Www Irs Govpubirs Pdf2021 Form 1040 SR Internal Revenue Service 2021

Understanding the 2019 IRS Form 1040 SR

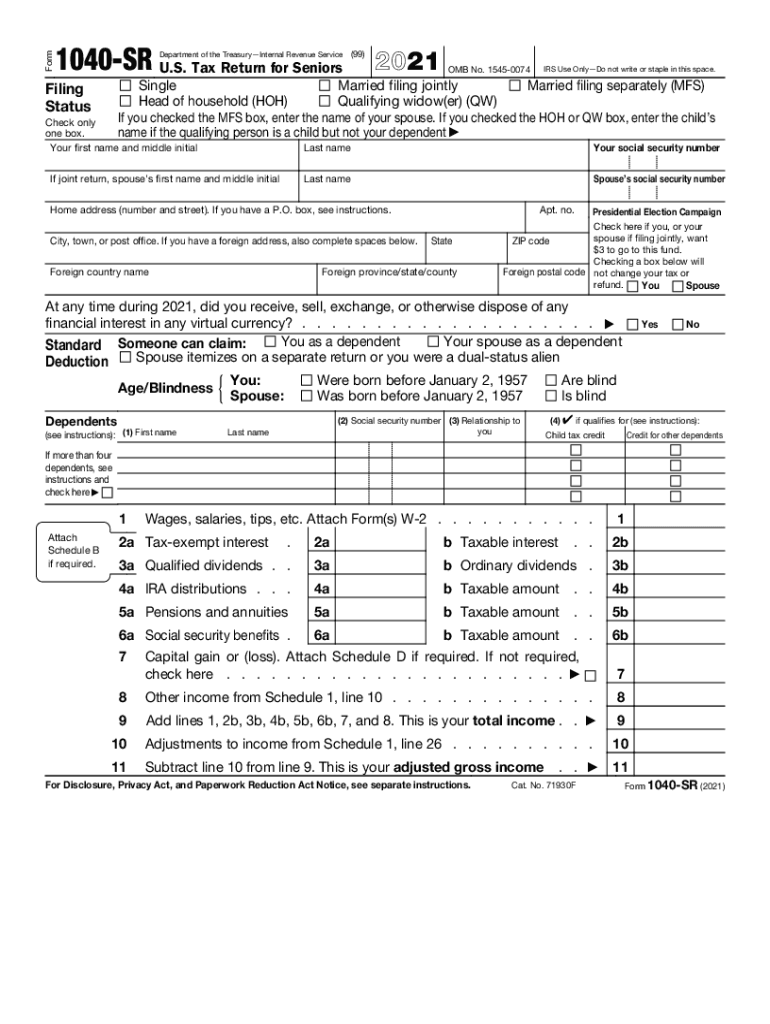

The 2019 IRS Form 1040 SR is a simplified tax form specifically designed for senior taxpayers aged sixty-five and older. This form allows eligible individuals to report their income and calculate their tax obligations in a straightforward manner. It includes larger print and a more user-friendly layout, making it easier for seniors to complete their tax returns. The form incorporates standard deductions and allows for the reporting of various income types, including pensions and Social Security benefits.

Steps to Complete the 2019 IRS Form 1040 SR

Filling out the 2019 IRS Form 1040 SR involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Start by entering personal information, such as your name, address, and Social Security number.

- Report your income in the designated sections, ensuring you include all sources of income.

- Apply the standard deduction for your filing status, which is higher for seniors.

- Calculate your tax liability based on the provided tax tables.

- Sign and date the form before submitting it.

Legal Use of the 2019 IRS Form 1040 SR

The 2019 IRS Form 1040 SR is legally recognized as a valid tax document when filled out accurately and submitted on time. To ensure compliance with IRS regulations, taxpayers must provide truthful information and retain copies of their completed forms and supporting documents. The form must be filed by the tax deadline to avoid penalties and interest on any owed taxes.

Filing Deadlines for the 2019 IRS Form 1040 SR

Taxpayers must adhere to specific filing deadlines when submitting the 2019 IRS Form 1040 SR. The standard deadline for filing individual tax returns is April fifteenth. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers who require additional time may file for an extension, allowing them until October fifteenth to submit their forms, although any taxes owed must still be paid by the original deadline.

Required Documents for the 2019 IRS Form 1040 SR

To successfully complete the 2019 IRS Form 1040 SR, taxpayers should gather the following documents:

- W-2 forms from employers detailing wages and withheld taxes.

- 1099 forms for any freelance work or other income sources.

- Statements showing pensions, annuities, and Social Security benefits.

- Records of any deductible expenses, such as medical costs or charitable contributions.

Form Submission Methods for the 2019 IRS Form 1040 SR

The 2019 IRS Form 1040 SR can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online filing through IRS-approved tax software, which often simplifies the process.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, though appointments may be required.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 1040 sr internal revenue service

Effortlessly Prepare Www irs govpubirs pdf2021 Form 1040 SR Internal Revenue Service on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delay. Handle Www irs govpubirs pdf2021 Form 1040 SR Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Www irs govpubirs pdf2021 Form 1040 SR Internal Revenue Service with Ease

- Find Www irs govpubirs pdf2021 Form 1040 SR Internal Revenue Service and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Www irs govpubirs pdf2021 Form 1040 SR Internal Revenue Service and ensure outstanding communication throughout any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 form 1040 sr internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 1040 sr internal revenue service

The way to create an e-signature for your PDF document online

The way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an e-signature for a PDF file on Android OS

People also ask

-

What is the 2019 IRS Form 1040 SR?

The 2019 IRS Form 1040 SR is a simplified version of the standard 1040 form specifically designed for seniors aged 65 and older. It features larger print and provides a straightforward approach to reporting income, deductions, and credits.

-

How can airSlate SignNow assist with filing the 2019 IRS Form 1040 SR?

AirSlate SignNow allows users to securely send and eSign documents, making it easier to handle important tax forms like the 2019 IRS Form 1040 SR. With our platform, you can ensure that all required signatures are obtained efficiently and legally.

-

Is airSlate SignNow cost-effective for submitting the 2019 IRS Form 1040 SR?

Yes, airSlate SignNow offers a cost-effective solution that streamlines the document signing process, including for tax forms like the 2019 IRS Form 1040 SR. Our pricing plans are designed to fit a variety of budgets, ensuring accessibility for all users.

-

What features does airSlate SignNow offer for eSigning the 2019 IRS Form 1040 SR?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage, all of which can enhance the experience of eSigning the 2019 IRS Form 1040 SR. These tools help ensure that your documents are processed quickly and safely.

-

Does airSlate SignNow integrate with tax preparation software for the 2019 IRS Form 1040 SR?

Yes, airSlate SignNow is compatible with various tax preparation software, allowing for a seamless integration when handling the 2019 IRS Form 1040 SR. This enables users to easily incorporate eSigning into their tax filing routine.

-

What benefits can I expect when using airSlate SignNow for my 2019 IRS Form 1040 SR?

Using airSlate SignNow for your 2019 IRS Form 1040 SR offers benefits like reducing paperwork, speeding up the signing process, and enhancing compliance with eSignature laws. These advantages can lead to a more efficient tax filing experience.

-

How secure is airSlate SignNow when handling the 2019 IRS Form 1040 SR?

AirSlate SignNow prioritizes security and compliance, employing industry-standard encryption to protect sensitive documents like the 2019 IRS Form 1040 SR. Our platform ensures that all data is kept safe and confidential throughout the signing process.

Get more for Www irs govpubirs pdf2021 Form 1040 SR Internal Revenue Service

- 14 10 127 crs form

- Instructions to file a motion or stipulation to relocate minor children colorado form

- Colorado maintenance pdf form

- Terminate maintenance form

- Modify child colorado form

- Instructions for motion for modification of child support colorado form

- Co child support form

- Colorado child support online form

Find out other Www irs govpubirs pdf2021 Form 1040 SR Internal Revenue Service

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now