990 Form 2017

What is the 990 Form

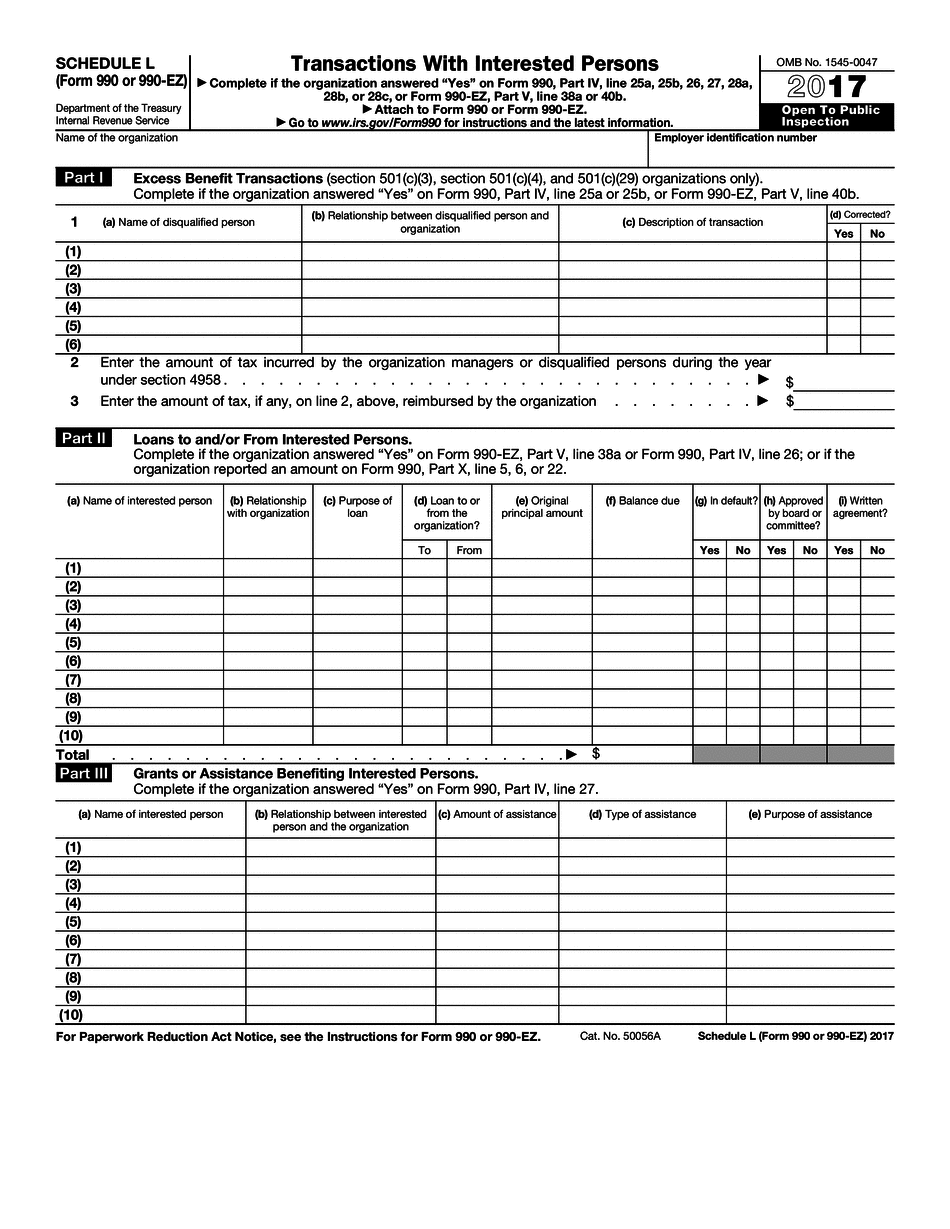

The 990 form is a tax document that nonprofit organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides essential information about a nonprofit's financial activities, governance, and compliance with federal regulations. It is primarily used to ensure transparency and accountability, allowing the public and potential donors to assess the nonprofit's financial health and operational efficiency. The 990 form is crucial for maintaining tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

How to obtain the 990 Form

Obtaining the 990 form is straightforward. Nonprofits can access the form directly from the IRS website, where it is available for download in PDF format. Additionally, many tax preparation software programs include the 990 form as part of their offerings, making it easier for organizations to complete and file the document. Nonprofits may also request a copy from a tax professional or accountant who specializes in nonprofit tax issues.

Steps to complete the 990 Form

Completing the 990 form involves several key steps. First, organizations must gather financial statements, including income statements and balance sheets, to accurately report their revenue and expenses. Next, they should review the form's sections, which include details about governance, programs, and financial activities. It is essential to ensure that all information is current and accurately reflects the organization's operations for the reporting year. After filling out the necessary sections, organizations should review the form for completeness and accuracy before submitting it to the IRS.

Filing Deadlines / Important Dates

The deadline for filing the 990 form is typically the fifteenth day of the fifth month after the end of the nonprofit's fiscal year. For organizations that operate on a calendar year, this means the form is due on May fifteenth. Nonprofits can apply for an extension, which allows them an additional six months to file. However, it is important to note that an extension only applies to the filing deadline, not the payment of any taxes owed.

Key elements of the 990 Form

The 990 form consists of several key elements that provide a comprehensive overview of a nonprofit's operations. These include:

- Revenue and Expenses: Detailed reporting of all income sources and expenditures.

- Program Services: Information about the nonprofit's mission and the programs it operates.

- Governance: Details regarding the board of directors and organizational structure.

- Financial Statements: Summary of the organization's assets, liabilities, and net assets.

These elements are crucial for demonstrating compliance with IRS regulations and maintaining public trust.

Penalties for Non-Compliance

Nonprofits that fail to file the 990 form or submit it late may face significant penalties. The IRS imposes fines that can accumulate for each month the form is overdue. Additionally, failure to file for three consecutive years can result in automatic revocation of tax-exempt status. This can have serious implications for an organization's ability to operate and receive donations, making timely and accurate filing essential.

Quick guide on how to complete a name of disqualified person

Explore the simplest method to complete and endorse your 990 Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior option to fulfill and endorse your 990 Form and related forms for public services. Our intelligent eSignature platform equips you with all the tools you need to handle documents swiftly and in line with official standards - comprehensive PDF editing, managing, safeguarding, signing, and sharing functionalities, all available within a user-friendly interface.

Only a few steps are necessary to fill out and endorse your 990 Form:

- Upload the fillable template to the editor using the Get Form button.

- Verify the information you need to input in your 990 Form.

- Navigate through the fields using the Next button to ensure you don’t miss any sections.

- Utilize Text, Check, and Cross tools to fill the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Remove fields that are no longer relevant.

- Press Sign to create a legally binding eSignature using any method you prefer.

- Add the Date beside your signature and conclude your task with the Done button.

Store your completed 990 Form in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our platform also supports versatile file sharing. There’s no need to print your forms when sending them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct a name of disqualified person

FAQs

-

What is the meaning of “name of two honorable person” when filling out a form?

‘Two honourable persons’ means ‘two references’. They should be two people who know you well and have worked with you. They can guarantee that you have the skills or character that you claim to have in your CV. That information will allow your prospective employer to contact them to know more about you or to verify the facts.CV References Made EASY!References may be needed for other applications but the purpose is the same.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can you find out someone's name from a picture?

Here is what you can doStep 1: Head over to Google’s image search: Google Images Step 2: Click on the camera icon within the search bar.Step 3: In the popup that opens up, click on "Upload an image" and then click on "Choose file" to select the photography you had saved. You can also use the image URL. If it is online, in windows you right click the image and click on "copy image URL" in a MAC computer you get an image URL as explained here If I am on a Mac, how do I get the URL of an image from a website? (Explained by browser)Step 4: Within seconds Google will search for similar images on the internet and provide you with a list of images that match with the image provided by you. If the person is famous, you would even get the person's name.Good luck with the search!

-

If a person has two or more middle names, how do they fill out forms that has one blank space for the middle name?

Middle names and middle initials are optional in most forms.Middle names or middle initials are not mandatory unless they are government-issued application forms where the government would want to know and store your full name for future reference.Instead of middle names, provide middle initials. Provide middle initials only if necessary. If the blank space only accepts one letter, then you might want to provide the initial of your second given name.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

How should I fill out the JEE Mains form if my Aadhaar card has the incorrect spelling of my name?

See, if your board marksheet name and aadhaar card name doesn't matches then only the issue arrises. So, you need to make your aadhaar name get corrected first. It take a small procedure doing that which is easy. Afterwords fill your jee main application form.HOPE IT HELPS! !ALL THE BEST! !

-

How do people with just one legal name (a mononym) fill out online forms that ask for their first and last names?

I know a mononymous person (who has one legal name; no separate given and family names) and he said something along the lines of using one ofNameName .Name 'Mr NameName NameNFN Name (‘No First Name’)until he finds a variation that is accepted.Ah, found where I might have read it - one of the top comments on Page on reddit.com, by ‘saizai’ (Sai).Another result is that some departments/organisations/sites consider his name to be a family name, others consider it to be a given name.

Create this form in 5 minutes!

How to create an eSignature for the a name of disqualified person

How to create an eSignature for the A Name Of Disqualified Person online

How to create an electronic signature for your A Name Of Disqualified Person in Google Chrome

How to make an eSignature for signing the A Name Of Disqualified Person in Gmail

How to make an electronic signature for the A Name Of Disqualified Person from your smart phone

How to create an electronic signature for the A Name Of Disqualified Person on iOS devices

How to create an eSignature for the A Name Of Disqualified Person on Android

People also ask

-

What is the 990 Form and why is it important?

The 990 Form is a tax return required for tax-exempt organizations in the United States. It provides key information about the organization's mission, programs, and finances, helping to ensure transparency and accountability. Filing the 990 Form correctly is essential for maintaining tax-exempt status and for public trust.

-

How can airSlate SignNow help with signing the 990 Form?

airSlate SignNow streamlines the process of signing the 990 Form by allowing users to eSign documents securely and efficiently. Our platform offers easy-to-use tools that ensure compliance and save time, making it simpler for organizations to gather necessary signatures without delays.

-

Is there a cost associated with using airSlate SignNow for the 990 Form?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. Each plan provides access to essential features for managing documents like the 990 Form, including unlimited eSignatures and secure storage, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the 990 Form?

airSlate SignNow offers features like template creation, customizable workflows, and secure cloud storage that simplify the management of the 990 Form. Additionally, our platform provides real-time tracking and notifications, ensuring you stay updated on the status of your documents.

-

Can I integrate airSlate SignNow with other software for managing the 990 Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, including CRM systems and cloud storage services, to help you manage the 990 Form and other important documents. This integration supports a more efficient workflow and enhances your overall document management process.

-

What are the benefits of using airSlate SignNow for the 990 Form?

Using airSlate SignNow for the 990 Form offers multiple benefits, including time savings, improved accuracy, and enhanced security. With our platform, you can quickly eSign documents, reduce paperwork, and ensure that your sensitive information is protected throughout the signing process.

-

Is airSlate SignNow compliant with regulations for signing the 990 Form?

Yes, airSlate SignNow complies with all legal regulations related to electronic signatures, ensuring that your signed 990 Form is valid and enforceable. Our platform adheres to the ESIGN Act and UETA, providing peace of mind that your documents are legally sound.

Get more for 990 Form

Find out other 990 Form

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online