1040 Department of the Treasury Internal Revenue Service 2024-2026

Understanding Form 1040-SR

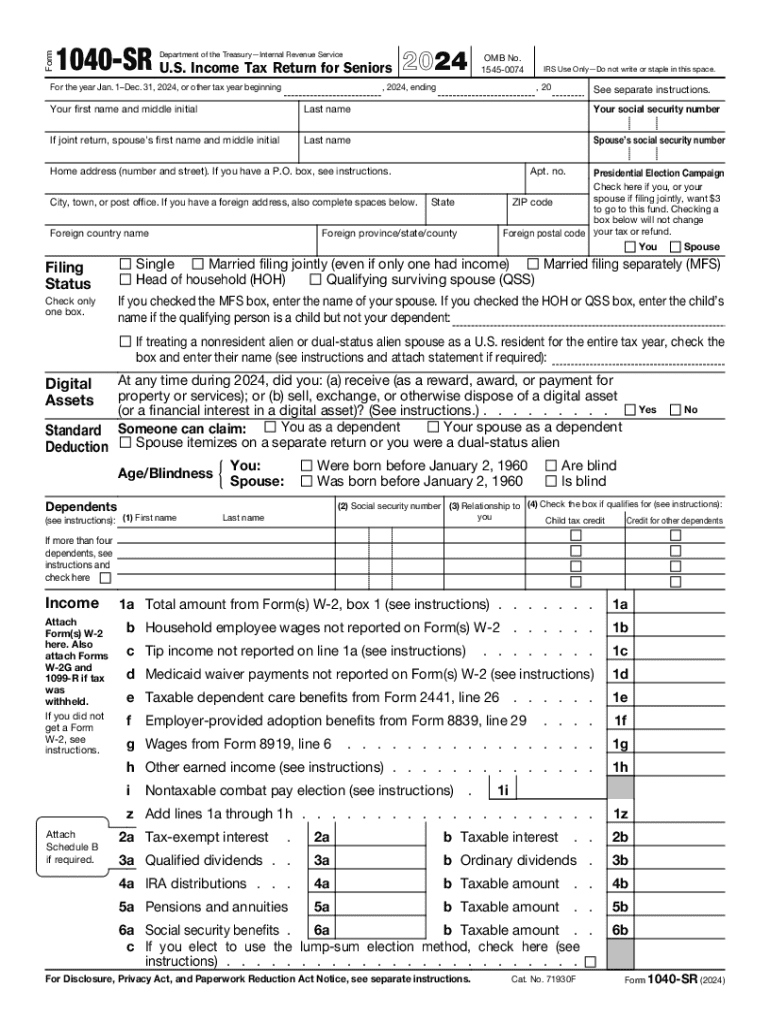

The 1040-SR is a simplified version of the standard IRS Form 1040, specifically designed for seniors aged sixty-five and older. This form allows eligible taxpayers to report their income, claim deductions, and calculate their tax liability. It features larger print and a straightforward layout, making it easier for older individuals to read and complete. The 1040-SR can be used for various income types, including pensions, retirement distributions, and Social Security benefits.

Steps to Complete Form 1040-SR

Completing Form 1040-SR involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income on the appropriate lines of the form.

- Claim deductions and credits you qualify for, such as the standard deduction for seniors.

- Calculate your total tax liability or refund.

- Sign and date the form before submission.

Eligibility Criteria for Using Form 1040-SR

To use Form 1040-SR, taxpayers must meet specific eligibility criteria:

- Be at least sixty-five years old by the end of the tax year.

- Have a total income that falls within the limits set by the IRS.

- Not be claiming dependents on the tax return.

Taxpayers who do not meet these criteria may need to use the standard Form 1040 instead.

Filing Deadlines for Form 1040-SR

The deadline for filing Form 1040-SR is typically April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an extension, which allows for an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods

Form 1040-SR can be submitted in several ways:

- Electronically through tax preparation software or e-filing services.

- By mail, sending the completed form to the appropriate IRS address based on your state of residence.

- In-person at designated IRS offices or during tax assistance events.

Choosing the right submission method can help ensure timely processing of your tax return.

Key Elements of Form 1040-SR

Form 1040-SR includes several key elements that are essential for accurate tax reporting:

- Personal information section for taxpayer identification.

- Income reporting lines for various sources of income.

- Deductions and credits section to reduce taxable income.

- Signature area to validate the return.

Understanding these elements can help taxpayers navigate the form more effectively.

Handy tips for filling out 1040 Department Of The Treasury Internal Revenue Service online

Quick steps to complete and e-sign 1040 Department Of The Treasury Internal Revenue Service online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant service for maximum simplicity. Use signNow to e-sign and share 1040 Department Of The Treasury Internal Revenue Service for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct 1040 department of the treasury internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 1040 department of the treasury internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1040 SR?

Form 1040 SR is a simplified version of the standard Form 1040, designed specifically for seniors aged 65 and older. It allows for easier reporting of income and deductions, making tax filing more straightforward for older adults. This form includes larger print and a standard deduction chart, enhancing accessibility.

-

How can airSlate SignNow help with form 1040 SR?

airSlate SignNow streamlines the process of completing and eSigning form 1040 SR by providing an intuitive platform for document management. Users can easily upload, fill out, and send their tax forms securely. This ensures that your form 1040 SR is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 1040 SR?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of a user-friendly platform that simplifies the eSigning process for documents like form 1040 SR. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for form 1040 SR?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for documents like form 1040 SR. These tools enhance the efficiency of your tax filing process, ensuring that you can manage your documents with ease. Additionally, the platform supports collaboration, allowing multiple parties to sign and review the form.

-

Can I integrate airSlate SignNow with other software for form 1040 SR?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including popular accounting and tax preparation tools. This integration allows for a smoother workflow when managing form 1040 SR and other tax documents. You can connect your existing systems to enhance productivity and streamline your tax filing process.

-

What are the benefits of using airSlate SignNow for form 1040 SR?

Using airSlate SignNow for form 1040 SR offers numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. The platform allows you to complete and sign your tax forms digitally, saving time and minimizing errors. Additionally, it provides a secure environment for your sensitive information, ensuring peace of mind during tax season.

-

Is airSlate SignNow user-friendly for seniors filing form 1040 SR?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for seniors filing form 1040 SR. The platform features a simple interface and clear instructions, which help users navigate the eSigning process with ease. This ensures that older adults can manage their tax documents without unnecessary complications.

Get more for 1040 Department Of The Treasury Internal Revenue Service

- Passages 2 third edition workbook answer key pdf form

- Icici lombard policy number format

- Bank draft maybank form

- Eservicesarchivesgovorderonline form

- Business statistics ken black 7th edition pdf form

- Hardware accomplishment summary form

- Meningitis form cuny

- Marine incident record serious incident form transport safety

Find out other 1040 Department Of The Treasury Internal Revenue Service

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent