Sc State Income Tax Forms and Instructions" Keyword Found 2020

Understanding SC State Income Tax Forms and Instructions

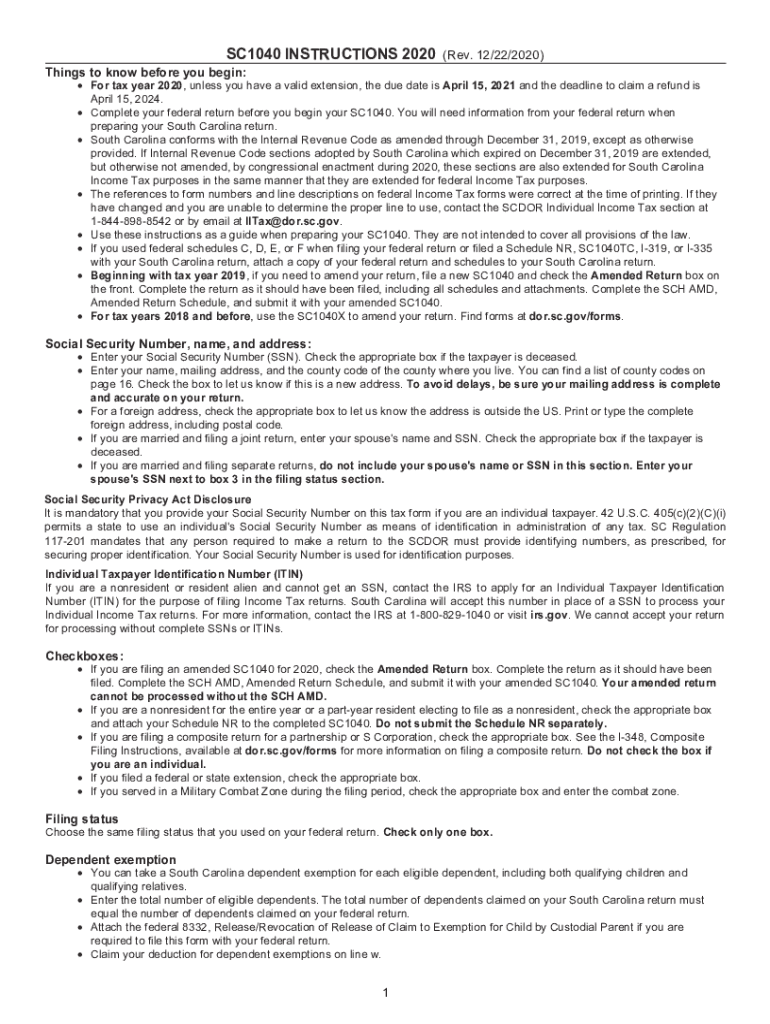

The SC state income tax forms are essential documents for individuals and businesses in South Carolina to report their income and calculate their tax obligations. These forms include various types, such as the SC-1040, which is the primary form for individual income tax. Each form comes with specific instructions to guide taxpayers in accurately completing them. Understanding these forms is crucial for compliance with state tax laws and for ensuring that taxpayers do not miss out on potential deductions or credits.

Steps to Complete the SC State Income Tax Forms

Completing the SC state income tax forms involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, download the correct form, such as the SC-1040, from the South Carolina Department of Revenue website. Carefully follow the instructions provided for each section, ensuring that all information is accurate and complete. After filling out the form, review it thoroughly for any errors before submitting it.

Legal Use of SC State Income Tax Forms

SC state income tax forms are legally binding documents that must be completed in accordance with South Carolina tax laws. Proper completion and submission of these forms are necessary to avoid penalties and legal issues. Taxpayers are required to sign and date their forms, which certifies that the information provided is true and accurate to the best of their knowledge. Utilizing a reliable eSignature solution can enhance the legal validity of these documents when submitted electronically.

Filing Deadlines and Important Dates

Filing deadlines for SC state income tax forms are critical for compliance. Typically, individual income tax returns are due on April fifteenth. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for taxpayers to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Required Documents for SC State Tax Forms

To complete the SC state income tax forms accurately, taxpayers must gather several required documents. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits claimed

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are reported correctly.

Form Submission Methods

Taxpayers in South Carolina can submit their state income tax forms through various methods. These include:

- Online submission via the South Carolina Department of Revenue website

- Mailing a paper form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method depends on individual preferences and circumstances, such as the need for immediate confirmation of receipt.

Quick guide on how to complete sc state income tax forms and instructionsampquot keyword found

Complete Sc State Income Tax Forms And Instructions" Keyword Found effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Manage Sc State Income Tax Forms And Instructions" Keyword Found on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Sc State Income Tax Forms And Instructions" Keyword Found with ease

- Obtain Sc State Income Tax Forms And Instructions" Keyword Found and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Alter and eSign Sc State Income Tax Forms And Instructions" Keyword Found while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc state income tax forms and instructionsampquot keyword found

Create this form in 5 minutes!

How to create an eSignature for the sc state income tax forms and instructionsampquot keyword found

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to create an e-signature from your smart phone

How to create an e-signature for a PDF document on iOS

How to create an e-signature for a PDF file on Android OS

People also ask

-

What is the sc tax form used for?

The SC tax form is used by residents of South Carolina to report income and calculate state tax obligations. It ensures compliance with state tax laws and helps taxpayers determine their refund or balance due. Understanding the sc tax form is crucial for accurate tax filing.

-

How can airSlate SignNow assist with the sc tax form?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including the sc tax form. Our user-friendly interface streamlines the document management process, allowing you to complete your state tax filings swiftly and securely. Experience the convenience of eSigning your sc tax form with airSlate SignNow.

-

Is there a fee to use airSlate SignNow for the sc tax form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs when managing the sc tax form. Our subscription options are cost-effective, ensuring that you can efficiently handle your document signing without breaking the bank. Choose the plan that aligns with your requirements for seamless eSigning.

-

Can I integrate airSlate SignNow with other tools for filing the sc tax form?

Absolutely! airSlate SignNow allows integrations with popular business tools to streamline the process of filing your sc tax form. By integrating with accounting software and document management systems, you can enhance your workflow and ensure a smoother filing experience. Leverage our integrations to optimize your tax preparation tasks.

-

What are the benefits of using airSlate SignNow for the sc tax form?

Using airSlate SignNow for your sc tax form offers numerous benefits including improved efficiency and reduced paperwork. Our digital solution saves time by eliminating the need for printing and mailing documents, while ensuring compliance with tax regulations. Experience the ease of managing your tax documentation with a secure eSigning platform.

-

How secure is airSlate SignNow when handling the sc tax form?

airSlate SignNow prioritizes security and compliance, ensuring that your sc tax form and other sensitive documents are protected. We utilize advanced encryption and secure servers to safeguard your information from unauthorized access. Trust airSlate SignNow for a secure eSigning solution for your tax documents.

-

Can I access the sc tax form from mobile devices using airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly platform to access and sign your sc tax form on the go. Whether you're using a smartphone or tablet, our application allows for convenient document management anytime, anywhere. Stay productive and manage your taxes efficiently with our mobile capabilities.

Get more for Sc State Income Tax Forms And Instructions" Keyword Found

Find out other Sc State Income Tax Forms And Instructions" Keyword Found

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document