Instructions for Form it 219 Credit for New York City NEW YORK CITY DEPARTMENT of FINANCE Instructions for Form Instructions for 2020

Understanding Form IT-219 for New York City

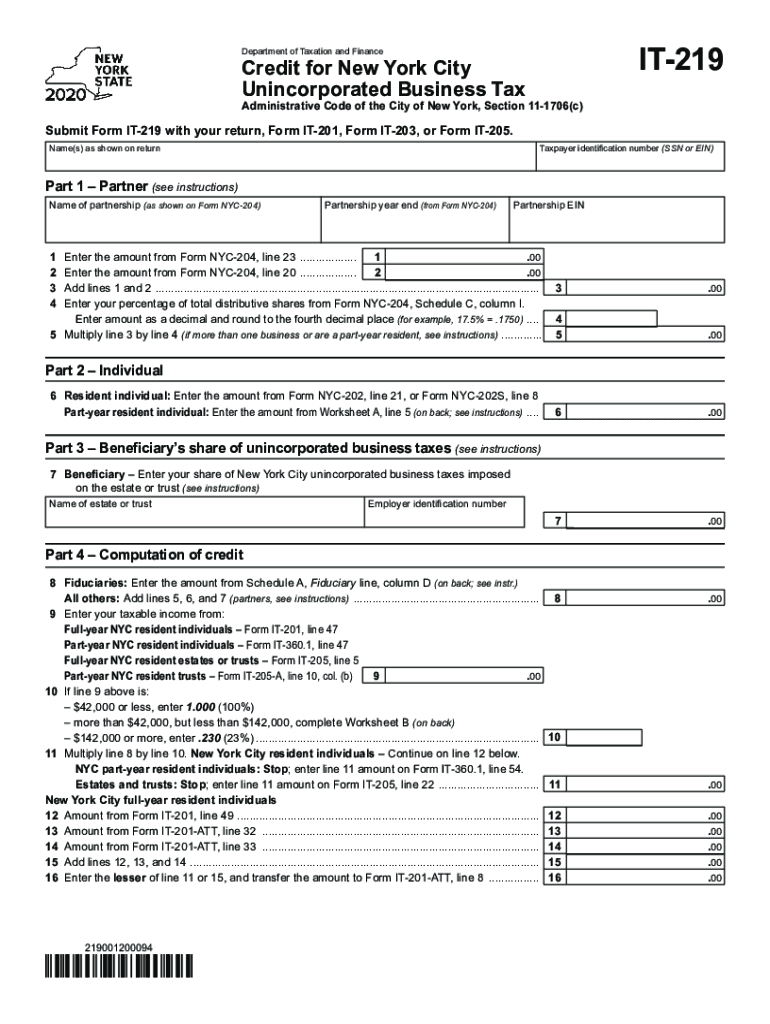

Form IT-219 is a crucial document for individuals and businesses in New York City looking to claim a credit against their business taxes. This form is specifically designed to help taxpayers navigate the complexities of the tax system. It is essential to understand the purpose and requirements of this form to ensure compliance and maximize potential credits.

The New York City Department of Finance issues Form IT-219, which allows eligible taxpayers to receive a credit for certain taxes paid. Understanding the eligibility criteria and the specifics of the credit can significantly impact your tax obligations. It is advisable to review the instructions carefully to ensure all necessary information is provided accurately.

Steps to Complete Form IT-219

Completing Form IT-219 involves several key steps to ensure accuracy and compliance with New York City tax regulations. First, gather all necessary documentation, including previous tax returns and any relevant financial records. This preparation helps streamline the process.

Next, fill out the form by providing accurate information regarding your business and the taxes paid. Pay close attention to the sections that require specific details about the credit you are claiming. After completing the form, review it thoroughly to check for any errors or omissions, as these could delay processing or result in penalties.

Legal Use of Form IT-219

The legal standing of Form IT-219 is significant, as it must comply with various tax regulations set forth by the New York City Department of Finance. To be considered valid, the form must be completed accurately and submitted within the designated deadlines.

Additionally, eSignatures can be utilized for the digital submission of this form, provided that they meet the requirements established by the ESIGN Act and UETA. This ensures that your submission is legally binding and recognized by the relevant authorities.

Eligibility Criteria for Form IT-219

To qualify for the credit associated with Form IT-219, taxpayers must meet specific eligibility criteria set by the New York City Department of Finance. This typically includes being a registered business entity within the city and having paid certain taxes that qualify for the credit.

It is essential to review the detailed eligibility requirements outlined in the form's instructions. This ensures that you do not miss out on potential benefits due to oversight or misunderstanding of the qualifications.

Required Documents for Form IT-219

When preparing to submit Form IT-219, certain documents are required to support your claim for the credit. These documents may include previous tax returns, proof of tax payments, and any other financial statements that demonstrate your eligibility for the credit.

Organizing these documents in advance can facilitate a smoother submission process and help avoid delays. Ensure that all documents are accurate and up to date, as discrepancies can lead to complications with your filing.

Form Submission Methods for IT-219

Form IT-219 can be submitted through various methods, including online, by mail, or in person at designated offices. Each submission method has its own set of guidelines and requirements, so it is important to choose the option that best fits your needs.

For online submissions, ensure that you have a reliable digital signature solution that complies with legal standards. If opting to submit by mail, confirm that you are sending the form to the correct address to avoid processing delays.

Quick guide on how to complete instructions for form it 219 credit for new york city new york city department of finance instructions for form instructions

Complete Instructions For Form IT 219 Credit For New York City NEW YORK CITY DEPARTMENT OF FINANCE Instructions For Form Instructions For effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, enabling you to access the right file and securely retain it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form IT 219 Credit For New York City NEW YORK CITY DEPARTMENT OF FINANCE Instructions For Form Instructions For on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Instructions For Form IT 219 Credit For New York City NEW YORK CITY DEPARTMENT OF FINANCE Instructions For Form Instructions For with ease

- Obtain Instructions For Form IT 219 Credit For New York City NEW YORK CITY DEPARTMENT OF FINANCE Instructions For Form Instructions For and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or mistakes that necessitate printing out new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Instructions For Form IT 219 Credit For New York City NEW YORK CITY DEPARTMENT OF FINANCE Instructions For Form Instructions For and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 219 credit for new york city new york city department of finance instructions for form instructions

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 219 credit for new york city new york city department of finance instructions for form instructions

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to New York 219?

airSlate SignNow is a comprehensive digital signature solution that allows businesses to send and eSign documents seamlessly. With features tailored to meet the needs of users in New York 219, it simplifies the signing process while ensuring compliance with local regulations.

-

How much does airSlate SignNow cost in New York 219?

Pricing for airSlate SignNow in New York 219 is designed to be affordable for all businesses. We offer flexible subscription plans, catering to various needs, ensuring that every customer in New York 219 finds a suitable solution without breaking the bank.

-

What features does airSlate SignNow offer for users in New York 219?

airSlate SignNow offers a range of features such as document templates, advanced security options, and real-time tracking specifically optimized for businesses in New York 219. These features help streamline your workflows and improve productivity.

-

How can airSlate SignNow benefit businesses in New York 219?

Businesses in New York 219 can benefit from airSlate SignNow by reducing paperwork and enhancing efficiency. The easy-to-use platform allows for faster transaction times, making it easier to close deals and manage documentation effectively.

-

Does airSlate SignNow integrate with other software commonly used in New York 219?

Yes, airSlate SignNow offers integrations with popular software applications commonly used in New York 219, such as CRM systems, cloud storage, and productivity tools. This ensures a seamless workflow, allowing users to manage documents effortlessly.

-

Is airSlate SignNow compliant with regulations in New York 219?

Absolutely, airSlate SignNow is fully compliant with electronic signature laws and regulations in New York 219. This compliance provides peace of mind to users that their electronic signatures are legally binding and secure.

-

Can airSlate SignNow help with remote work in New York 219?

airSlate SignNow is an ideal solution for remote work in New York 219, allowing users to send, sign, and manage documents from anywhere. This flexibility enhances collaboration among teams while maintaining security and compliance.

Get more for Instructions For Form IT 219 Credit For New York City NEW YORK CITY DEPARTMENT OF FINANCE Instructions For Form Instructions For

Find out other Instructions For Form IT 219 Credit For New York City NEW YORK CITY DEPARTMENT OF FINANCE Instructions For Form Instructions For

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy