Form it 230 Separate Tax on Lump Sum Distributions Tax Year

What is the Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

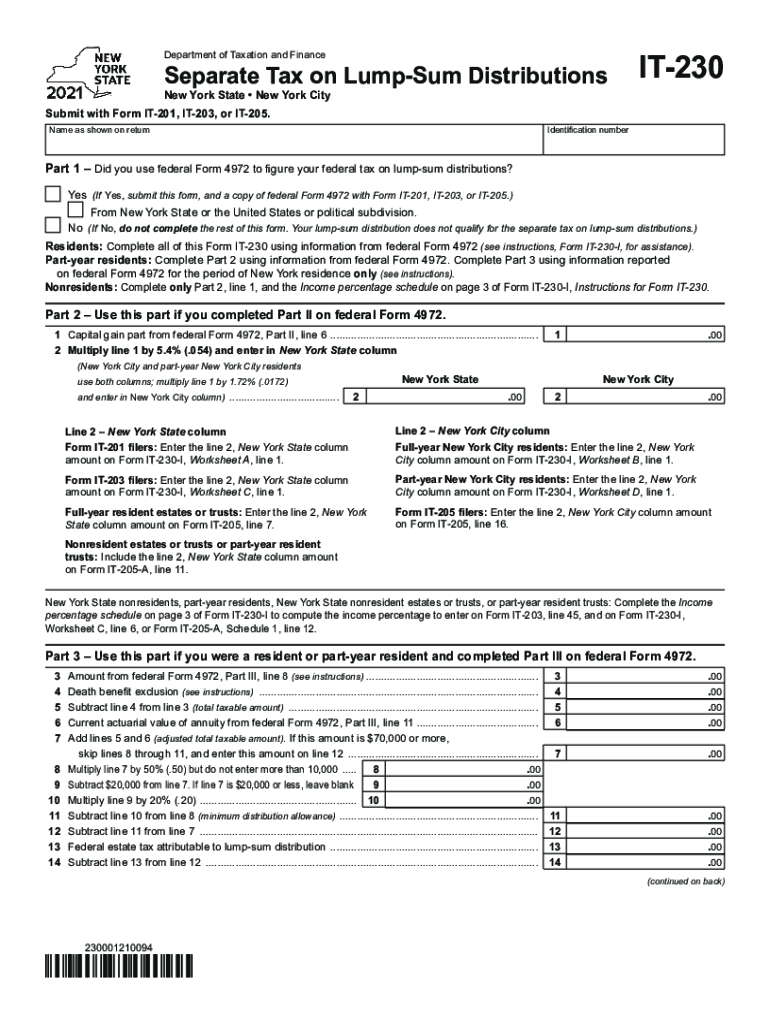

The Form IT 230 is a tax form used in the United States to calculate and report the separate tax on lump sum distributions from retirement plans. This form is specifically designed for taxpayers who receive a one-time distribution from their retirement accounts, such as pensions or 401(k) plans. By using this form, individuals can determine the tax implications of these distributions, which may be subject to different tax rates compared to regular income. Understanding the purpose of the IT 230 is crucial for accurate tax reporting and compliance.

Steps to Complete the Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

Completing the Form IT 230 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the lump sum distribution, including the amount received and the type of retirement account. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report the total amount of the distribution and calculate the tax owed using the applicable tax rate. Finally, review the completed form for any errors before submitting it with your tax return.

How to Obtain the Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

The Form IT 230 can be obtained through various channels. It is typically available on the official state tax authority website, where taxpayers can download and print the form. Additionally, many tax preparation software programs offer the form as part of their services, allowing users to complete it digitally. For those who prefer a physical copy, local tax offices may also provide printed versions of the IT 230 upon request.

Legal Use of the Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

The legal use of the Form IT 230 is essential for ensuring compliance with U.S. tax laws. This form must be completed accurately to reflect the taxpayer's financial situation regarding lump sum distributions. Failure to use the form correctly may result in penalties or additional taxes owed. The IT 230 is recognized by the IRS and state tax authorities, making it a crucial document for reporting income derived from retirement distributions.

Key Elements of the Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

Key elements of the Form IT 230 include sections for personal identification, details of the distribution, and tax calculation. Taxpayers must provide their name, address, and Social Security number, along with the total amount of the lump sum distribution. The form also includes specific lines for calculating the tax owed based on the distribution amount and applicable tax rates. Understanding these elements is vital for ensuring that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 230 typically align with the general tax return deadlines in the United States. Taxpayers must submit the form by the annual tax filing deadline, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important for taxpayers to be aware of these dates to avoid late filing penalties and ensure compliance with tax regulations.

Examples of Using the Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

Examples of using the Form IT 230 include scenarios where an individual receives a lump sum distribution from a pension plan after retirement or a 401(k) plan upon leaving an employer. In these cases, the taxpayer would report the distribution on the IT 230 to accurately calculate the tax owed. Another example could involve an individual who chooses to cash out their retirement savings early, necessitating the use of the form to determine the tax implications of that decision.

Quick guide on how to complete form it 230 separate tax on lump sum distributions tax year 2021

Effortlessly Prepare Form IT 230 Separate Tax On Lump Sum Distributions Tax Year on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a sustainable alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without complications. Manage Form IT 230 Separate Tax On Lump Sum Distributions Tax Year on any platform with the airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

The Easiest Way to Edit and eSign Form IT 230 Separate Tax On Lump Sum Distributions Tax Year Without Hassle

- Find Form IT 230 Separate Tax On Lump Sum Distributions Tax Year and click Get Form to begin.

- Use the resources available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Form IT 230 Separate Tax On Lump Sum Distributions Tax Year and ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 230 separate tax on lump sum distributions tax year 2021

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 230?

airSlate SignNow is an electronic signature solution that helps businesses streamline their document workflow. With its intuitive interface and affordability, it supports the it 230 requirement for secure and compliant document signing.

-

How does pricing work for airSlate SignNow and the it 230 features?

AirSlate SignNow offers competitive pricing plans that cater to different business sizes, ensuring that the it 230 features are accessible. Each plan includes essential tools for document management and eSigning, making it a cost-effective choice for businesses.

-

What are the key features of airSlate SignNow related to it 230?

Key features of airSlate SignNow include customizable templates, in-person signing, and advanced security settings, all of which align with the it 230 standards. These tools help businesses improve operational efficiency while ensuring compliant document handling.

-

Can airSlate SignNow integrate with other software for it 230 compliance?

Yes, airSlate SignNow offers integrations with popular platforms like Google Workspace, Salesforce, and Zapier. This flexibility ensures that businesses can easily maintain it 230 compliance across their existing workflows by integrating eSigning solutions.

-

What are the benefits of using airSlate SignNow for it 230 related documents?

The main benefits of using airSlate SignNow for it 230 related documents include improved productivity, reduced turnaround times, and enhanced security. These advantages allow businesses to complete their signing processes efficiently while adhering to necessary regulations.

-

Is training available for new users of airSlate SignNow focused on it 230?

Yes, airSlate SignNow provides extensive training resources and support for new users to familiarize themselves with it 230 guidelines. These resources help users maximize the software's potential, ensuring compliance and efficient use.

-

How does airSlate SignNow ensure the security of it 230 documents?

AirSlate SignNow employs advanced encryption protocols and secure servers to protect it 230 documents during transmission and storage. This comprehensive security infrastructure ensures that businesses can trust their sensitive documents are well-protected.

Get more for Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

Find out other Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself