Form it 258 Claim for Nursing Home Assessment Credit Tax

What is the Form IT 258 Claim For Nursing Home Assessment Credit Tax

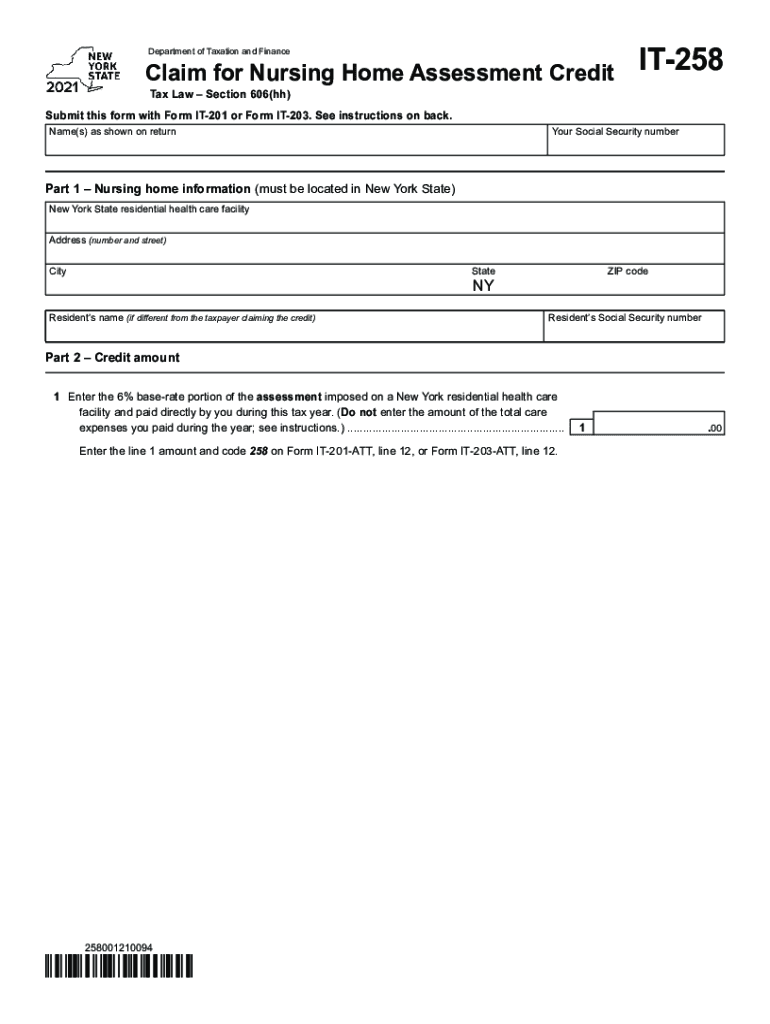

The Form IT 258 is a tax document used in New York State to claim a nursing home assessment credit. This credit is designed to provide financial relief to eligible taxpayers who have incurred expenses related to nursing home care. The form allows individuals to report their nursing home costs and determine their eligibility for the credit, which can significantly reduce their overall tax liability. Understanding the purpose of this form is crucial for those seeking to benefit from the nursing home assessment credit.

Steps to complete the Form IT 258 Claim For Nursing Home Assessment Credit Tax

Completing the Form IT 258 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts for nursing home expenses and any relevant personal information. Next, fill out the form by entering your personal details, including your name, address, and Social Security number. Then, report the total amount of nursing home expenses incurred during the tax year. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Eligibility Criteria

To qualify for the nursing home assessment credit using Form IT 258, taxpayers must meet specific eligibility criteria. Generally, the individual must be a resident of New York State and have incurred qualified nursing home expenses during the tax year. Additionally, the nursing home must be licensed and meet state regulations. It is essential to review the eligibility requirements carefully to ensure that all conditions are met before submitting the claim.

Required Documents

When filing the Form IT 258, certain documents are necessary to support your claim for the nursing home assessment credit. These documents typically include:

- Receipts or invoices from the nursing home detailing the costs incurred.

- Proof of payment, such as bank statements or canceled checks.

- Any relevant tax documents that may provide additional context for your claim.

Having these documents ready can facilitate a smoother filing process and help substantiate your claim if required.

How to obtain the Form IT 258 Claim For Nursing Home Assessment Credit Tax

The Form IT 258 can be obtained through several channels. Taxpayers can download the form directly from the New York State Department of Taxation and Finance website. Alternatively, physical copies may be available at local tax offices or public libraries. Ensuring you have the most recent version of the form is crucial for accurate filing.

Form Submission Methods (Online / Mail / In-Person)

Once the Form IT 258 is completed, there are multiple submission methods available. Taxpayers can file the form online through the New York State Department of Taxation and Finance e-filing system. Alternatively, the completed form can be mailed to the designated tax office address provided on the form. In-person submissions may also be accepted at local tax offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete form it 258 claim for nursing home assessment credit tax

Complete Form IT 258 Claim For Nursing Home Assessment Credit Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents rapidly without interruptions. Manage Form IT 258 Claim For Nursing Home Assessment Credit Tax on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Form IT 258 Claim For Nursing Home Assessment Credit Tax without any hassle

- Find Form IT 258 Claim For Nursing Home Assessment Credit Tax and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form IT 258 Claim For Nursing Home Assessment Credit Tax and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 258 claim for nursing home assessment credit tax

How to generate an e-signature for a PDF online

How to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

How to make an e-signature for a PDF on Android

People also ask

-

What is a claim nursing form in the context of airSlate SignNow?

A claim nursing form is a specific document that healthcare professionals use to submit claims for services rendered. With airSlate SignNow, you can easily create, send, and eSign these forms, ensuring a streamlined process that saves time and reduces errors.

-

How does airSlate SignNow improve the claim nursing form process?

airSlate SignNow simplifies the claim nursing form process by allowing users to generate forms digitally, eSign them, and manage submissions in one platform. This not only enhances efficiency but also ensures compliance, making it easier for nursing professionals to handle claims accurately and quickly.

-

Is there a cost associated with using airSlate SignNow for claim nursing forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs. You can choose a plan that suits your budget while enabling you to effectively manage claim nursing forms and other documents without breaking the bank.

-

Can I integrate airSlate SignNow with other platforms for my claim nursing forms?

Absolutely! airSlate SignNow offers seamless integrations with numerous platforms such as Google Drive, Dropbox, and various healthcare management systems. These integrations help streamline the workflow associated with claim nursing forms and enhance overall productivity.

-

What are the key features of airSlate SignNow for handling claim nursing forms?

Key features of airSlate SignNow include customizable templates for claim nursing forms, eSignature capabilities, automated workflows, and document tracking. These features are designed to help nursing professionals ensure their claims are processed efficiently and stay compliant with regulations.

-

How secure is my data when using airSlate SignNow for claim nursing forms?

Data security is a top priority for airSlate SignNow. Your claim nursing forms and personal information are protected with industry-standard encryption, ensuring that your sensitive data remains confidential and secure throughout the entire process.

-

Can I track the status of my claim nursing forms within airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your claim nursing forms. You can monitor the status of each document, receive notifications when they are viewed or signed, and ensure everything is processed in a timely manner.

Get more for Form IT 258 Claim For Nursing Home Assessment Credit Tax

Find out other Form IT 258 Claim For Nursing Home Assessment Credit Tax

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT