to complete instructions for form it 201 v payment voucher for income tax returns revised 1222

Complete Instructions For Form IT 201 V Payment Voucher For Income Tax Returns Revised 1222 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form IT 201 V Payment Voucher For Income Tax Returns Revised 1222 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Instructions For Form IT 201 V Payment Voucher For Income Tax Returns Revised 1222 with ease

- Obtain Instructions For Form IT 201 V Payment Voucher For Income Tax Returns Revised 1222 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Instructions For Form IT 201 V Payment Voucher For Income Tax Returns Revised 1222 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 201 v payment voucher for income tax returns revised 1222

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 201 v payment voucher for income tax returns revised 1222

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to IT 201 V?

airSlate SignNow is a document signing and management solution that simplifies the process of sending and eSigning documents. It is particularly relevant for the IT 201 V environment as it enhances workflow efficiency and ensures compliance, making it an ideal tool for professionals in the IT sector.

-

How much does airSlate SignNow cost for IT 201 V users?

Pricing for airSlate SignNow varies depending on the features required, whether you're an individual or a business. For IT 201 V users, the platform offers competitive pricing plans that ensure maximum return on investment while providing comprehensive eSigning functionalities.

-

What key features does airSlate SignNow offer for enhancing IT 201 V operations?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking, all tailored to support IT 201 V operations. These features simplify document management, streamline approvals, and improve collaboration among IT professionals.

-

Can airSlate SignNow integrate with other tools commonly used in IT 201 V?

Yes, airSlate SignNow seamlessly integrates with a variety of tools that are essential for the IT 201 V environment, including Google Workspace, Microsoft Office, and CRM systems. This integration capability allows users to enhance their document workflows without disrupting existing processes.

-

What benefits does airSlate SignNow provide for IT professionals?

For IT professionals, airSlate SignNow offers a straightforward eSigning solution that saves time and reduces paperwork. By utilizing IT 201 V functionalities, users can ensure greater accuracy and compliance in their document processes, leading to improved operational efficiency.

-

Is airSlate SignNow secure for handling sensitive documents in IT 201 V?

Absolutely. airSlate SignNow employs industry-leading security measures such as encryption and secure data storage, making it a trustworthy choice for handling sensitive documents in IT 201 V. This commitment to security helps protect against data bsignNowes and unauthorized access.

-

How can I get started with airSlate SignNow for IT 201 V?

Getting started with airSlate SignNow is easy. Simply sign up for a free trial to explore the features tailored for IT 201 V, and see how the platform can transform your document signing process. Once you’re ready, choose the plan that best fits your business needs.

Get more for Instructions For Form IT 201 V Payment Voucher For Income Tax Returns Revised 1222

- Electrical contractor package pennsylvania form

- Sheetrock drywall contractor package pennsylvania form

- Flooring contractor package pennsylvania form

- Trim carpentry contractor package pennsylvania form

- Fencing contractor package pennsylvania form

- Hvac contractor package pennsylvania form

- Landscaping contractor package pennsylvania form

- Commercial contractor package pennsylvania form

Find out other Instructions For Form IT 201 V Payment Voucher For Income Tax Returns Revised 1222

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation