Instructions for Form it 219 Tax NY Gov 2022

Understanding the IT-219 Tax Form for New York

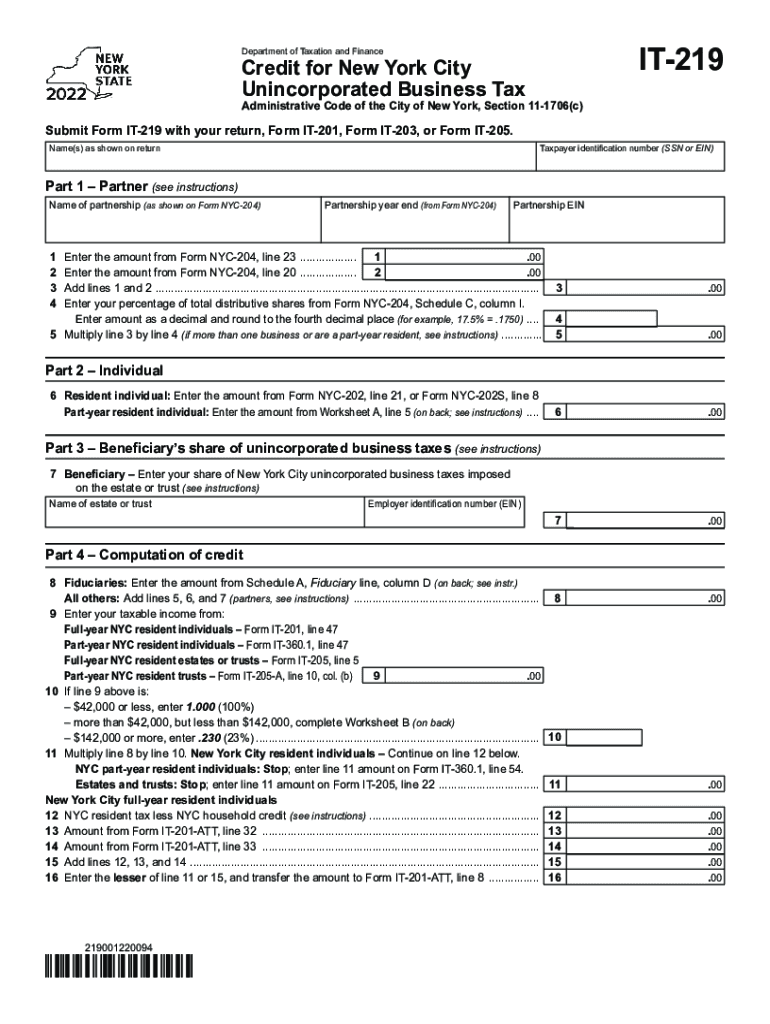

The IT-219 form is essential for unincorporated businesses in New York. It allows individuals to calculate their unincorporated business tax liability. This tax applies to various business structures, including sole proprietorships and partnerships. Understanding the form is crucial for compliance and ensuring accurate tax reporting.

Steps to Complete the IT-219 Tax Form

Completing the IT-219 form involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by reporting your total gross income and allowable deductions. Pay special attention to the calculations, as errors can lead to penalties. Lastly, review the completed form for accuracy before submission.

Filing Deadlines for the IT-219 Tax Form

Timely filing of the IT-219 form is crucial. The deadline for submission typically aligns with the due date for your federal income tax return. For most taxpayers, this means the form is due on April 15. However, if this date falls on a weekend or holiday, the deadline may extend to the next business day. It's important to stay informed about any changes to these deadlines to avoid late fees.

Required Documents for the IT-219 Tax Form

When preparing to file the IT-219 form, several documents are essential. You will need your profit and loss statements, records of business expenses, and any previous tax returns. Additionally, if you are claiming any credits or deductions, supporting documentation is necessary. Having these documents organized will streamline the filing process and ensure compliance with tax regulations.

Penalties for Non-Compliance with the IT-219 Tax Form

Failure to file the IT-219 form on time or inaccuracies in reporting can result in significant penalties. The New York State Department of Taxation and Finance may impose fines based on the amount owed. Additionally, interest will accrue on any unpaid taxes, increasing the total liability. It is advisable to file accurately and on time to avoid these financial repercussions.

Eligibility Criteria for the IT-219 Tax Form

Eligibility for the IT-219 form primarily depends on your business structure. Unincorporated businesses, including sole proprietorships and partnerships, must file this form if they generate income in New York. Additionally, businesses must meet specific income thresholds to qualify for certain deductions and credits. Understanding these criteria is vital for ensuring compliance and maximizing potential tax benefits.

Quick guide on how to complete instructions for form it 219 taxnygov

Effortlessly Complete Instructions For Form IT 219 Tax NY gov on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without complications. Manage Instructions For Form IT 219 Tax NY gov on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Alter and eSign Instructions For Form IT 219 Tax NY gov with Ease

- Find Instructions For Form IT 219 Tax NY gov and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Instructions For Form IT 219 Tax NY gov and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 219 taxnygov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 219 taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is unincorporated business tax?

Unincorporated business tax is a tax levied on income generated by businesses that are not incorporated. This can include sole proprietorships, partnerships, and LLCs. Understanding this tax is crucial for proper financial planning and compliance.

-

How does airSlate SignNow help with unincorporated business tax documents?

AirSlate SignNow provides an easy-to-use platform for sending and eSigning documents related to unincorporated business tax. Users can streamline the process of completing tax forms, agreements, and other critical documents without the hassles of printing and mailing.

-

What features does airSlate SignNow offer for unincorporated businesses?

AirSlate SignNow offers features tailored for unincorporated businesses, including template creation, bulk sending, and advanced tracking. These features simplify the process of managing paperwork for unincorporated business tax, ensuring all documents are signed and filed on time.

-

Is there a pricing plan specifically for unincorporated businesses?

Yes, airSlate SignNow offers flexible pricing plans that cater to unincorporated businesses. Whether you need basic eSigning capabilities or advanced features, there is a plan suited to your needs, helping you efficiently manage your unincorporated business tax documents.

-

How can I integrate airSlate SignNow with my accounting software for unincorporated business tax?

AirSlate SignNow integrates seamlessly with various accounting software, making it ideal for managing unincorporated business tax. This integration allows you to automate the document flow, ensuring that all relevant tax information is accurately captured and easily accessible.

-

What benefits does airSlate SignNow provide for managing unincorporated business taxes?

Using airSlate SignNow for unincorporated business tax offers numerous benefits, including improved efficiency and reduced paperwork. The platform's eSigning capabilities eliminate delays in document processing, helping you stay compliant and organized during tax season.

-

Can airSlate SignNow assist with filing unincorporated business tax returns?

While airSlate SignNow doesn't file tax returns directly, it greatly facilitates the preparation by allowing you to create and sign necessary documents electronically. This ensures that all your unincorporated business tax documentation is ready for filing without any headaches.

Get more for Instructions For Form IT 219 Tax NY gov

Find out other Instructions For Form IT 219 Tax NY gov

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed