Unincorporated Business Tax Fill Out and Sign Printable 2023

What is the Unincorporated Business Tax?

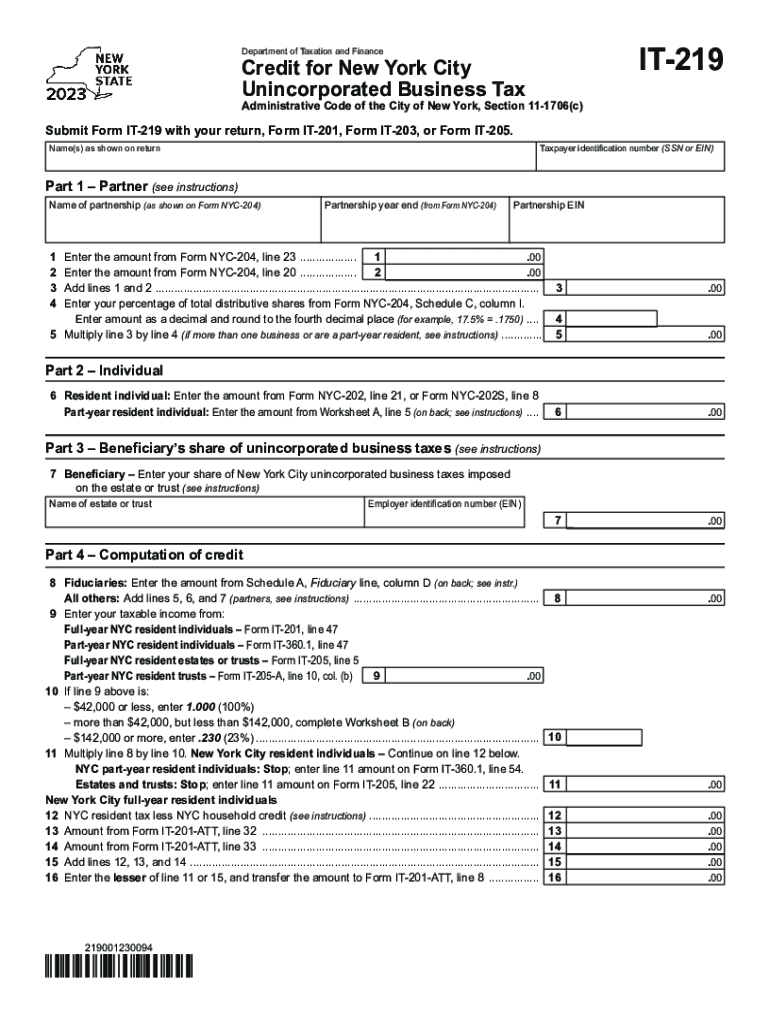

The unincorporated business tax is a tax levied on businesses that are not registered as corporations. This tax applies to sole proprietorships and partnerships operating in certain jurisdictions, including New York City. It is essential for business owners to understand their tax obligations to ensure compliance and avoid penalties.

This tax is calculated based on the net income of the business and is reported on specific tax forms, such as the IT-219 form in New York. The tax rate and regulations can vary by state, so it is important to refer to local guidelines for accurate information.

Steps to Complete the Unincorporated Business Tax Form

Completing the unincorporated business tax form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Obtain the correct tax form for your jurisdiction, such as the IT-219 for New York.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or by mail.

Following these steps can help streamline the filing process and minimize the risk of errors.

Required Documents for Filing

When preparing to file the unincorporated business tax, certain documents are essential:

- Income statements detailing all revenue generated by the business.

- Expense records, including receipts and invoices, to substantiate deductions.

- Previous tax returns, if applicable, for reference and consistency.

- Any additional forms required by the state or local tax authority.

Having these documents ready can facilitate a smoother filing experience and ensure compliance with tax regulations.

Filing Deadlines and Important Dates

It is crucial for business owners to be aware of filing deadlines to avoid penalties. In New York, the unincorporated business tax is typically due on the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. Additionally, estimated tax payments may be required quarterly.

Staying informed about these dates helps ensure timely submissions and compliance with tax obligations.

Penalties for Non-Compliance

Failure to comply with unincorporated business tax regulations can result in significant penalties. Common penalties include:

- Late filing penalties, which can accrue based on the amount of tax owed.

- Interest on unpaid taxes, which accumulates from the due date until payment is made.

- Potential audits or increased scrutiny from tax authorities.

Understanding these penalties emphasizes the importance of timely and accurate filing.

IRS Guidelines for Unincorporated Businesses

The Internal Revenue Service (IRS) provides guidelines for unincorporated businesses, outlining the requirements for reporting income and expenses. Business owners should be familiar with the IRS rules regarding self-employment income, allowable deductions, and the necessity of maintaining accurate records. Compliance with IRS guidelines is essential to avoid issues during tax season and ensure proper tax treatment.

Quick guide on how to complete unincorporated business tax fill out and sign printable

Effortlessly Prepare Unincorporated Business Tax Fill Out And Sign Printable on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents rapidly without any delays. Handle Unincorporated Business Tax Fill Out And Sign Printable on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to Edit and eSign Unincorporated Business Tax Fill Out And Sign Printable with Ease

- Locate Unincorporated Business Tax Fill Out And Sign Printable and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the information and click the Done button to secure your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Unincorporated Business Tax Fill Out And Sign Printable and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct unincorporated business tax fill out and sign printable

Create this form in 5 minutes!

How to create an eSignature for the unincorporated business tax fill out and sign printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is unincorporated business tax?

Unincorporated business tax refers to the tax imposed on businesses that are not incorporated as separate legal entities, such as sole proprietorships or partnerships. This tax applies to the income generated by these businesses, and understanding it is crucial for compliance and financial planning.

-

How does airSlate SignNow help with unincorporated business tax documentation?

With airSlate SignNow, businesses can easily create, send, and eSign important documents related to unincorporated business tax. Our platform simplifies the management of tax forms and contracts, ensuring that essential paperwork is handled efficiently and securely.

-

What are the costs associated with using airSlate SignNow for managing unincorporated business tax documents?

airSlate SignNow offers a range of pricing plans to fit different business needs, including options for startups and small businesses dealing with unincorporated business tax. The cost is competitive and reflects the robust features provided, such as document storage and eSignature capabilities.

-

Can airSlate SignNow integrate with accounting software for unincorporated business tax management?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier for businesses to manage their unincorporated business tax documents alongside their financial data. This integration helps streamline operations and ensures accurate record-keeping.

-

What are the benefits of using airSlate SignNow for unincorporated business tax workflows?

Using airSlate SignNow for unincorporated business tax workflows enhances efficiency and accuracy. You can speed up document turnaround times with eSignatures and automated reminders, helping you stay compliant with tax regulations and deadlines.

-

Is airSlate SignNow compliant with regulations regarding unincorporated business tax?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations concerning document handling and eSigning, ensuring that your unincorporated business tax documents are legally binding and secure.

-

How user-friendly is airSlate SignNow for those unfamiliar with unincorporated business tax?

airSlate SignNow is built with simplicity in mind, making it easy for users who may not be familiar with unincorporated business tax. Our intuitive interface and helpful resources guide you through creating and managing essential tax documents effortlessly.

Get more for Unincorporated Business Tax Fill Out And Sign Printable

Find out other Unincorporated Business Tax Fill Out And Sign Printable

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe