Www Tax Ny GovpdfcurrentformsInstructions for Form it 219 Credit for New York City 2021

Understanding the IT-219 Form

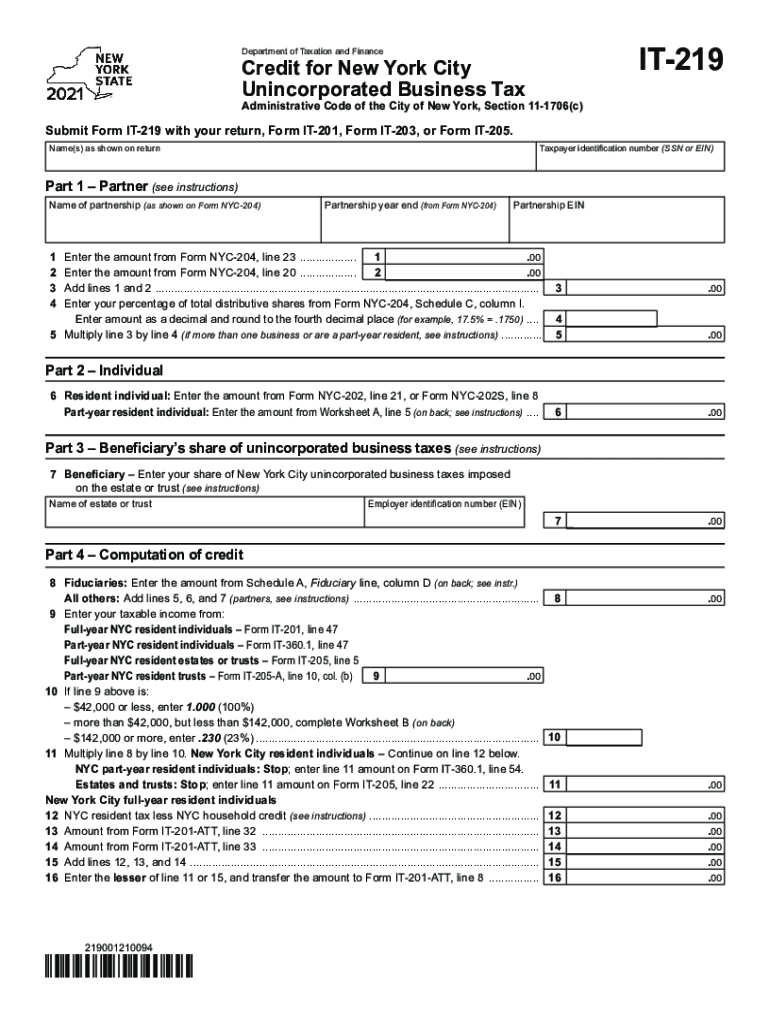

The IT-219 form, also known as the New York City Unincorporated Business Tax Credit form, is designed for individuals and businesses that operate as unincorporated entities within New York City. This form allows eligible taxpayers to claim a credit against their unincorporated business tax liability. Understanding the purpose and requirements of the IT-219 form is essential for ensuring compliance and maximizing potential tax benefits.

Steps to Complete the IT-219 Form

Completing the IT-219 form involves several key steps to ensure accuracy and compliance with New York tax regulations. Here is a straightforward process to follow:

- Gather necessary documentation, including income statements and expense records related to your unincorporated business.

- Carefully read the instructions provided with the form to understand eligibility criteria and required information.

- Fill out the form accurately, providing all requested details, including your business name, address, and tax identification number.

- Calculate the credit amount based on your taxable income and the applicable rates.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria for the IT-219 Form

To qualify for the IT-219 form, taxpayers must meet specific eligibility criteria. Generally, the following conditions apply:

- The taxpayer must operate as an unincorporated business in New York City.

- Eligible businesses include sole proprietorships, partnerships, and LLCs treated as partnerships.

- The business must have a valid New York City business license and must be compliant with local tax regulations.

- Taxpayers must demonstrate that they have incurred unincorporated business tax liabilities during the tax year.

Legal Use of the IT-219 Form

The IT-219 form is legally recognized by the New York City Department of Finance as a valid means for claiming tax credits. To ensure that the form is legally binding, it must be filled out accurately and submitted within the designated filing period. Compliance with all relevant tax laws and regulations is crucial for the legitimacy of the form and the credit claimed.

Filing Deadlines for the IT-219 Form

Timely submission of the IT-219 form is essential to avoid penalties and ensure that tax credits are applied appropriately. The filing deadline typically aligns with the annual tax return due date for unincorporated businesses. Taxpayers should verify the specific deadlines for the current tax year, as they may vary. It is advisable to file the form as early as possible to allow for any potential issues that may arise.

Form Submission Methods

The IT-219 form can be submitted using various methods to accommodate different preferences. Taxpayers may choose to file the form online through the New York City Department of Finance's website, or they can submit a paper version via mail. In-person submissions may also be accepted at designated tax offices. Each method has its own processing times and requirements, so it is important to select the most convenient option.

Quick guide on how to complete wwwtaxnygovpdfcurrentformsinstructions for form it 219 credit for new york city

Complete Www tax ny govpdfcurrentformsInstructions For Form IT 219 Credit For New York City effortlessly on any device

Digital document management has gained increased traction among businesses and individuals. It offers an excellent green alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruption. Manage Www tax ny govpdfcurrentformsInstructions For Form IT 219 Credit For New York City on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Www tax ny govpdfcurrentformsInstructions For Form IT 219 Credit For New York City seamlessly

- Obtain Www tax ny govpdfcurrentformsInstructions For Form IT 219 Credit For New York City and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Www tax ny govpdfcurrentformsInstructions For Form IT 219 Credit For New York City and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxnygovpdfcurrentformsinstructions for form it 219 credit for new york city

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxnygovpdfcurrentformsinstructions for form it 219 credit for new york city

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a 219 form and how can airSlate SignNow help with it?

A 219 form is typically used for various business purposes, such as tax filings or regulatory compliance. airSlate SignNow simplifies the process of completing and signing your 219 form by offering a user-friendly platform that enables easy electronic signatures and document management.

-

Is airSlate SignNow suitable for handling 219 forms securely?

Yes, airSlate SignNow is designed with top-notch security protocols to ensure that your 219 form and any other documents are protected. Our platform complies with industry standards to safeguard your data while enabling seamless eSigning.

-

What are the pricing options for using airSlate SignNow for the 219 form?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Whether you're a small business or a large enterprise, you can choose a plan that suits your requirements for managing and signing 219 forms efficiently and affordably.

-

Can I track the status of my 219 form when using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your 219 form as it moves through the signing process. You'll receive notifications when it's viewed and signed, keeping you informed every step of the way.

-

What features does airSlate SignNow offer for managing 219 forms?

airSlate SignNow offers a variety of features designed specifically for managing 219 forms, including customizable templates, an easy-to-use interface, and advanced collaboration tools. These features enable you to streamline the signing process and improve overall workflow efficiency.

-

Are there integrations available for using airSlate SignNow with other software for 219 forms?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to leverage your existing software for handling 219 forms. Whether it's connecting with your CRM or cloud storage, our integrations enhance your operational capabilities.

-

How does airSlate SignNow improve the efficiency of processing 219 forms?

By using airSlate SignNow, businesses can signNowly improve their efficiency in processing 219 forms through automation and simplified workflows. Our platform reduces paper usage, speeds up signature collection, and minimizes delays in document handling.

Get more for Www tax ny govpdfcurrentformsInstructions For Form IT 219 Credit For New York City

- Lien statement colorado form

- Quitclaim deed from an individual to three individuals colorado form

- Temporary order and citation colorado form

- Motion pretrial conference form

- Colorado special warranty 497299786 form

- Colorado limited company 497299787 form

- Colorado limited company 497299788 form

- Colorado special warranty deed form

Find out other Www tax ny govpdfcurrentformsInstructions For Form IT 219 Credit For New York City

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online