Form 1040 SR, U S Tax Return for Seniors Internal 2020

What is the 2019 IRS 1040 SR Form?

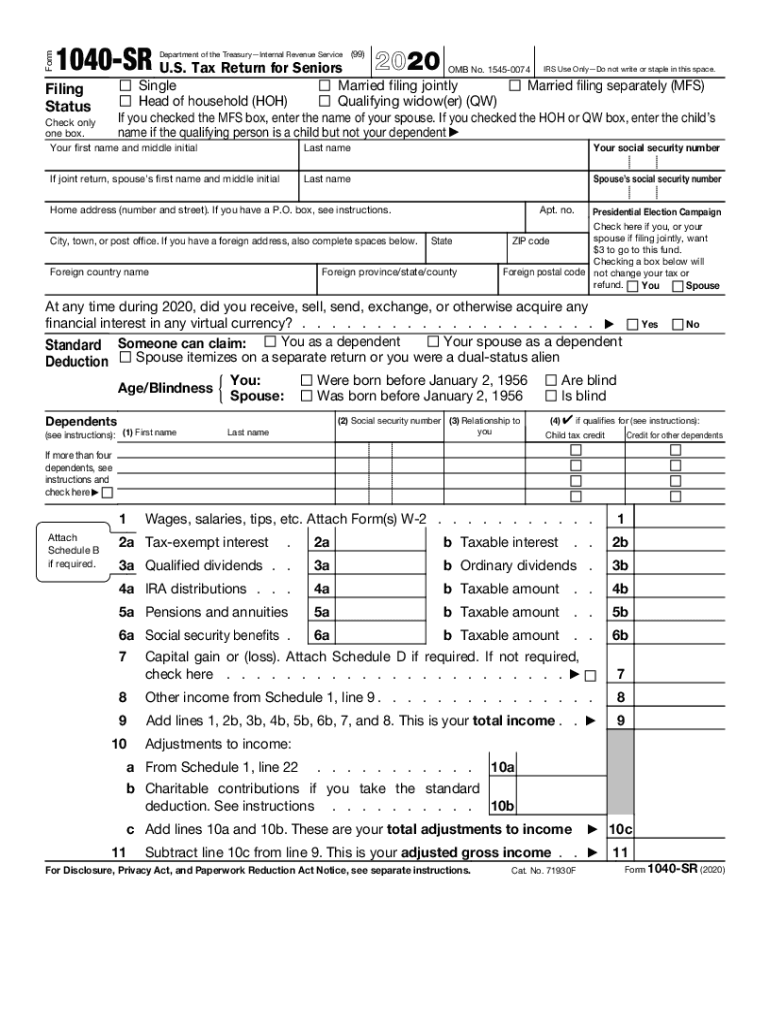

The 2019 IRS 1040 SR form is a simplified tax return designed specifically for seniors aged sixty-five and older. This form allows eligible taxpayers to report their income and claim deductions in a straightforward manner. The 1040 SR is similar to the standard 1040 form but includes larger print and a more user-friendly layout, making it easier for older adults to read and complete. It is important for seniors to understand this form as it caters to their unique financial situations, including social security benefits and retirement income.

How to Use the 2019 IRS 1040 SR Form

Using the 2019 IRS 1040 SR form involves several key steps. First, taxpayers should gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, they will fill out the form, starting with personal information such as name, address, and Social Security number. The form requires reporting various income sources, claiming eligible deductions, and calculating tax liability. Seniors can also take advantage of the standard deduction, which is higher for those aged sixty-five and older. Once completed, the form can be submitted electronically or via mail.

Steps to Complete the 2019 IRS 1040 SR Form

Completing the 2019 IRS 1040 SR form involves a systematic approach:

- Gather Documents: Collect all relevant tax documents, including income statements and any deduction records.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, pensions, and Social Security benefits.

- Claim Deductions: Determine your eligibility for the standard deduction or itemized deductions, if applicable.

- Calculate Tax: Follow the instructions to compute your total tax liability based on your reported income.

- Review and Sign: Ensure all information is accurate before signing and dating the form.

- Submit the Form: Choose to e-file or mail the completed form to the appropriate IRS address.

Legal Use of the 2019 IRS 1040 SR Form

The 2019 IRS 1040 SR form is legally binding when completed accurately and submitted according to IRS guidelines. It serves as an official document for reporting income and calculating tax obligations. To ensure legal compliance, taxpayers must adhere to the requirements set forth by the IRS, including accurate reporting of income and claiming only eligible deductions. Additionally, electronic signatures are recognized as valid under federal law, provided that proper eSignature protocols are followed.

Eligibility Criteria for the 2019 IRS 1040 SR Form

To qualify for the 2019 IRS 1040 SR form, taxpayers must meet specific eligibility criteria. Primarily, individuals must be aged sixty-five or older at the end of the tax year. Furthermore, the form is intended for those whose taxable income does not exceed certain limits, which may vary based on filing status. Seniors who have income from sources such as wages, pensions, or Social Security benefits can utilize this form, making it a practical choice for many retirees.

Filing Deadlines for the 2019 IRS 1040 SR Form

The filing deadline for the 2019 IRS 1040 SR form aligns with the standard tax return deadlines set by the IRS. Typically, tax returns for the 2019 tax year must be filed by April fifteenth of the following year. If taxpayers require additional time, they may file for an extension, which grants an additional six months to submit their return. However, it is essential to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete form 1040 sr us tax return for seniors internal

Effortlessly manage Form 1040 SR, U S Tax Return For Seniors Internal on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Form 1040 SR, U S Tax Return For Seniors Internal on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and electronically sign Form 1040 SR, U S Tax Return For Seniors Internal with ease

- Find Form 1040 SR, U S Tax Return For Seniors Internal and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1040 SR, U S Tax Return For Seniors Internal while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sr us tax return for seniors internal

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sr us tax return for seniors internal

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the 2019 IRS 1040 SR form?

The 2019 IRS 1040 SR form is a simplified tax return designed for seniors aged 65 and older. It includes larger text and a straightforward layout, making it easier for older taxpayers to file their returns. This form can be particularly beneficial if you're looking for a simple way to report income and claim deductions.

-

How can airSlate SignNow assist with the 2019 IRS 1040 SR form?

AirSlate SignNow allows you to easily upload, send, and eSign your 2019 IRS 1040 SR form securely and efficiently. With our platform, you can streamline the signing process and ensure that your tax documents are signed and submitted timely. This helps reduce errors and speeds up your filing process.

-

Are there any costs associated with using airSlate SignNow for the 2019 IRS 1040 SR form?

AirSlate SignNow offers a cost-effective solution tailored to meet budgetary needs when handling documents like the 2019 IRS 1040 SR form. Our pricing plans are designed to fit various business sizes, with options for monthly or annual subscriptions. You can choose a plan that best suits your usage frequency and features required.

-

What features does airSlate SignNow provide for handling the 2019 IRS 1040 SR form?

AirSlate SignNow offers features such as customizable templates, mobile-friendly signing, and status tracking for your 2019 IRS 1040 SR form. You can also leverage document analytics to gain insights into your signed documents. These features enhance your document management experience and make it more efficient.

-

Is it safe to eSign the 2019 IRS 1040 SR form with airSlate SignNow?

Yes, eSigning the 2019 IRS 1040 SR form with airSlate SignNow is highly secure. We implement top-tier encryption and security protocols to protect your sensitive tax information. Rest assured, your data remains confidential and secure throughout the signing process.

-

Can airSlate SignNow integrate with other software for managing the 2019 IRS 1040 SR form?

Absolutely! AirSlate SignNow supports integrations with various applications, allowing you to manage your 2019 IRS 1040 SR form seamlessly alongside your existing software systems. This capability enhances your workflow by connecting document signing with other tools you may already be using.

-

What are the benefits of using airSlate SignNow for the 2019 IRS 1040 SR form?

Using airSlate SignNow for the 2019 IRS 1040 SR form provides numerous benefits, including time savings, enhanced organization, and improved collaboration. With our user-friendly interface and powerful features, you can manage your tax documents more effectively, ensuring a smoother filing process every tax season.

Get more for Form 1040 SR, U S Tax Return For Seniors Internal

- Wwwnewbridgerugbycomwp contentuploadsirish rugby football union youthadult player registration form

- Sports massage consultation form template uk

- Wwwctqgouvqcca fileadmin documentstransport of persons by bus and leasing of buses quebecca form

- Microsoft word registration form regular

- Hospice referral form

- Client referral form final seniors services

- Wwwpdffillercom438120198 ellice swamp hunting ellice swamp hunting fill online printable fillable form

- Declaration and client consent form hawthorn clinic

Find out other Form 1040 SR, U S Tax Return For Seniors Internal

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation