Form it 219 Credit for New York City Unincorporated Business Tax Tax Year 2024-2026

What is the Form IT-219 for New York City Unincorporated Business Tax?

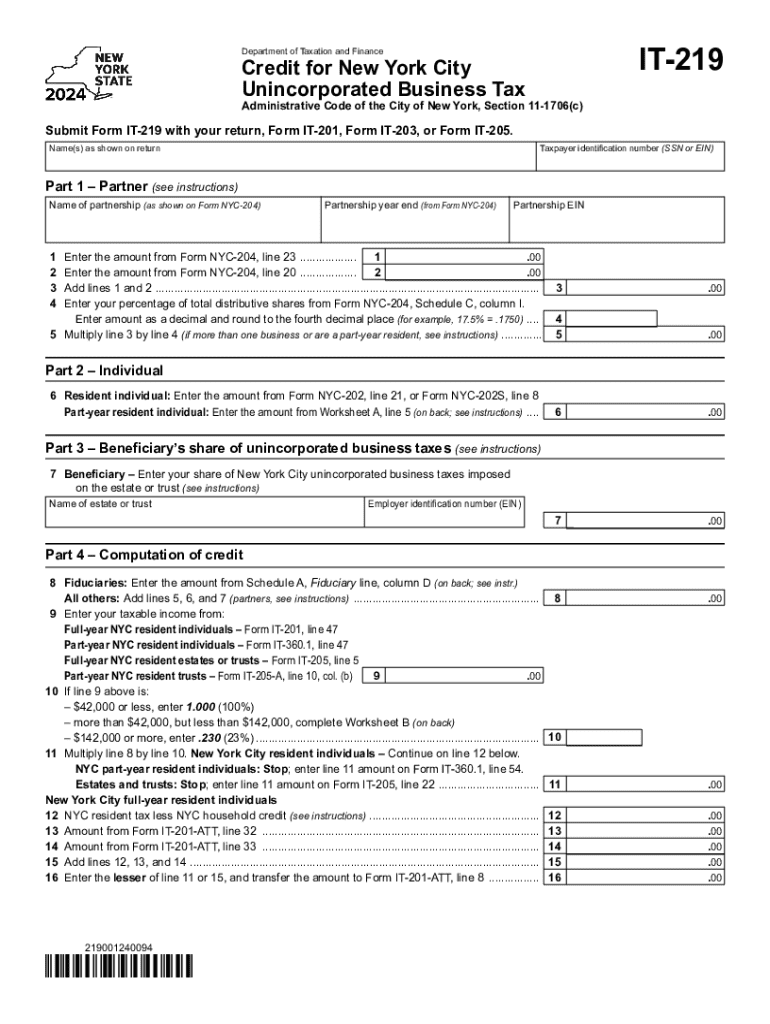

The Form IT-219 is a tax form used by unincorporated businesses in New York City to claim a credit against the unincorporated business tax. This form is essential for businesses operating as sole proprietorships, partnerships, or limited liability companies (LLCs) that are not classified as corporations. The credit aims to reduce the overall tax burden on these businesses, which can be especially beneficial for small business owners. Understanding the specifics of this form can help ensure compliance and optimize tax savings.

Steps to Complete the Form IT-219

Completing the Form IT-219 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section, providing your business name, address, and taxpayer identification number.

- Calculate your unincorporated business income and any applicable deductions.

- Determine the amount of credit you are eligible for based on your business activities and tax liabilities.

- Review all entries for accuracy before submitting the form.

Completing the form accurately is crucial to avoid delays or penalties. It is advisable to consult with a tax professional if you have questions during this process.

Legal Use of the Form IT-219

The Form IT-219 is legally required for unincorporated businesses in New York City to claim the unincorporated business tax credit. Filing this form correctly ensures compliance with local tax regulations and helps avoid potential legal issues related to tax evasion. Businesses must adhere to the guidelines set by the New York City Department of Finance, which governs the use and submission of this form.

Filing Deadlines for Form IT-219

Timely filing of the Form IT-219 is essential to avoid penalties. Generally, the form must be submitted by the due date of your unincorporated business tax return. This is typically aligned with the annual tax filing deadlines, which may vary based on your business's fiscal year. It is important to stay informed about any changes in deadlines that the New York City Department of Finance may announce.

Eligibility Criteria for Form IT-219

To be eligible to file the Form IT-219, your business must meet specific criteria. These include:

- Your business must be classified as unincorporated, such as a sole proprietorship, partnership, or LLC.

- You must have generated income that is subject to the New York City unincorporated business tax.

- All required financial documentation must be accurate and complete to support your claim for the credit.

Understanding these eligibility requirements is crucial for ensuring that your business can benefit from the available tax credits.

How to Obtain the Form IT-219

The Form IT-219 can be obtained through the New York City Department of Finance website or by visiting their offices. It is available in both digital and printable formats, allowing businesses the flexibility to complete the form electronically or by hand. Ensuring you have the correct version of the form is important, as older versions may not be accepted for filing.

Create this form in 5 minutes or less

Find and fill out the correct form it 219 credit for new york city unincorporated business tax tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 219 credit for new york city unincorporated business tax tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an unincorporated business tax form?

An unincorporated business tax form is a document used by individuals or partnerships that operate a business without formal incorporation. This form helps report income and expenses to the IRS, ensuring compliance with tax regulations. Understanding how to fill out this form is crucial for unincorporated businesses to avoid penalties.

-

How can airSlate SignNow help with unincorporated business tax forms?

airSlate SignNow simplifies the process of preparing and signing unincorporated business tax forms. With our easy-to-use platform, you can quickly fill out, eSign, and send your tax documents securely. This streamlines your workflow and ensures that your forms are submitted on time.

-

What features does airSlate SignNow offer for managing unincorporated business tax forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for unincorporated business tax forms. These tools enhance efficiency and ensure that all necessary information is accurately captured. Additionally, our platform allows for easy collaboration with accountants or partners.

-

Is there a cost associated with using airSlate SignNow for unincorporated business tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those focused on unincorporated business tax forms. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for unincorporated business tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software, making it easier to manage unincorporated business tax forms. This integration allows for automatic data transfer and reduces the risk of errors, enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for unincorporated business tax forms?

Using airSlate SignNow for unincorporated business tax forms offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on your business.

-

How secure is airSlate SignNow when handling unincorporated business tax forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your unincorporated business tax forms and sensitive information. Our compliance with industry standards ensures that your documents are safe from unauthorized access.

Get more for Form IT 219 Credit For New York City Unincorporated Business Tax Tax Year

- Missouri caregiver background screening 1028785 form

- Worker steward investigation agreement seiu uhw form

- Form rd 2036 3

- Neb rev stat 43 2930 form

- Deo form awa 01 rev 03 12 department of economic opportunity

- 1 iron infusion gp referral form 4docx

- Authorization for cremation and disposition form

- Direct deposit sign up form kuwait

Find out other Form IT 219 Credit For New York City Unincorporated Business Tax Tax Year

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast